Question: Please work on this document and share back with me as soon as work on it. The below is a picture of what the working

Please work on this document and share back with me as soon as work on it.

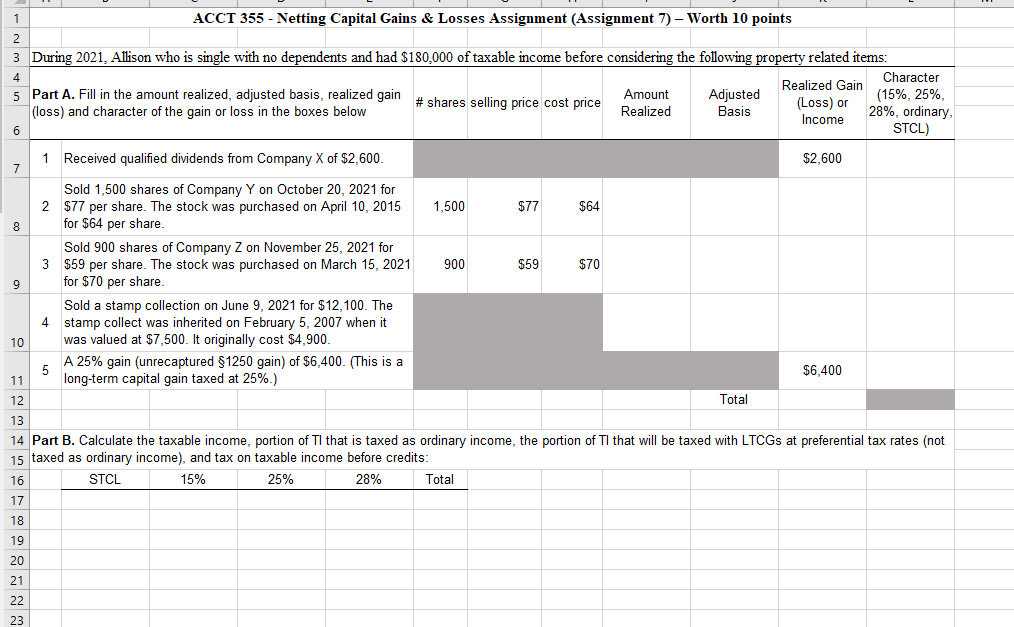

The below is a picture of what the working excel document looks like.

Calculate the taxable income, portion of TI that is taxed as ordinary income, the portion of TI that will be taxed with LTCGs at preferential tax rates (not taxed as ordinary income), and tax on taxable income before credits: STCL 15% 25% 28% Total

Step by Step Solution

3.24 Rating (148 Votes )

There are 3 Steps involved in it

1 Calculate the realized gain loss for each transaction a For the qualified dividends from Company X the realized gain is 2600 b For the sale of 1500 ... View full answer

Get step-by-step solutions from verified subject matter experts