Question: Please with full explained steps Question 2 1 pts Summer Co. expects to pay a dividend of $3.75 per share-one year from now-out of earnings

Please with full explained steps

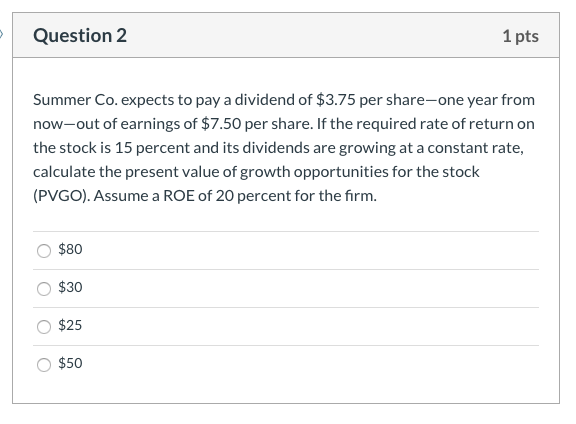

Question 2 1 pts Summer Co. expects to pay a dividend of $3.75 per share-one year from now-out of earnings of $7.50 per share. If the required rate of return on the stock is 15 percent and its dividends are growing ata constant rate, calculate the present value of growth opportunities for the stock (PVGO). Assume a ROE of 20 percent for the firm. $80 $30 $25 $50 OO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts