Question: Please use this template (: Trez Company began operations this year. During this first year, the company produced 100,000 units and sold 80,000 units. The

Please use this template (:

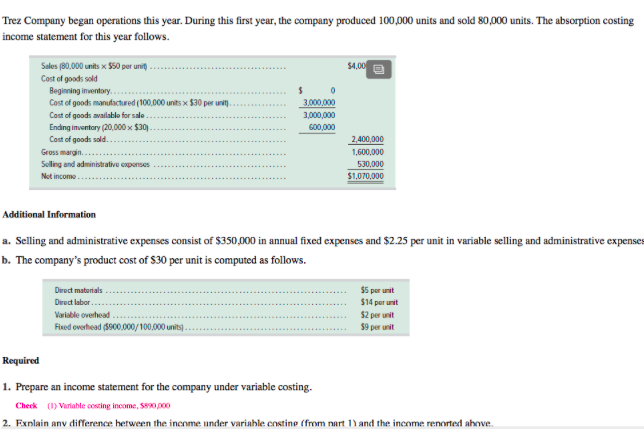

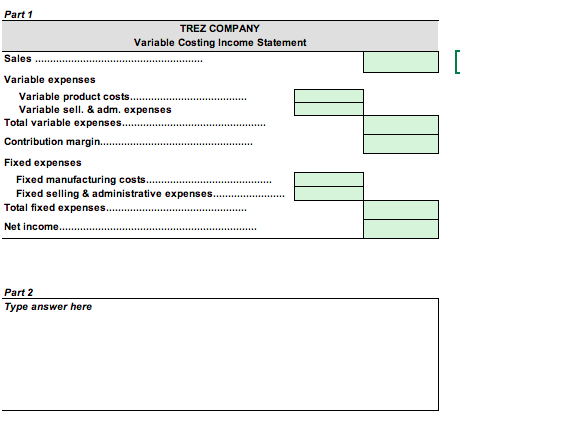

Trez Company began operations this year. During this first year, the company produced 100,000 units and sold 80,000 units. The absorption costing income statement for this year follows. $4.00 Sales (80,000 units x $50 per unit Cost of goods sold Beginning inventory... Cost of goods manufactured (100,000 units x 530 per unit). Cost of goods available for sale Ending inventory (20,000 $30 Cost of goods sold. Gross margin... Selling and administrative expenses Not income 3,000,000 3,000,000 600,000 2,400,000 1,600,000 530,000 $1,070,000 Additional Information a. Selling and administrative expenses consist of $350,000 in annual fixed expenses and $2.25 per unit in variable selling and administrative expenses b. The company's product cost of $30 per unit is computed as follows. Direct materials Direct labor... Variable overhead Fived overhead ($900,000/100.000 units) $5 per unit $14 per unit $2 per unit 59 per unit Required 1. Prepare an income statement for the company under variable costing. Check (1) Variable costing income, 5590.000 2. Explain any difference between the income under variable costino (from nart 1) and the income renortest above, Part 1 TREZ COMPANY Variable Costing Income Statement Sales Variable expenses Variable product costs Variable sell. & adm. expenses Total variable expenses.... Contribution margin... Fixed expenses Fixed manufacturing costs.... Fixed selling & administrative expenses. Total fixed expenses... Net income... Part 2 Type answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts