Question: Please Using Excel mRNATech is a large pharmaceutical firm that is working on a new vaccine against Covid 19. The vaccine needs to be approved

Please Using Excel

mRNATech is a large pharmaceutical firm that is working on a new vaccine against Covid 19. The

vaccine needs to be approved before it can actually be used to vaccinate people. The vaccine

development and approval process will take six months. To ensure that the vaccine is readily available

after the approval, mRNATech needs to invest one million GBP (1,000K) in its capacity. If the vaccine

is approved, mRNATech expects to make 6% return on investment, i.e., the net profit after subtracting

the initial capacity investment is equal to sixty thousand GBP (60K).

However, there is a 5% chance that the vaccine is not effective enough so that it will not be approved

by the government. If the vaccine is not approved, mRNATech can salvage its capacity to another

vaccine manufacturer for 500K. mRNATech has to decide whether or not to invest in the capacity

now. If it decides not to make the investment and cease the project now, it can use 1,000K to make

an alternative investment that will return 10K sure net profit.

Question 1: Evaluation of the Capacity Investment

a) Construct the decision tree for mRNATechs decision problem. Assuming it is risk-neutral,

would you recommend mRNATech to make the capacity investment?

b) Define the risk profiles associated with the optimal strategy. Taking risk into

consideration, what would be your recommendation to mRNATech? While determining your

recommendation, assume that mRNATech is a large pharmaceutical firm that considers

investing in around 1000 similar projects every year.

Question 2: Value of Perfect Information

mRNATech is considering hiring DataAnalytics, an independent third party company, which would be

able to predict whether mRNATechs vaccine will be approved or not.

Suppose DataAnalytics is able to predict whether the vaccine will be approved or not with

perfect accuracy. What is the maximum that mRNATech should be willing to pay in order to

obtain this perfect information? Answer this question by constructing a decision tree.

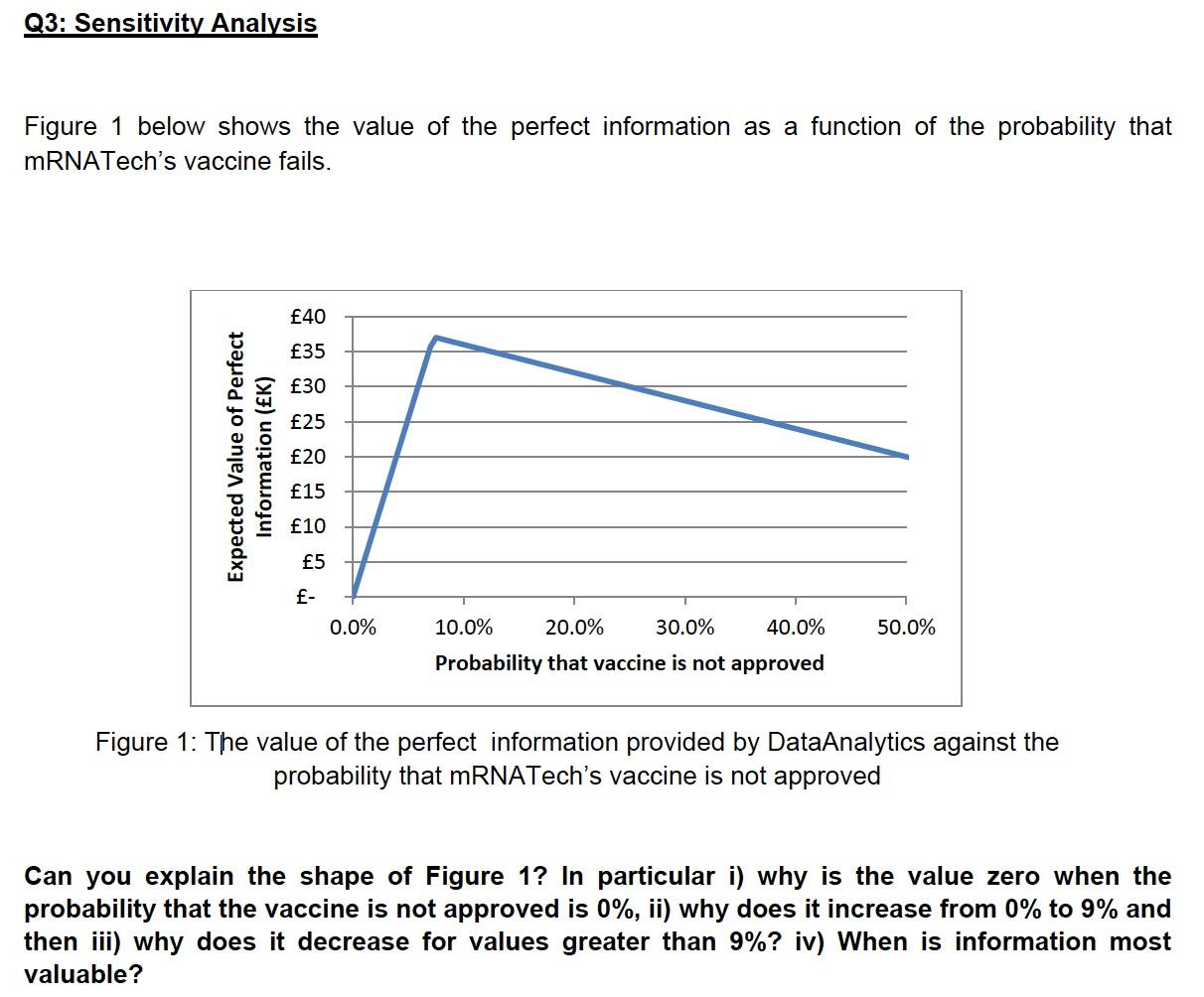

Q3: Sensitivity Analysis Figure 1 below shows the value of the perfect information as a function of the probability that mRNATech's vaccine fails. 40 35 30 25 Expected Value of Perfect Information (EK) 20 15 10 5 E- 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% Probability that vaccine is not approved Figure 1: The value of the perfect information provided by DataAnalytics against the probability that mRNATech's vaccine is not approved Can you explain the shape of Figure 1? In particular i) why is the value zero when the probability that the vaccine is not approved is 0%, ii) why does it increase from 0% to 9% and then iii) why does it decrease for values greater than 9%? iv) When is information most valuable? Question 4: Value of Imperfect Information Data Analytics charges mRNATech 15K for predicting whether the vaccine will be approved or not. For this fee, it will conduct a detailed analysis of the vaccine and provide a recommendation to mRNATech, either "favourable or unfavourable". The probability that Data Analytics will make a favourable recommendation is equal to 91.75%. Unfortunately, Data Analytics's recommendations can sometimes be wrong. The probability that the vaccine will not be approved given a favourable recommendation by Data Analytics is 1.63%. On the other hand, the probability that the vaccine will not be approved given an unfavourable recommendation by DataAnalytics is 42.42%. Given these statistics, mRNATech is wondering whether it would be worthwhile to pay 15K to DataAnalytics to perform this analysis. a) What is the value of imperfect information that Data Analytics provides? Should mRNATech hire Data Analytics? Construct a decision tree to answer this question. [7 marks] b) Ignoring the cost of hiring Data Analytics, define the risk profiles for the case when mRNATech hires Data Analytics. Taking into account the risk, would you recommend mRNATech to pay 15K to hire Data Analytics? [3 marks] Q3: Sensitivity Analysis Figure 1 below shows the value of the perfect information as a function of the probability that mRNATech's vaccine fails. 40 35 30 25 Expected Value of Perfect Information (EK) 20 15 10 5 E- 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% Probability that vaccine is not approved Figure 1: The value of the perfect information provided by DataAnalytics against the probability that mRNATech's vaccine is not approved Can you explain the shape of Figure 1? In particular i) why is the value zero when the probability that the vaccine is not approved is 0%, ii) why does it increase from 0% to 9% and then iii) why does it decrease for values greater than 9%? iv) When is information most valuable? Question 4: Value of Imperfect Information Data Analytics charges mRNATech 15K for predicting whether the vaccine will be approved or not. For this fee, it will conduct a detailed analysis of the vaccine and provide a recommendation to mRNATech, either "favourable or unfavourable". The probability that Data Analytics will make a favourable recommendation is equal to 91.75%. Unfortunately, Data Analytics's recommendations can sometimes be wrong. The probability that the vaccine will not be approved given a favourable recommendation by Data Analytics is 1.63%. On the other hand, the probability that the vaccine will not be approved given an unfavourable recommendation by DataAnalytics is 42.42%. Given these statistics, mRNATech is wondering whether it would be worthwhile to pay 15K to DataAnalytics to perform this analysis. a) What is the value of imperfect information that Data Analytics provides? Should mRNATech hire Data Analytics? Construct a decision tree to answer this question. [7 marks] b) Ignoring the cost of hiring Data Analytics, define the risk profiles for the case when mRNATech hires Data Analytics. Taking into account the risk, would you recommend mRNATech to pay 15K to hire Data Analytics? [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts