Question: Please use these Comparisons to determine the ERR Percentage for this Solution The Types of Comparisons can be: 1) T1 vs T2 2) T1 vs

Please use these Comparisons to determine the ERR Percentage for this Solution

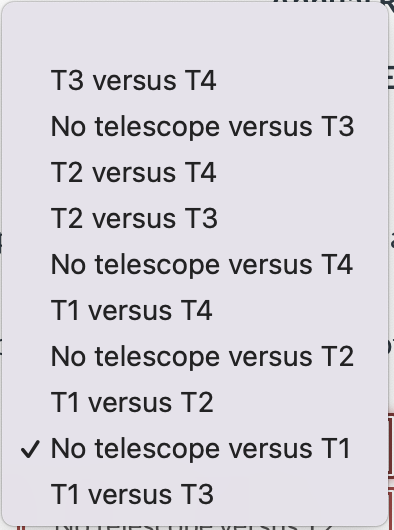

The Types of Comparisons can be:

1) T1 vs T2

2) T1 vs T3

3) T2 vs T4

4) T2 vs. T3

These are all of the Comparision Options

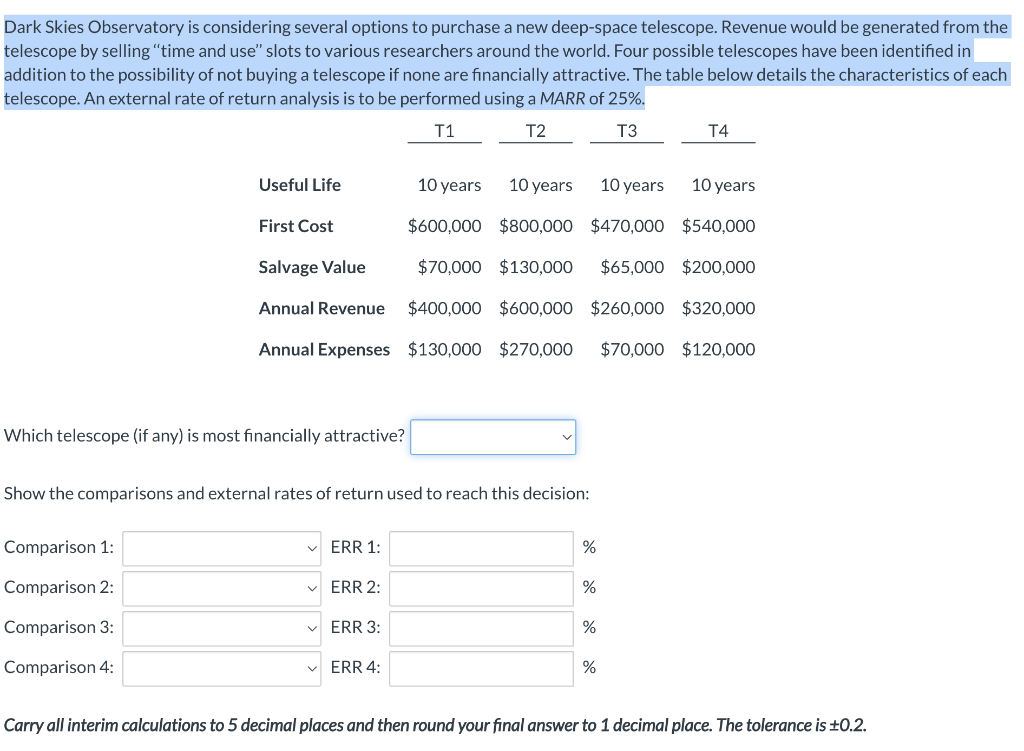

Dark Skies Observatory is considering several options to purchase a new deep-space telescope. Revenue would be generated from the telescope by selling "time and use" slots to various researchers around the world. Four possible telescopes have been identified in addition to the possibility of not buying a telescope if none are financially attractive. The table below details the characteristics of each telescope. An external rate of return analysis is to be performed using a MARR of 25%. T1 T2 T3 T4 Useful Life 10 years 10 years 10 years 10 years First Cost $600,000 $800,000 $470,000 $540,000 Salvage Value $70,000 $130,000 $65,000 $200,000 Annual Revenue $400,000 $600,000 $260,000 $320,000 Annual Expenses $130,000 $270,000 $70,000 $120,000 Which telescope (if any) is most financially attractive? Show the comparisons and external rates of return used to reach this decision: Comparison 1: ERR 1: % Comparison 2: ERR 2: % Comparison 3: ERR 3: % Comparison 4: ERR 4: % Carry all interim calculations to 5 decimal places and then round your final answer to 1 decimal place. The tolerance is 0.2. T3 versus T4 No telescope versus T3 T2 versus T4 T2 versus T3 No telescope versus T4 T1 versus T4 No telescope versus T2 T1 versus T2 No telescope versus T1 T1 versus T3 TYETTE VERSIT Dark Skies Observatory is considering several options to purchase a new deep-space telescope. Revenue would be generated from the telescope by selling "time and use" slots to various researchers around the world. Four possible telescopes have been identified in addition to the possibility of not buying a telescope if none are financially attractive. The table below details the characteristics of each telescope. An external rate of return analysis is to be performed using a MARR of 25%. T1 T2 T3 T4 Useful Life 10 years 10 years 10 years 10 years First Cost $600,000 $800,000 $470,000 $540,000 Salvage Value $70,000 $130,000 $65,000 $200,000 Annual Revenue $400,000 $600,000 $260,000 $320,000 Annual Expenses $130,000 $270,000 $70,000 $120,000 Which telescope (if any) is most financially attractive? Show the comparisons and external rates of return used to reach this decision: Comparison 1: ERR 1: % Comparison 2: ERR 2: % Comparison 3: ERR 3: % Comparison 4: ERR 4: % Carry all interim calculations to 5 decimal places and then round your final answer to 1 decimal place. The tolerance is 0.2. T3 versus T4 No telescope versus T3 T2 versus T4 T2 versus T3 No telescope versus T4 T1 versus T4 No telescope versus T2 T1 versus T2 No telescope versus T1 T1 versus T3 TYETTE VERSIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts