Question: Please use the same drop down menu to answer each item (three options). Which of the following income items, when received by a corporation, are

Please use the same drop down menu to answer each item (three options).

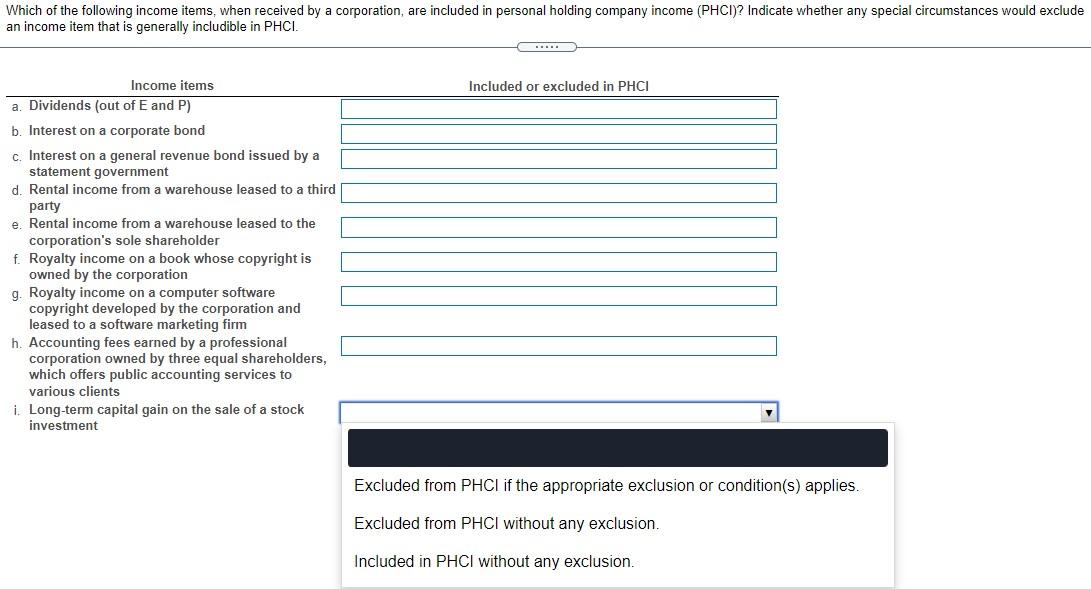

Which of the following income items, when received by a corporation, are included in personal holding company income (PHCI)? Indicate whether any special circumstances would exclude an income item that is generally includible in PHCI. .... Included or excluded in PHCI Income items a. Dividends (out of E and P) b. Interest on a corporate bond c. Interest on a general revenue bond issued by a statement government d. Rental income from a warehouse leased to a third party e. Rental income from a warehouse leased to the corporation's sole shareholder f. Royalty income on a book whose copyright is owned by the corporation 9. Royalty income on a computer software copyright developed by the corporation and leased to a software marketing firm h. Accounting fees earned by a professional corporation owned by three equal shareholders, which offers public accounting services to various clients i Long-term capital gain on the sale of a stock investment Excluded from PHCl if the appropriate exclusion or condition(s) applies. Excluded from PHCI without any exclusion. Included in PHCI without any exclusion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts