Question: Please use the provided excel and show work / formula in working cell for a thumb up. Please use the provided excel and show work

Please use the provided excel and show work / formula in working cell for a thumb up.

Please use the provided excel and show work / formula in working cell for a thumb up.

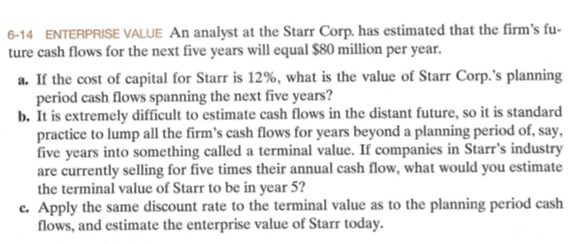

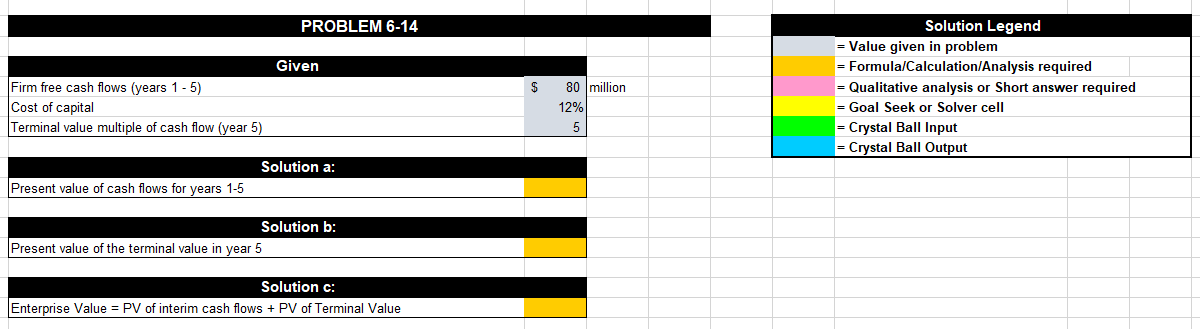

6-14 ENTERPRISE VALUE An analyst at the Starr Corp. has estimated that the firm's fu- ture cash flows for the next five years will equal $80 million per year. a. If the cost of capital for Starr is 12%, what is the value of Starr Corp.'s planning period cash flows spanning the next five years? b. It is extremely difficult to estimate cash flows in the distant future, so it is standard practice to lump all the firm's cash flows for years beyond a planning period of, say, five years into something called a terminal value. If companies in Starr's industry are currently selling for five times their annual cash flow, what would you estimate the terminal value of Starr to be in year 5? c. Apply the same discount rate to the terminal value as to the planning period cash flows, and estimate the enterprise value of Starr today. PROBLEM 6-14 Given Firm free cash flows (years 1 - 5) Cost of capital Terminal value multiple of cash flow (year 5) 80 million 12% 5 Solution Legend = Value given in problem = Formula/Calculation/Analysis required = Qualitative analysis or Short answer required = Goal Seek or Solver cell = Crystal Ball Input = Crystal Ball Output Solution a: Present value of cash flows for years 1-5 Solution b: Present value of the terminal value in year 5 Solution c: Enterprise Value = PV of interim cash flows + PV of Terminal Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts