Question: Please verify these to see if there correct 2. In Table 14.7, assume the banks have made the additional loans. Complete the balance sheet to

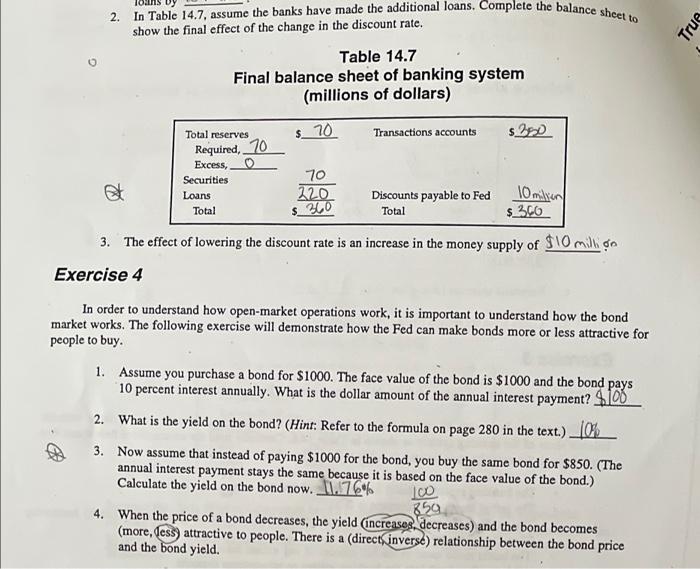

2. In Table 14.7, assume the banks have made the additional loans. Complete the balance sheet to show the final effect of the change in the discount rate. Table 14.7 Final balance sheet of banking system (millions of dollars) Total reserves $ 70 Transactions accounts $350 70 220 $360 Discounts payable to Fed 10 milion Total $360 Total 3. The effect of lowering the discount rate is an increase in the money supply of $10 millio Exercise 4 In order to understand how open-market operations work, it is important to understand how the bond market works. The following exercise will demonstrate how the Fed can make bonds more or less attractive for people to buy. 1. Assume you purchase a bond for $1000. The face value of the bond is $1000 and the bond pays 10 percent interest annually. What is the dollar amount of the annual interest payment? $100 2. What is the yield on the bond? (Hint: Refer to the formula on page 280 in the text.)[0% 3. Now assume that instead of paying $1000 for the bond, you buy the same bond for $850. (The annual interest payment stays the same because it is based on the face value of the bond.) Calculate the yield on the bond now. 1.76 100 859 4. When the price of a bond decreases, the yield (increases, decreases) and the bond becomes (more, Jess) attractive to people. There is a (direct inverse) relationship between the bond price and the bond yield. Required, 70 Excess, 0 Securities Loans True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts