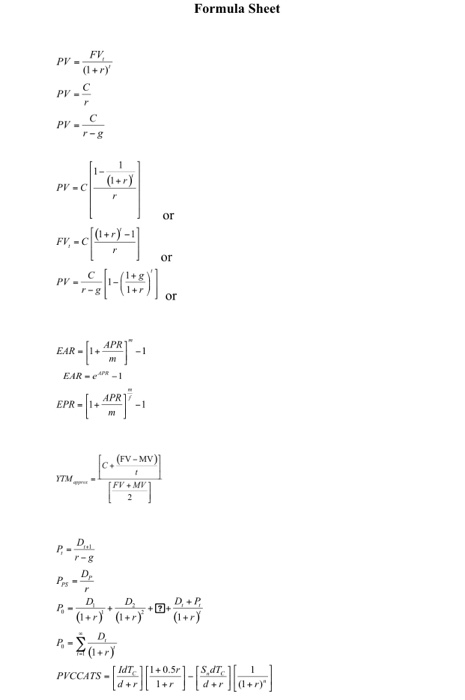

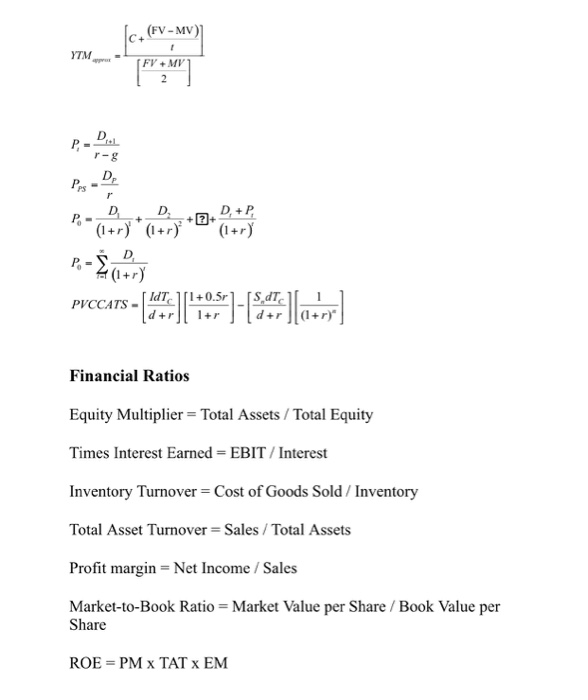

Question: Please using these formula sheet to solved this problems if you need it. Thanks. a. How does a bond issuer decide on the appropriate coupon

a. How does a bond issuer decide on the appropriate coupon rate to set on its bonds if the company wants to issue a bond at par value? b. Explain the difference between the coupon rate and the required rate of return and the impact of the required rate of return on the market value of the bond? Formula Sheet PV- FV (1+r) r PV - PV -- reg 1 (1+r) PVC r or or Pv----6) or EAR = [1 - 478) -- EPR= [1, 478)*-- EAR - - 1 (FV - MV)] Y7M FVMV 2 D D Prs r D P- D D+P P - PVCCATS - IdT d+r 10.5") (][0-3] (FV - MV) + YTM FV + MV D P. - r-8 D Pes + D D P.- D, + P (1+r)(1+r) (1+r) P- D 3 (1+r) IdT 11+0.5 S dr PVCCATS - d+r Financial Ratios Equity Multiplier = Total Assets / Total Equity Times Interest Earned = EBIT / Interest Inventory Turnover = Cost of Goods Sold / Inventory Total Asset Turnover = Sales/Total Assets Profit margin = Net Income / Sales Market-to-Book Ratio = Market Value per Share / Book Value per Share ROE = PM X TAT X EM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts