Question: Please verify where I am going wrong. My consolidation worksheet does not balance. Please and thank you. My consolidation worksheet does not balance. *Also the

Please verify where I am going wrong. My consolidation worksheet does not balance. Please and thank you.

My consolidation worksheet does not balance.

My consolidation worksheet does not balance.

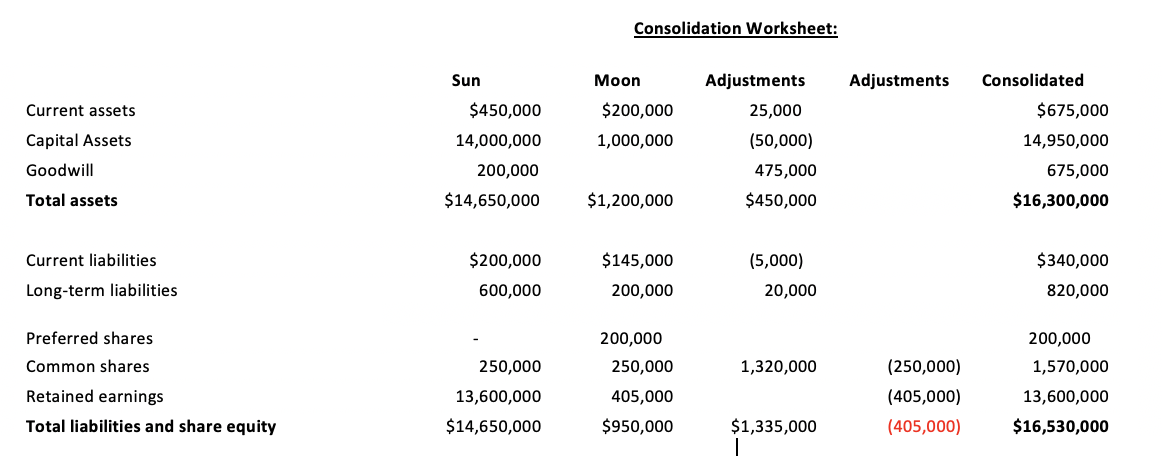

*Also the red (405,000) should be totalled to 655,000

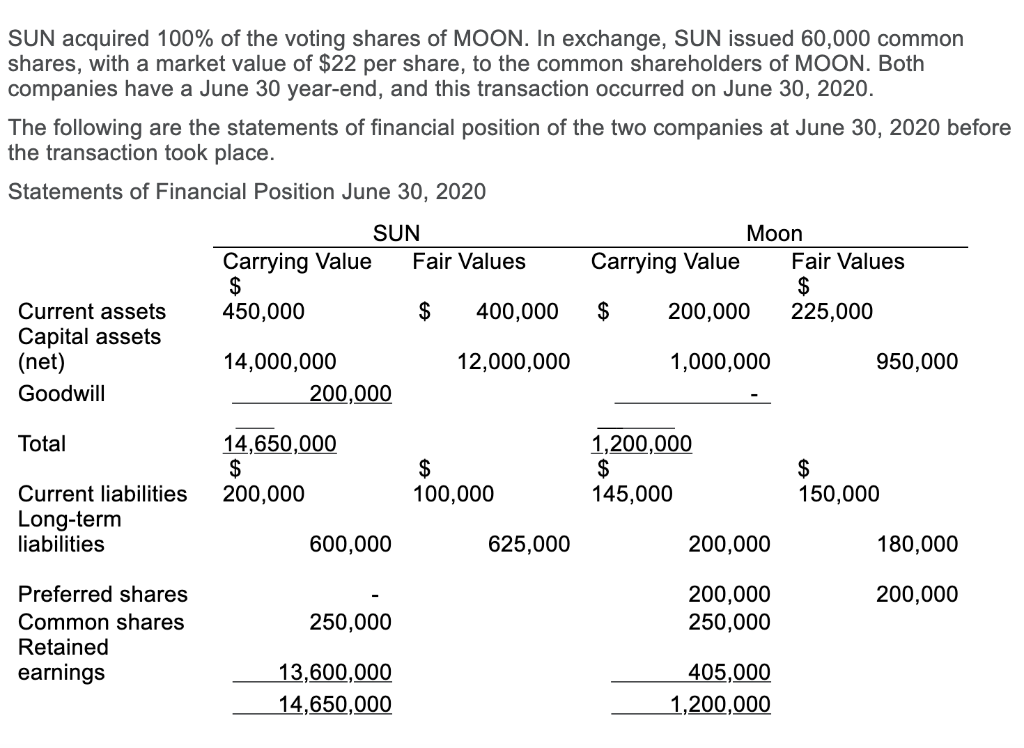

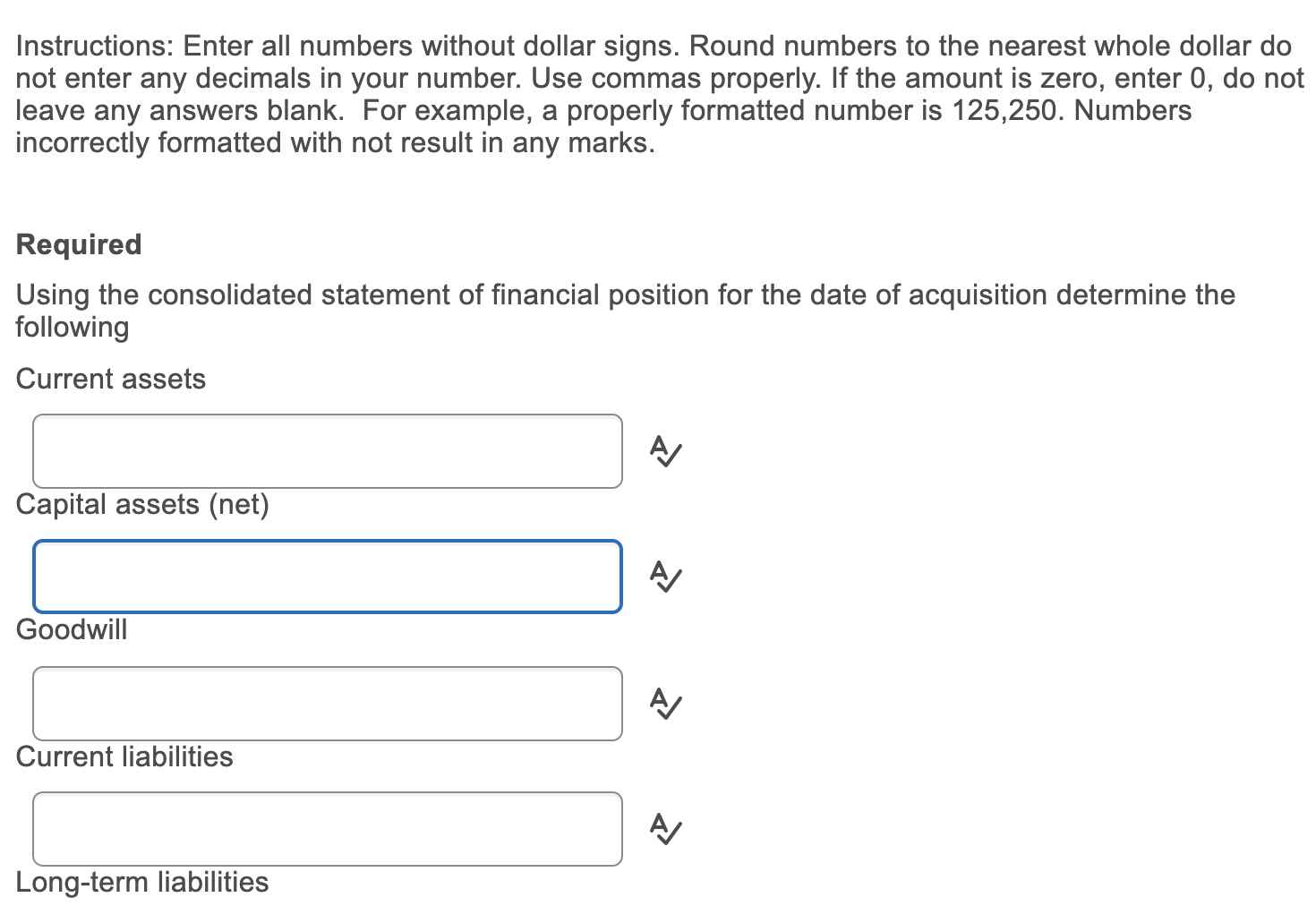

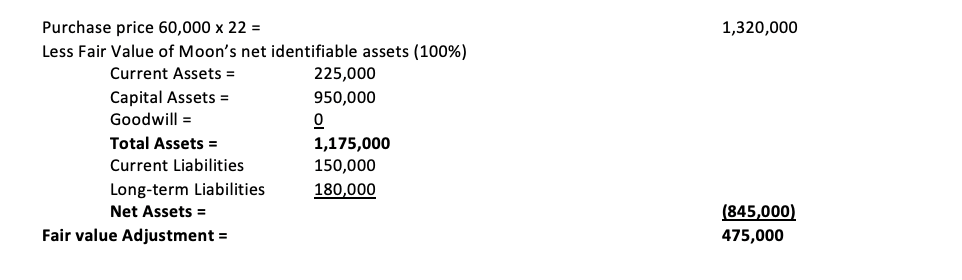

SUN acquired 100% of the voting shares of MOON. In exchange, SUN issued 60,000 common shares, with a market value of $22 per share, to the common shareholders of MOON. Both companies have a June 30 year-end, and this transaction occurred on June 30, 2020. The following are the statements of financial position of the two companies at June 30, 2020 before the transaction took place. Statements of Financial Position June 30, 2020 SUN Carrying Value Fair Values $ 450,000 $ 400,000 Moon Carrying Value Fair Values $ $ 200,000 225,000 Current assets Capital assets (net) Goodwill 12,000,000 1,000,000 950,000 14,000,000 200,000 Total 14,650,000 $ 200,000 $ 100,000 1,200,000 $ 145,000 $ 150,000 Current liabilities Long-term liabilities 600,000 625,000 200,000 180,000 200,000 200,000 250,000 250,000 Preferred shares Common shares Retained earnings 13,600,000 14,650,000 405,000 1,200,000 Instructions: Enter all numbers without dollar signs. Round numbers to the nearest whole dollar do not enter any decimals in your number. Use commas properly. If the amount is zero, enter 0, do not leave any answers blank. For example, a properly formatted number is 125,250. Numbers incorrectly formatted with not result in any marks. Required Using the consolidated statement of financial position for the date of acquisition determine the following Current assets A/ Capital assets (net) A Goodwill AJ Current liabilities A Long-term liabilities AJ Long-term liabilities A/ Preferred shares AJ Common shares AJ Retained earnings A 1,320,000 Purchase price 60,000 x 22 = Less Fair Value of Moon's net identifiable assets (100%) Current Assets = 225,000 Capital Assets = 950,000 Goodwill = 0 Total Assets = 1,175,000 Current Liabilities 150,000 Long-term Liabilities 180,000 Net Assets = Fair value Adjustment = (845,000) 475,000 Consolidation Worksheet: Sun Moon Adjustments Adjustments 25,000 Current assets $450,000 $200,000 14,000,000 1,000,000 Capital Assets Goodwill (50,000) 475,000 Consolidated $675,000 14,950,000 675,000 $16,300,000 200,000 $14,650,000 Total assets $1,200,000 $450,000 Current liabilities $200,000 600,000 $145,000 200,000 (5,000) 20,000 $340,000 820,000 Long-term liabilities Preferred shares 200,000 250,000 Common shares 250,000 1,320,000 200,000 1,570,000 13,600,000 $16,530,000 Retained earnings Total liabilities and share equity 13,600,000 $14,650,000 (250,000) (405,000) (405,000) 405,000 $950,000 $1,335,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts