Question: Please use this as a guide for the following solution. The problem is below: a.Bond Valuation On April 2, 2018P0=PV of Coupons + PV of

Please use this as a guide for the following solution. The problem is below:

Please use this as a guide for the following solution. The problem is below:

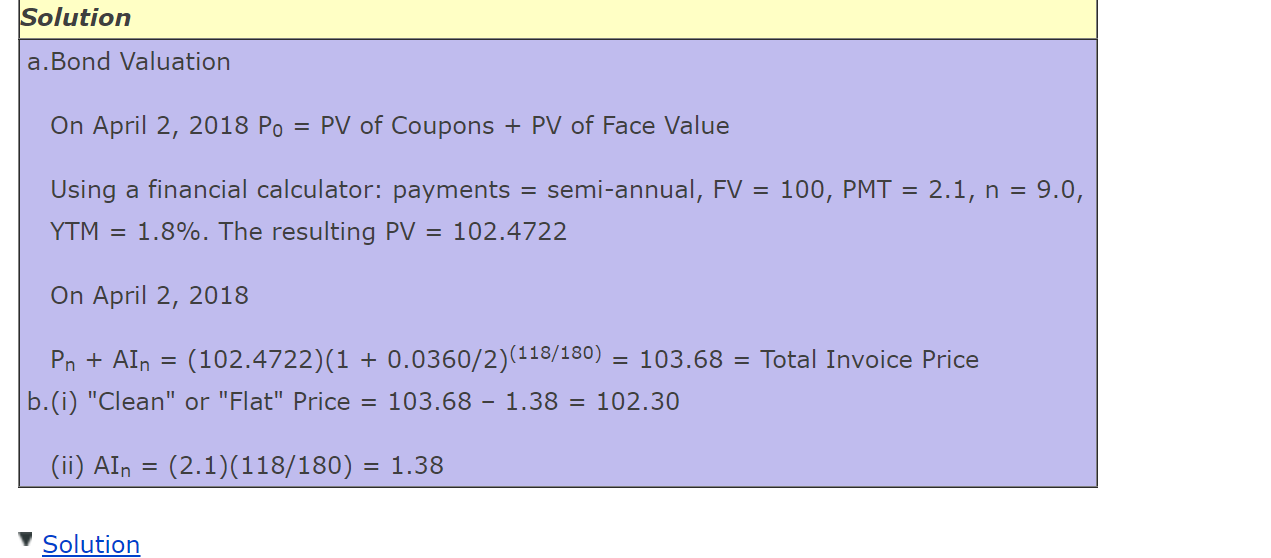

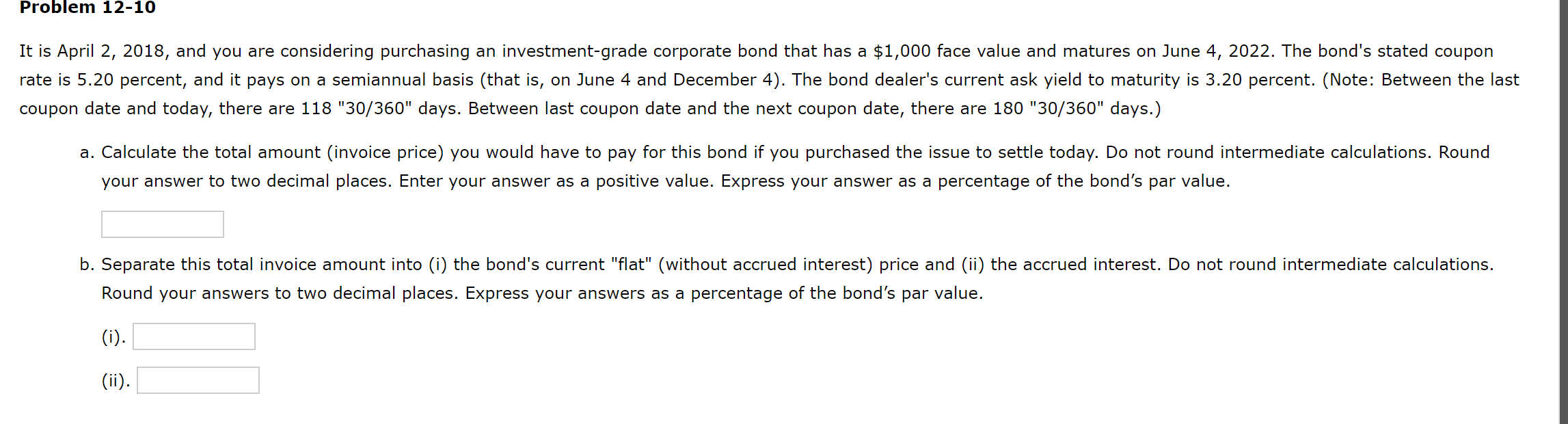

a.Bond Valuation On April 2, 2018P0=PV of Coupons + PV of Face Value Using a financial calculator: payments = semi-annual, FV=100,PMT=2.1,n=9.0, YTM =1.8%. The resulting PV=102.4722 On April 2, 2018 Pn+AIn=(102.4722)(1+0.0360/2)(118/180)=103.68= Total Invoice Price b.(i) "Clean" or "Flat" Price =103.681.38=102.30 (ii) AIn=(2.1)(118/180)=1.38 is April 2, 2018, and you are considering purchasing an investment-grade corporate bond that has a $1,000 face value and matures on June 4,2022 . The bond's stated coupon te is 5.20 percent, and it pays on a semiannual basis (that is, on June 4 and December 4 ). The bond dealer's current ask yield to maturity is 3.20 percent. (Note: Between the last upon date and today, there are 118 "30/360" days. Between last coupon date and the next coupon date, there are 180 "30/360" days.) a. Calculate the total amount (invoice price) you would have to pay for this bond if you purchased the issue to settle today. Do not round intermediate calculations. Round your answer to two decimal places. Enter your answer as a positive value. Express your answer as a percentage of the bond's par value. b. Separate this total invoice amount into (i) the bond's current "flat" (without accrued interest) price and (ii) the accrued interest. Do not round intermediate calculations. Round your answers to two decimal places. Express your answers as a percentage of the bond's par value. (i). (ii)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts