Question: Please with full explained steps Question 5 1 pts Percival Hygiene has $10 million invested in long-term corporate bonds. This bond portfolio's expected annual rate

Please with full explained steps

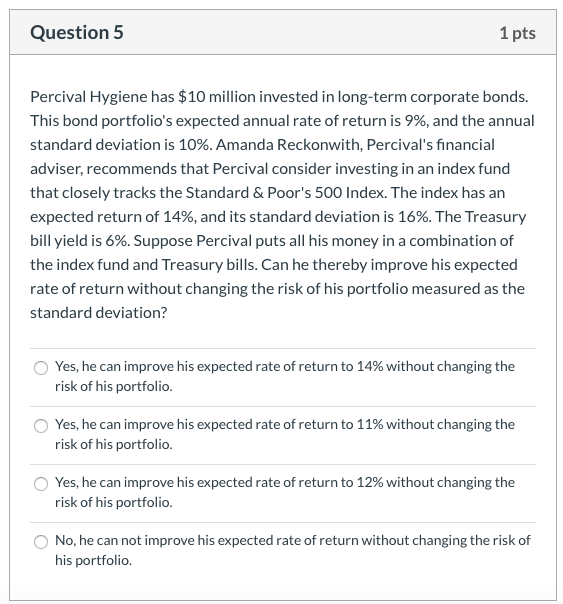

Question 5 1 pts Percival Hygiene has $10 million invested in long-term corporate bonds. This bond portfolio's expected annual rate of return is 9%, and the annual standard deviation is 10%. Amanda Reckonwith, Percival's financial adviser, recommends that Percival consider investing in an index fund that closely tracks the Standard & Poor's 500 Index. The index has an expected return of 14%, and its standard deviation is 16%. The Treasury bill yield is 6%. Suppose Percival puts all his money in a combination of the index fund and Treasury bills. Can he thereby improve his expected rate of return without changing the risk of his portfolio measured as the standard deviation? Yes, he can improve his expected rate of return to 14% without changing the risk of his portfolio. Yes, he can improve his expected rate of return to 11% without changing the risk of his portfolio Yes, he can improve his expected rate of return to 12% without changing the risk of his portfolio. No, he can not improve his expected rate of return without changing the risk of his portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts