Question: Please use the same format to answer the question so that it is easy to follow! Kansas Supplies is a manufacturer of plastic parts that

Please use the same format to answer the question so that it is easy to follow!

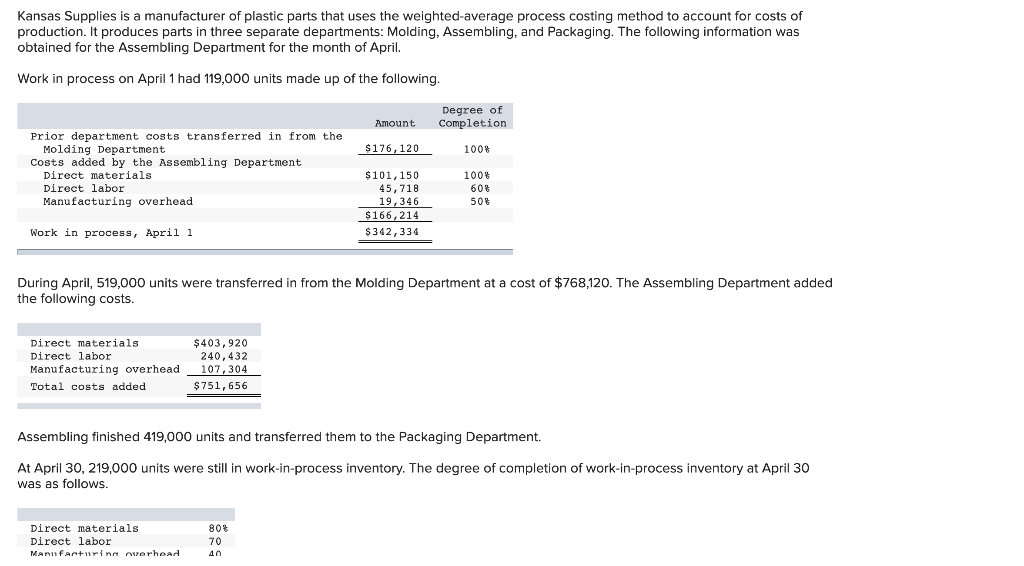

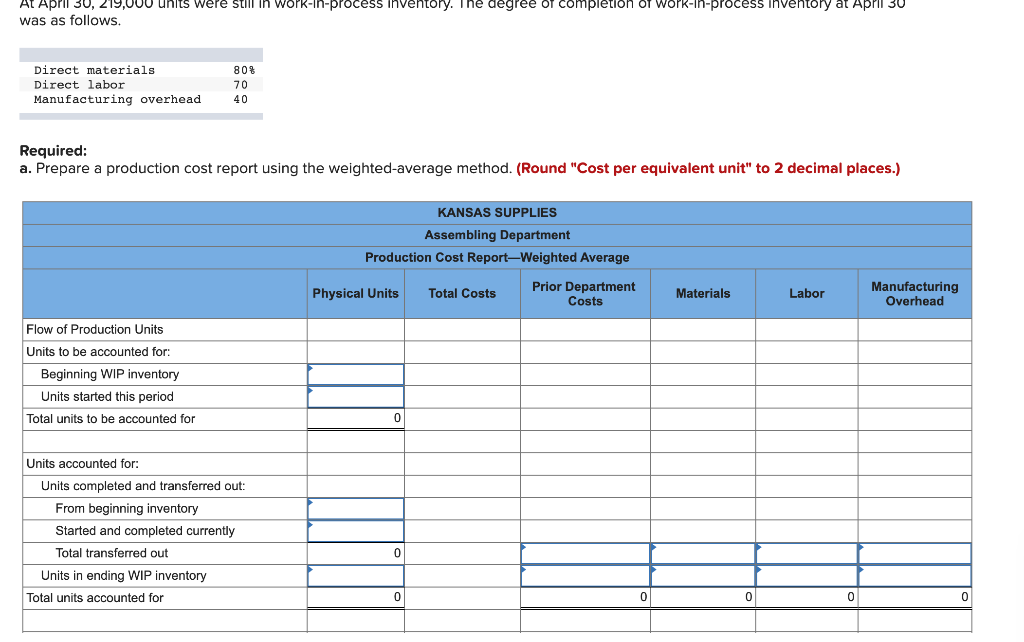

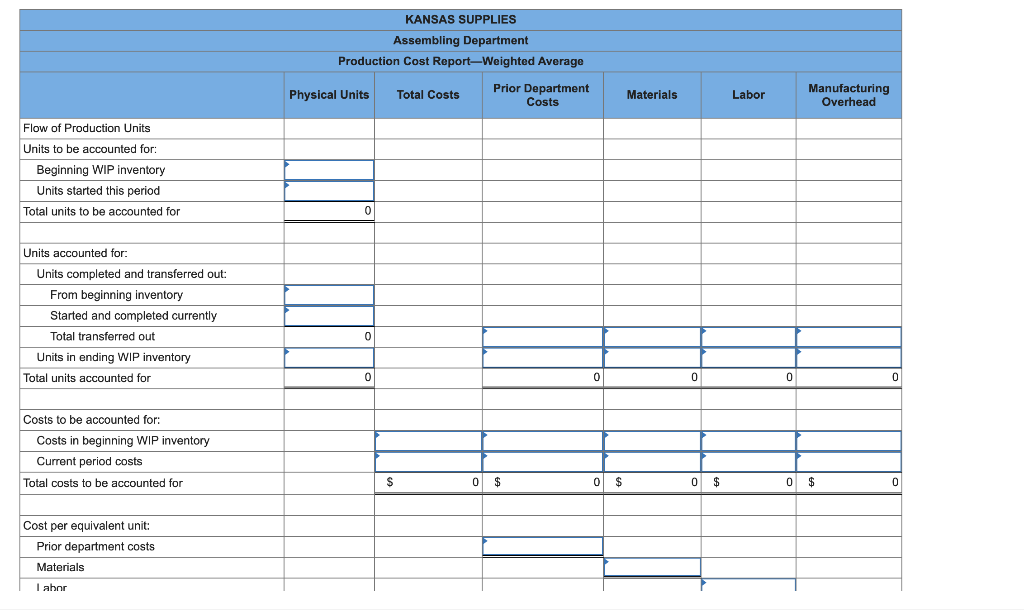

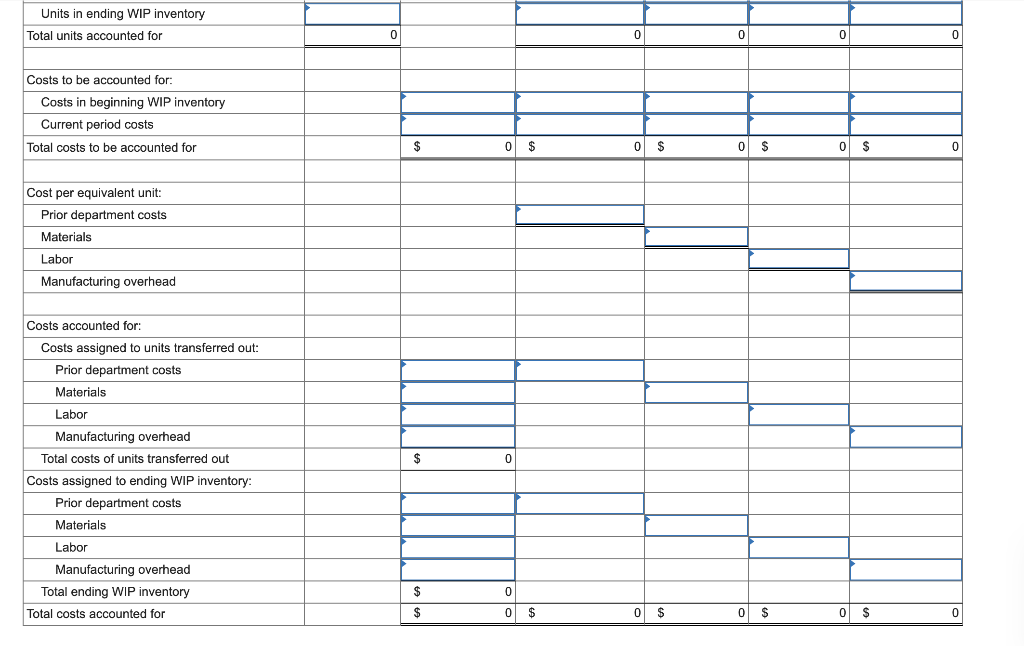

Kansas Supplies is a manufacturer of plastic parts that uses the weighted-average process costing method to account for costs of production. It produces parts in three separate departments: Molding, Assembling, and Packaging. The following information was obtained for the Assembling Department for the month of April. Work in process on April 1 had 119,000 units made up of the following. Degree of Completion Amount $176, 120 100% Prior department costs transferred in from the Molding Department Costs added by the Assembling Department Direct materials Direct labor Manufacturing overhead $ 101, 150 45,718 19,346 $ 166, 214 $342,334 1008 60% 50% Work in process, April 1 During April, 519,000 units were transferred in from the Molding Department at a cost of $768,120. The Assembling Department added the following costs. Direct materials Direct labor Manufacturing overhead Total costs added $ 403, 920 240,432 107,304 $751,656 Assembling finished 419,000 units and transferred them to the Packaging Department. At April 30, 219,000 units were still in work-in-process inventory. The degree of completion of work-in-process inventory at April 30 was as follows. Direct materials Direct labor Mannfarturinn overhead 80% 70 40 April 30, 219,000 units were still in work-in-process inventory. The degree of completion of work-in-process inventory at April 30 was as follows. Direct materials Direct labor Manufacturing overhead 80% 70 40 Required: a. Prepare a production cost report using the weighted average method. (Round "Cost per equivalent unit" to 2 decimal places.) KANSAS SUPPLIES Assembling Department Production Cost Report-Weighted Average Physical Units Total Costs Prior Department Costs Materials Labor Manufacturing Overhead Flow of Production Units Units to be accounted for: Beginning WIP inventory Units started this period Total units to be accounted for 0 Units accounted for: Units completed and transferred out: From beginning inventory Started and completed currently Total transferred out Units in ending WIP inventory Total units accounted for 0 0 0 0 0 KANSAS SUPPLIES Assembling Department Production Cost Report-Weighted Average Physical Units Total Costs Prior Department Costs Materials Labor Manufacturing Overhead Flow of Production Units Units to be accounted for: Beginning WIP inventory Units started this period Total units to be accounted for Units accounted for: Units completed and transferred out: From beginning inventory Started and completed currently Total transferred out Units in ending WIP inventory Total units accounted for 0 0 0 0 Costs to be accounted for: Costs in beginning WIP inventory Current period costs Total costs to be accounted for $ 0 $ 0 $ 0 $ 0 $ 0 Cost per equivalent unit: Prior department costs Materials Tabor Units in ending WIP inventory Total units accounted for 0 0 0 0 0 Costs to be accounted for: Costs in beginning WIP inventory Current period costs Total costs to be accounted for $ 0 $ 0 $ 0 $ 0 $ 0 Cost per equivalent unit: Prior department costs Materials Labor Manufacturing overhead Costs accounted for: Costs assigned to units transferred out: Prior department costs Materials Labor Manufacturing overhead Total costs of units transferred out Costs assigned to ending WIP inventory: Prior department costs Materials Labor $ 0 Manufacturing overhead Total ending WIP inventory Total costs accounted for 0 $ $ 0 $ 0 $ 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts