Question: Please use this information to handle Question 3 through 5. You are a financial manager of Fin 602 co. Currently your firm is considering issuing

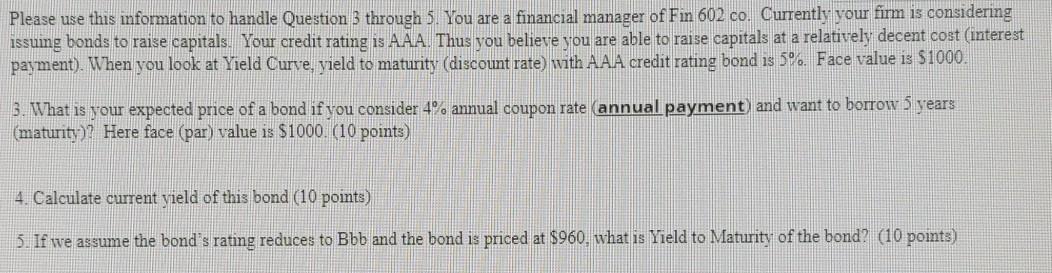

Please use this information to handle Question 3 through 5. You are a financial manager of Fin 602 co. Currently your firm is considering issuing bonds to raise capitals. Your credit rating is AAA. Thus you believe you are able to raise capitals at a relatively decent cost interest payment). When you look at Yield Curve, yield to maturity (discount rate) with AAA credit rating bond is 5%. Face value is $1000. 3. What is your expected price of a bond if you consider 4. annual coupon rate annual payment and want to borrow 5 years (maturity)? Here face (par) value is $1000. (10 points) 4. Calculate current yield of this bond (10 points) 5. If we assume the bond's rating reduces to Bbb and the bond is priced at $960, what is Yield to Maturity of the bond? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts