Question: Please use the problem statement data here for Questions 1 through 4. It's the start of 2020. For the year just ended, a firm had

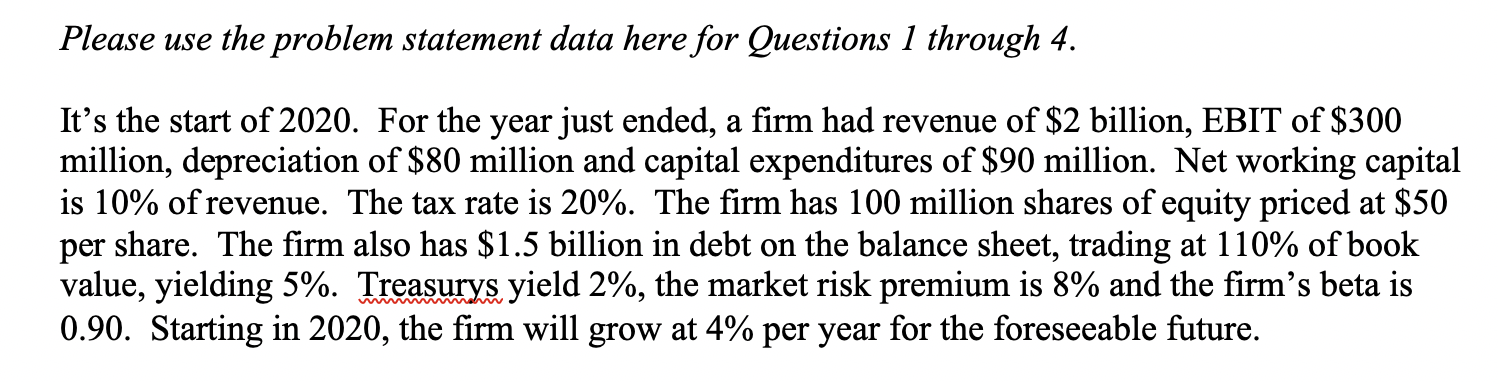

Please use the problem statement data here for Questions 1 through 4. It's the start of 2020. For the year just ended, a firm had revenue of $2 billion, EBIT of $300 million, depreciation of $80 million and capital expenditures of $90 million. Net working capital is 10% of revenue. The tax rate is 20%. The firm has 100 million shares of equity priced at $50 per share. The firm also has $1.5 billion in debt on the balance sheet, trading at 110% of book value, yielding 5%. Treasurys, yield 2%, the market risk premium is 8% and the firm's beta is 0.90. Starting in 2020, the firm will grow at 4% per year for the foreseeable future. 2. What is the appropriate cost of capital? (a) (b) (c) (d) 7.91% 8.00% 6.56% 9.20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts