Question: Please use this fact pattern and fill out 1040, please include any calculations and explanations you made, thank you! Jack and Jill have been married

Please use this fact pattern and fill out 1040, please include any calculations and explanations you made, thank you!

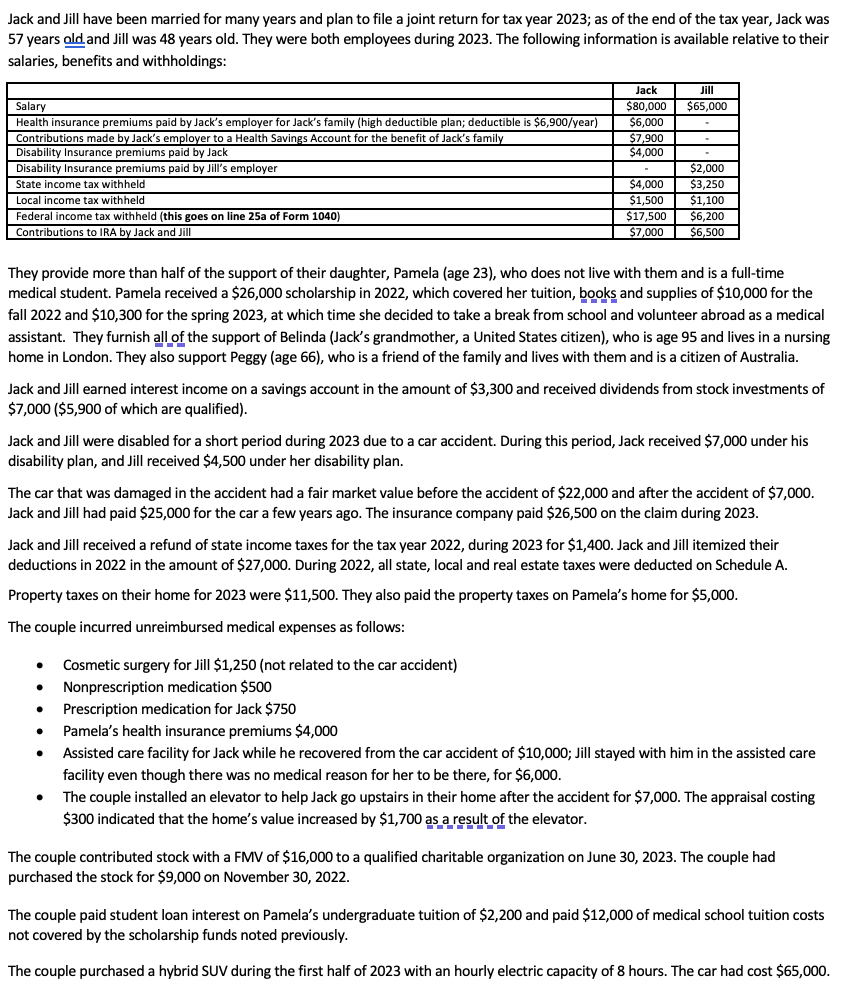

Jack and Jill have been married for many years and plan to file a joint return for tax year 2023; as of the end of the tax year, Jack was 57 years old and Jill was 48 years old. They were both employees during 2023 . The following information is available relative to their salaries, benefits and withholdings: They provide more than half of the support of their daughter, Pamela (age 23), who does not live with them and is a full-time medical student. Pamela received a $26,000 scholarship in 2022, which covered her tuition, books and supplies of $10,000 for the fall 2022 and $10,300 for the spring 2023, at which time she decided to take a break from school and volunteer abroad as a medical assistant. They furnish all of the support of Belinda (Jack's grandmother, a United States citizen), who is age 95 and lives in a nursing home in London. They also support Peggy (age 66), who is a friend of the family and lives with them and is a citizen of Australia. Jack and Jill earned interest income on a savings account in the amount of $3,300 and received dividends from stock investments of $7,000 ( $5,900 of which are qualified). Jack and Jill were disabled for a short period during 2023 due to a car accident. During this period, Jack received $7,000 under his disability plan, and Jill received $4,500 under her disability plan. The car that was damaged in the accident had a fair market value before the accident of $22,000 and after the accident of $7,000. Jack and Jill had paid $25,000 for the car a few years ago. The insurance company paid $26,500 on the claim during 2023. Jack and Jill received a refund of state income taxes for the tax year 2022, during 2023 for $1,400. Jack and Jill itemized their deductions in 2022 in the amount of $27,000. During 2022, all state, local and real estate taxes were deducted on Schedule A. Property taxes on their home for 2023 were $11,500. They also paid the property taxes on Pamela's home for $5,000. The couple incurred unreimbursed medical expenses as follows: - Cosmetic surgery for Jill $1,250 (not related to the car accident) - Nonprescription medication $500 - Prescription medication for Jack $750 - Pamela's health insurance premiums $4,000 - Assisted care facility for Jack while he recovered from the car accident of $10,000; Jill stayed with him in the assisted care facility even though there was no medical reason for her to be there, for $6,000. - The couple installed an elevator to help Jack go upstairs in their home after the accident for $7,000. The appraisal costing $300 indicated that the home's value increased by $1,700 as a result of the elevator. The couple contributed stock with a FMV of $16,000 to a qualified charitable organization on June 30,2023 . The couple had purchased the stock for $9,000 on November 30, 2022. The couple paid student loan interest on Pamela's undergraduate tuition of $2,200 and paid $12,000 of medical school tuition costs not covered by the scholarship funds noted previously. The couple purchased a hybrid SUV during the first half of 2023 with an hourly electric capacity of 8 hours. The car had cost $65,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts