Question: Please use the variances in Assignment 6.1 (below) that you completed in Connect and give an explanation of what caused the variances to occur. Please

Please use the variances in Assignment 6.1 (below) that you completed in Connect and give an explanation of what caused the variances to occur.

Please give a scenario of how these variances occur.

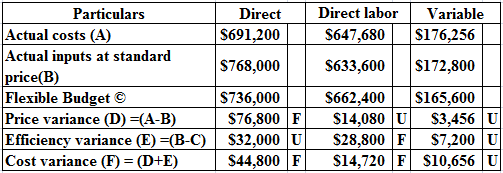

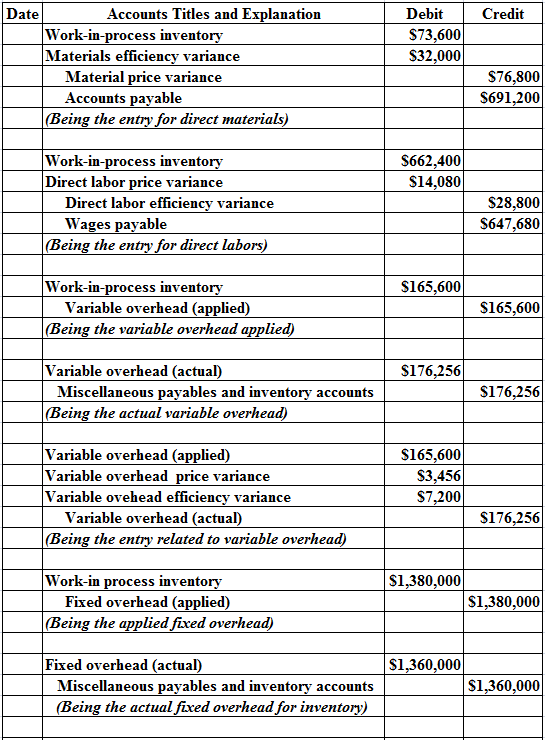

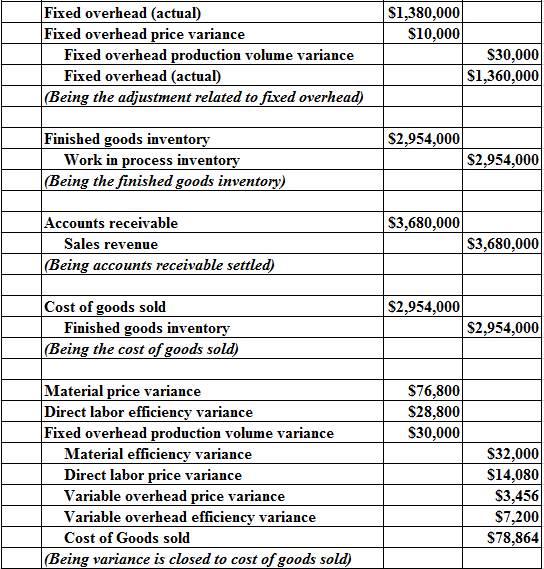

a. Prepare a cost variance analysis for each variable cost for Maple Leaf Productions. b. Prepare a fixed overhead cost variance analysis. c. (Appendix) Prepare the journal entries to record the activity for the last period using standard costing. Assume that all variances are closed to cost of goods sold at the end of the operating period.

Part a

Part b

Fixed overhead cost variance analysis is $20,000.

Part c

Particulars Direct Actual costs (A) $691,200 Actual inputs at standard S768,000 price(B) Flexible Budget $736,000 Price variance (D) =(A-B) $76,800 F Efficiency variance (E) =(B-C) $32,000 U Cost variance (F) = (D+E) $44,800 F Direct labor Variable $647,680 S176,256 $633,600 $172,800 $662,400 $165,600 $14,080 U $3,456 U $28,800 F $7,200 U $14,720 F $10,656 U Credit Debit $73,600 $32,000 Date Accounts Titles and Explanation Work-in-process inventory Materials efficiency variance Material price variance Accounts payable (Being the entry for direct materials) $76,800 $691,200 $662,400 $14,080 Work-in-process inventory Direct labor price variance Direct labor efficiency variance Wages payable (Being the entry for direct labors) $28,800 $647,680 $165,600 Work-in-process inventory Variable overhead (applied) (Being the variable overhead applied) $165,600 $176,256 Variable overhead (actual) Miscellaneous payables and inventory accounts Being the actual variable overhead) $176,256 Variable overhead (applied) Variable overhead price variance Variable ovehead efficiency variance Variable overhead (actual) (Being the entry related to variable overhead) $165,600 $3,456 $7,200 $176,256 Work-in process inventory Fixed overhead (applied) (Being the applied fixed overhead) $1,380,000 $1,380,000 Fixed overhead (actual) $1,360,000 Miscellaneous payables and inventory accounts $1,360,000 (Being the actual fixed overhead for inventory) Fixed overhead (actual) Fixed overhead price variance Fixed overhead production volume variance Fixed overhead (actual) (Being the adjustment related to fixed overhead) $1,380,000 $10,000 $30,000 $1,360,000 Finished goods inventory Work in process inventory (Being the finished goods inventory) $2,954,000 $2,954,000 $3,680,000 Accounts receivable Sales revenue (Being accounts receivable settled) $3,680,000 $2,954,000 Cost of goods sold Finished goods inventory (Being the cost of goods sold) $2,954,000 $76,800 $28,800 $30,000 Material price variance Direct labor efficiency variance Fixed overhead production volume variance Material efficiency variance Direct labor price variance Variable overhead price variance Variable overhead efficiency variance Cost of Goods sold (Being variance is closed to cost of goods sold) $32,000 $14,080 $3,456 $7,200 $78,864

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts