Question: Please view all the problems from the attachment and solve all of them. $100 for all of the question and please give your expert answers

Please view all the problems from the attachment and solve all of them. $100 for all of the question and please give your expert answers

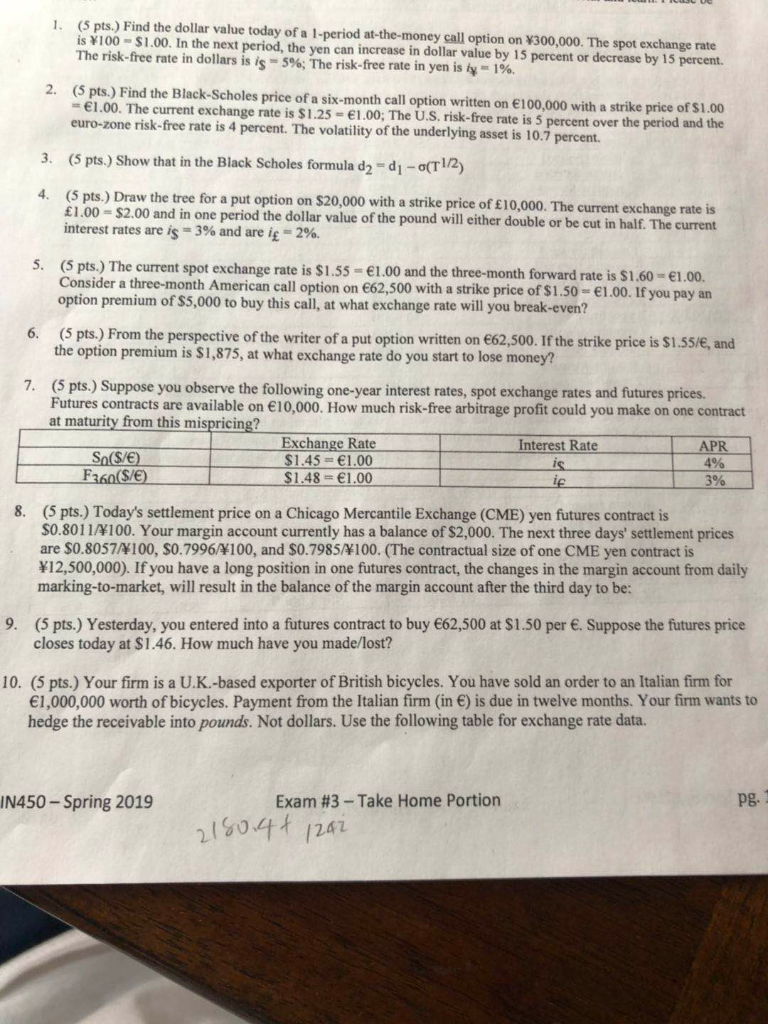

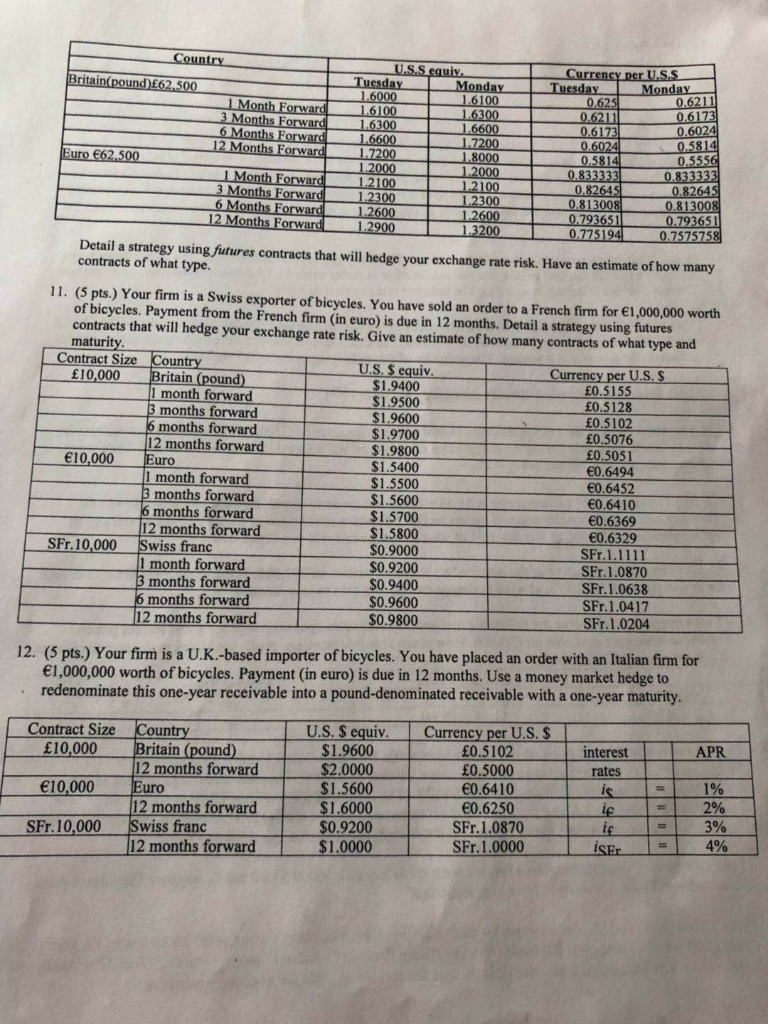

. (5 pts.) Find the dollar value today of a 1-period at-the-money call option on x300,000. The spot exchange rate is Y100 $1.00. In the next period, the yen can increase in dollar value by 15 percent or decrease by 15 percent. The risk-free rate in dollars is iS-594; The risk-free rate in yen is i-1%. 2. (5 pts.) Find the Black-Scholes price of a six-month call option written on e100,000 with a strike price of Si 00 1.00. The current exchange rate is $1.25 1.00; The U.S. risk-free rate is 5 percent over the period and the euro-zone risk-free rate is 4 percent. The volatility of the underlying asset is 10.7 percent. 3. (5 pts) Show that in the Black Scholes formula d2- d-(T12) 4. (5 pts.) Draw the tree for a put option on $20,000 with a strike price of 10,000. The current exchange rate is 00 - S2.00 and in one period the dollar value of the pound will either double or be cut in half. The current interest rates are S-3% and are i-2%. 5. (5 pts.) The current spot exchange rate is $1.55 -1.00 and the three-month forward rate is $1.60-1.00. Consider a three-month American call option on 62,500 with a strike price of $1.50-1.00. If you pay an option premium of $5,000 to buy this call, at what exchange rate will you break-even? 6. (5 pts.) Fom the perspective of the writer of a put option written on 662,500. If the strike price is S1.55/, and the option premium is $1,875, at what exchange rate do you start to lose money? 7. (5 pts.) Suppose you observe the following one-year interest rates, spot exchange rates and futures prices Futures contracts are available on e10,000. How much risk-free arbitrage profit could you make on one contract at maturity from this mispricing? Exchange Rate S1.45 1.00 1.48 1.00 Interest Rate Sa(S/E) Fasa S/E APR 4% 3% (5 pts.) Today's settlement price on a Chicago Mercantile Exchange (CME) yen futures contract is S0.8011/100. Your margin account currently has a balance of $2,000. The next three days' settlement prices are $0.8057/100, S0.7996/100, and $O.7985/100. (The contractual size of one CME yen contract is 12,500,000). Ifyou have a long position in one futures contract, the changes in the margin account from daily marking-to-market, will result in the balance of the margin account after the third day to be 8. 9. (5 pts.) Yesterday, you entered into a futures contract to buy 62,500 at $1.50 per . Suppose the futures price closes today at $1.46. How much have you made/lost? 10. (5 pts.) Your firm is a U.K.-based exporter of British bicycles. You have sold an order to an Italian firm for 1,000,000 worth of bicycles. Payment from the Italian firm (in ) is due in twelve months. Your firm wants to hedge the receivable into pounds. Not dollars. Use the following table for exchange rate data. IN450-Spring 2019 Exam #3-Take Home Portion 104 1241 Currency per uS.S 0.621 0.6173 Euro 62,500 12000 12100 123000.8 3 Months Forward12300 12 Months Forwar 0.775 0.757575 Detail a strategy using, futures contracts that will hedge your exchange rate risk. Have an estimate of how many contracts of what type. 11. (5 pts.) Your firm is a Swiss exporter of bicycles. You have sold an order to a French firm for 1,000,000 worth of bicycles. Payment from the French firm (in euro) is due in 12 months. Detail a strategy using futures contracts that will hedge your exchange rate risk. Give an estimate of how many contracts of what type and maturit Contract Size Country uiv 10,000 Currency per U.S. S ritain (pound) 1 month forward months forward months forward 12 months forward $1.9400 1.9500 1.9600 $1.9700 $1.9800 S1.5400 $1.5500 1.5600 0.51 0.5128 0.5102 0.5076 0.5051 0.6494 10,000 uro 1 month forward 0.6452 0.6410 0.6369 0.6329 SFr.1.1111 SFr.1.0870 SFr.1.0638 SFr1.0417 SFr.1.0204 months forward months forward 12 months forward $1.5800 $0.9000 $0.9200 0.9400 $0.9600 $0.9800 SFr.10,000 Swiss franc 1 month forward months forward months forward 12 months forward 12. (5 pts.) Your firm is a U.K.-based importer of bicycles. You have placed an order with an Italian firm for 1,000,000 worth of bicycles. Payment (in euro) is due in 12 months. Use a money market hedge to redenominate this one-year receivable into a pound-denominated receivable with a one-year maturity. Contract Size Country U.S. S equiv. Currency per U.S. S APR 10,000 e10,000 SFr. 10,000 ritain (pound) $1.9600 $2.0000 $1.5600 1.6000 $0.9200 $1.0000 0.5102 0.5000 0.6410 0.6250 SFr.1.0870 SFr.1.0000 interest rates 12 months forward 12 months forward 12 months forward 190 2% 3% 4% uro Swiss franc . (5 pts.) Find the dollar value today of a 1-period at-the-money call option on x300,000. The spot exchange rate is Y100 $1.00. In the next period, the yen can increase in dollar value by 15 percent or decrease by 15 percent. The risk-free rate in dollars is iS-594; The risk-free rate in yen is i-1%. 2. (5 pts.) Find the Black-Scholes price of a six-month call option written on e100,000 with a strike price of Si 00 1.00. The current exchange rate is $1.25 1.00; The U.S. risk-free rate is 5 percent over the period and the euro-zone risk-free rate is 4 percent. The volatility of the underlying asset is 10.7 percent. 3. (5 pts) Show that in the Black Scholes formula d2- d-(T12) 4. (5 pts.) Draw the tree for a put option on $20,000 with a strike price of 10,000. The current exchange rate is 00 - S2.00 and in one period the dollar value of the pound will either double or be cut in half. The current interest rates are S-3% and are i-2%. 5. (5 pts.) The current spot exchange rate is $1.55 -1.00 and the three-month forward rate is $1.60-1.00. Consider a three-month American call option on 62,500 with a strike price of $1.50-1.00. If you pay an option premium of $5,000 to buy this call, at what exchange rate will you break-even? 6. (5 pts.) Fom the perspective of the writer of a put option written on 662,500. If the strike price is S1.55/, and the option premium is $1,875, at what exchange rate do you start to lose money? 7. (5 pts.) Suppose you observe the following one-year interest rates, spot exchange rates and futures prices Futures contracts are available on e10,000. How much risk-free arbitrage profit could you make on one contract at maturity from this mispricing? Exchange Rate S1.45 1.00 1.48 1.00 Interest Rate Sa(S/E) Fasa S/E APR 4% 3% (5 pts.) Today's settlement price on a Chicago Mercantile Exchange (CME) yen futures contract is S0.8011/100. Your margin account currently has a balance of $2,000. The next three days' settlement prices are $0.8057/100, S0.7996/100, and $O.7985/100. (The contractual size of one CME yen contract is 12,500,000). Ifyou have a long position in one futures contract, the changes in the margin account from daily marking-to-market, will result in the balance of the margin account after the third day to be 8. 9. (5 pts.) Yesterday, you entered into a futures contract to buy 62,500 at $1.50 per . Suppose the futures price closes today at $1.46. How much have you made/lost? 10. (5 pts.) Your firm is a U.K.-based exporter of British bicycles. You have sold an order to an Italian firm for 1,000,000 worth of bicycles. Payment from the Italian firm (in ) is due in twelve months. Your firm wants to hedge the receivable into pounds. Not dollars. Use the following table for exchange rate data. IN450-Spring 2019 Exam #3-Take Home Portion 104 1241 Currency per uS.S 0.621 0.6173 Euro 62,500 12000 12100 123000.8 3 Months Forward12300 12 Months Forwar 0.775 0.757575 Detail a strategy using, futures contracts that will hedge your exchange rate risk. Have an estimate of how many contracts of what type. 11. (5 pts.) Your firm is a Swiss exporter of bicycles. You have sold an order to a French firm for 1,000,000 worth of bicycles. Payment from the French firm (in euro) is due in 12 months. Detail a strategy using futures contracts that will hedge your exchange rate risk. Give an estimate of how many contracts of what type and maturit Contract Size Country uiv 10,000 Currency per U.S. S ritain (pound) 1 month forward months forward months forward 12 months forward $1.9400 1.9500 1.9600 $1.9700 $1.9800 S1.5400 $1.5500 1.5600 0.51 0.5128 0.5102 0.5076 0.5051 0.6494 10,000 uro 1 month forward 0.6452 0.6410 0.6369 0.6329 SFr.1.1111 SFr.1.0870 SFr.1.0638 SFr1.0417 SFr.1.0204 months forward months forward 12 months forward $1.5800 $0.9000 $0.9200 0.9400 $0.9600 $0.9800 SFr.10,000 Swiss franc 1 month forward months forward months forward 12 months forward 12. (5 pts.) Your firm is a U.K.-based importer of bicycles. You have placed an order with an Italian firm for 1,000,000 worth of bicycles. Payment (in euro) is due in 12 months. Use a money market hedge to redenominate this one-year receivable into a pound-denominated receivable with a one-year maturity. Contract Size Country U.S. S equiv. Currency per U.S. S APR 10,000 e10,000 SFr. 10,000 ritain (pound) $1.9600 $2.0000 $1.5600 1.6000 $0.9200 $1.0000 0.5102 0.5000 0.6410 0.6250 SFr.1.0870 SFr.1.0000 interest rates 12 months forward 12 months forward 12 months forward 190 2% 3% 4% uro Swiss franc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts