Question: Please with full steps and explanation. Question 3 1 pts Consider a 5-year corporate bond with face value of $1000. The coupon rate is 5%

Please with full steps and explanation.

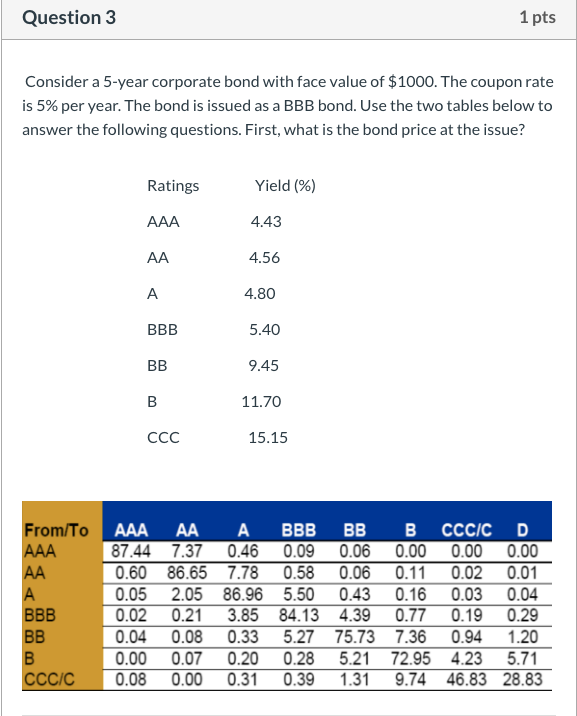

Question 3 1 pts Consider a 5-year corporate bond with face value of $1000. The coupon rate is 5% per year. The bond is issued as a BBB bond. Use the two tables below to answer the following questions. First, what is the bond price at the issue? Ratings Yield (%) 4.43 4.56 4.80 BBB 5.40 9.45 11.70 15.15 From/To 87.44 7.37 0.60 86.65 0.05 2.05 0.02 0.21 0.04 0.08 0.00 0.07 0.08 0.00 0.46 0.09 0.00 7.78 0.58 0.06 86.96 5.50 0.43 3.85 84.13 4.39 0.33 5.27 75.73 0.20 0.28 5.21 0.31 0.39 1.31 0.00 0.00 0.00 0.11 0.02 0.01 0.16 0.03 0.04 0.77 0.19 0.29 7.36 0.94 1.20 72.95 4.235.71 9.74 46.83 28.83

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts