Question: please verify 17 is b 18 is c 19 is d 20 is b 17. The capital assets pricing model (CAPM) tells us that in

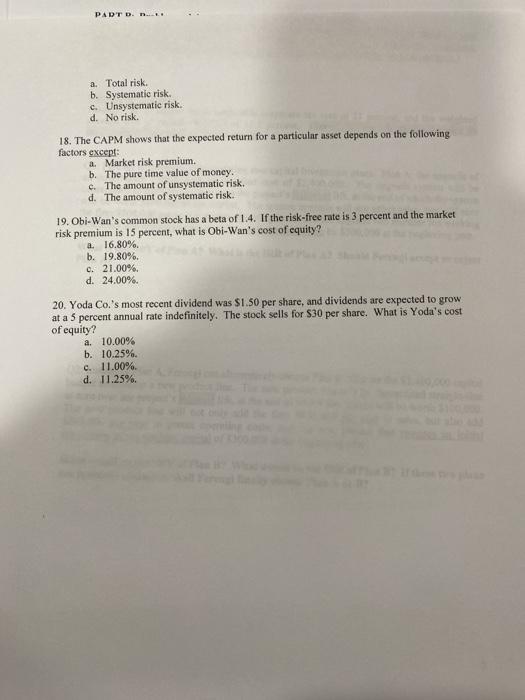

17. The capital assets pricing model (CAPM) tells us that in an efficient and fair capital market, the expected return on an asset only depends on its: 3 . . a. Total risk. b. Systematic risk c. Unsystematic risk. d. No risk. 18. The CAPM shows that the expected return for a particular asset depends on the following factors except: a. Market risk premium. b. The pure time value of money c. The amount of unsystematic risk. d. The amount of systematic risk. 19. Obi-Wan's common stock has a beta of 1.4. If the risk-free rate is 3 percent and the market risk premium is 15 percent, what is Obi-Wan's cost of equity? a. 16.80%. b. 19.80% c. 21.00% d. 24.00%. 20. Yoda Co.'s most recent dividend was $1.50 per share, and dividends are expected to grow at a 5 percent annual rate indefinitely. The stock sells for $30 per share. What is Yoda's cost of equity? a. 10.00% b. 10.25%. c. 11.00% d. 11.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts