Question: please work by hand as i would like to learn how to do it rather than using excel. thank you! 19. Consider a $1000 par

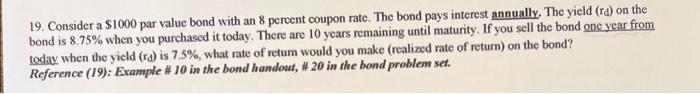

19. Consider a $1000 par value bond with an 8 percent coupon rate. The bond pays interest annually. The yield (rd) on the bond is 8.75% when you purchased it today. There are 10 years remaining until maturity. If you sell the bond one year from today when the yield (rd) is 7.5%, what rate of retum would you make (realized rate of return) on the bond? Reference (19): Example \#10 in the bond handout, \# 20 in the bond problem set

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts