Question: Please use this one thats just updated. please sew below Outz navigation Quin Me They see toodete to protection and it was the second The

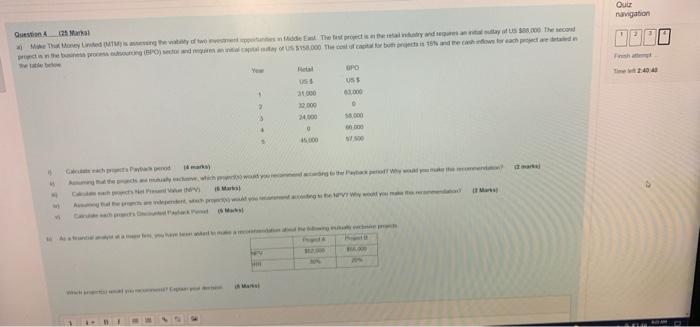

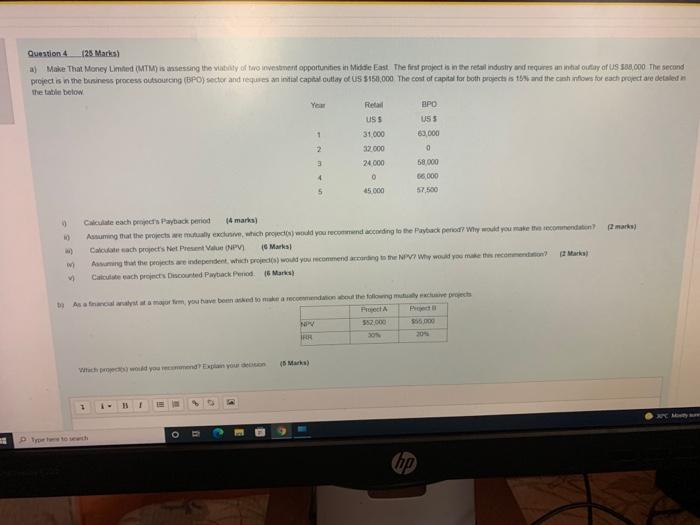

Outz navigation Quin Me They see toodete to protection and it was the second The Power US ST.000 The cost of cool for both in the show forward 04 30 000 2.000 . 2 2000 24000 3 8000 . S. Chand What we prowad your own 1 Mars A wwwwwww TM OWNERS TO IMMO . Hem 1 11 O Question 4 126 Marks) a) Make That Money Limted (MTM) is dessing the waiaty of two westent opportunities in Middle East The first project is in the retail industry and requires an initial out of US 533,000 The second project is in the business process outsourcing (DPO) seder and request cap outlay of US $150,000 The cost of capital for both project is to and the cash flows for each project are detailed the table below Year Ret BPO uss U55 1 31 000 63,000 2 32.000 3 24 000 58.000 O 56.000 5 15.000 57.500 0 4 mark Calculate each Payback period (4 marks) Anunting that the projects were many exch, which people you recommend according to the Playback period? Why would you make the coundation Calcach project's Net Presente NPV) I Markal Asuming that the projects are independent, which projects) would you recomendamonding to the NPV? Why would you make the recommend Marks Calculate each projects Discounted Payback Period 16 Marts M As a wows amortem, you have been asked to make a recommandation but the followme PA Foto NV 52.000 IRR SON 204 (Mark Wuched you you 1 M hip Outz navigation Quin Me They see toodete to protection and it was the second The Power US ST.000 The cost of cool for both in the show forward 04 30 000 2.000 . 2 2000 24000 3 8000 . S. Chand What we prowad your own 1 Mars A wwwwwww TM OWNERS TO IMMO . Hem 1 11 O Question 4 126 Marks) a) Make That Money Limted (MTM) is dessing the waiaty of two westent opportunities in Middle East The first project is in the retail industry and requires an initial out of US 533,000 The second project is in the business process outsourcing (DPO) seder and request cap outlay of US $150,000 The cost of capital for both project is to and the cash flows for each project are detailed the table below Year Ret BPO uss U55 1 31 000 63,000 2 32.000 3 24 000 58.000 O 56.000 5 15.000 57.500 0 4 mark Calculate each Payback period (4 marks) Anunting that the projects were many exch, which people you recommend according to the Playback period? Why would you make the coundation Calcach project's Net Presente NPV) I Markal Asuming that the projects are independent, which projects) would you recomendamonding to the NPV? Why would you make the recommend Marks Calculate each projects Discounted Payback Period 16 Marts M As a wows amortem, you have been asked to make a recommandation but the followme PA Foto NV 52.000 IRR SON 204 (Mark Wuched you you 1 M hip

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts