Question: please use this format (this is an example) 16. The Foothills Flyers is a minor league professional baseball team owned by Dawn French. A list

please use this format (this is an example)

please use this format (this is an example)

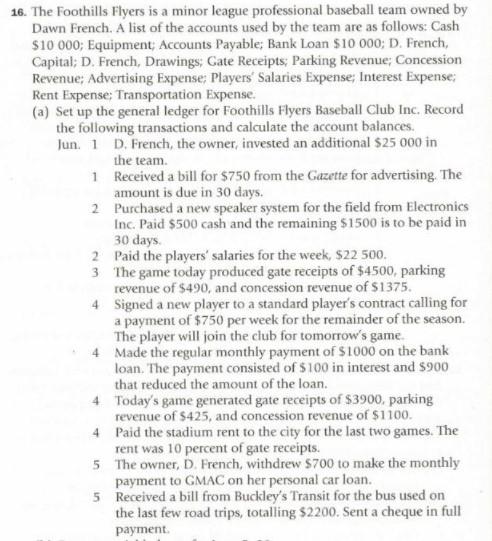

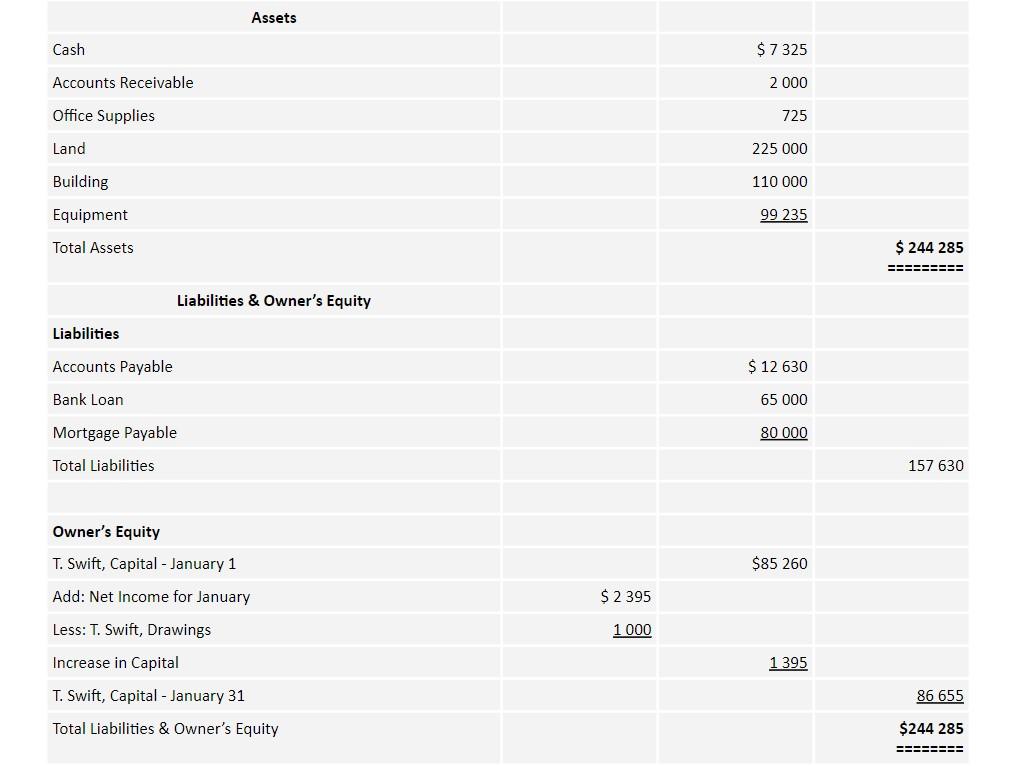

16. The Foothills Flyers is a minor league professional baseball team owned by Dawn French. A list of the accounts used by the team are as follows: Cash $10 000; Equipment Accounts Payable; Bank Loan $10 000; D. French Capital; D. French, Drawings: Cate Receipts; Parking Revenue; Concession Revenue; Advertising Expense; Players' Salaries Expense; Interest Expense; Rent Expense: Transportation Expense. (a) Set up the general ledger for Foothills Flyers Baseball Club Inc. Record the following transactions and calculate the account balances. Jun. 1 D. French, the owner, invested an additional $25 000 in the team. 1 Received a bill for $750 from the Gazette for advertising. The amount is due in 30 days. 2 Purchased a new speaker system for the field from Electronics Inc. Paid $500 cash and the remaining $1500 is to be paid in 30 days. 2 Paid the players' salaries for the week, S22 500. 3 The game today produced gate receipts of $4500, parking revenue of $490, and concession revenue of $1375. 4 Signed a new player to a standard player's contract calling for a payment of $750 per week for the remainder of the season The player will join the club for tomorrow's game. 4 Made the regular monthly payment of $1000 on the bank loan. The payment consisted of $100 in interest and $900 that reduced the amount of the loan. 4. Today's game generated gate receipts of $3900, parking revenue of $425, and concession revenue of $1100. 4 Paid the stadium rent to the city for the last two games. The rent was 10 percent of gate receipts. 5 The owner, D. French, withdrew $700 to make the monthly payment to GMAC on her personal car loan. 5 Received a bill from Buckley's Transit for the bus used on the last few road trips, totalling $2200. Sent a cheque in full payment Assets Cash $ 7 325 Accounts Receivable 2 000 Office Supplies 725 Land 225 000 Building 110 000 Equipment 99 235 Total Assets $ 244 285 RASEEEEEE Liabilities & Owner's Equity Liabilities Accounts Payable $ 12 630 Bank Loan 65 000 Mortgage Payable 80 000 Total Liabilities 157 630 Owner's Equity T. Swift, Capital - January 1 $85 260 Add: Net Income for January $ 2 395 Less: T. Swift, Drawings 1 000 Increase in Capital 1 395 T. Swift, Capital - January 31 86 655 Total Liabilities & Owner's Equity $244 285 ========

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts