Question: Please work on this excel file (need to see the formulae used within the relevant cells) and submit it. Can I see the formulas and

Please work on this excel file (need to see the formulae used within the relevant cells) and submit it. Can I see the formulas and some explanation on how to use those formulas using Excel. Thanks

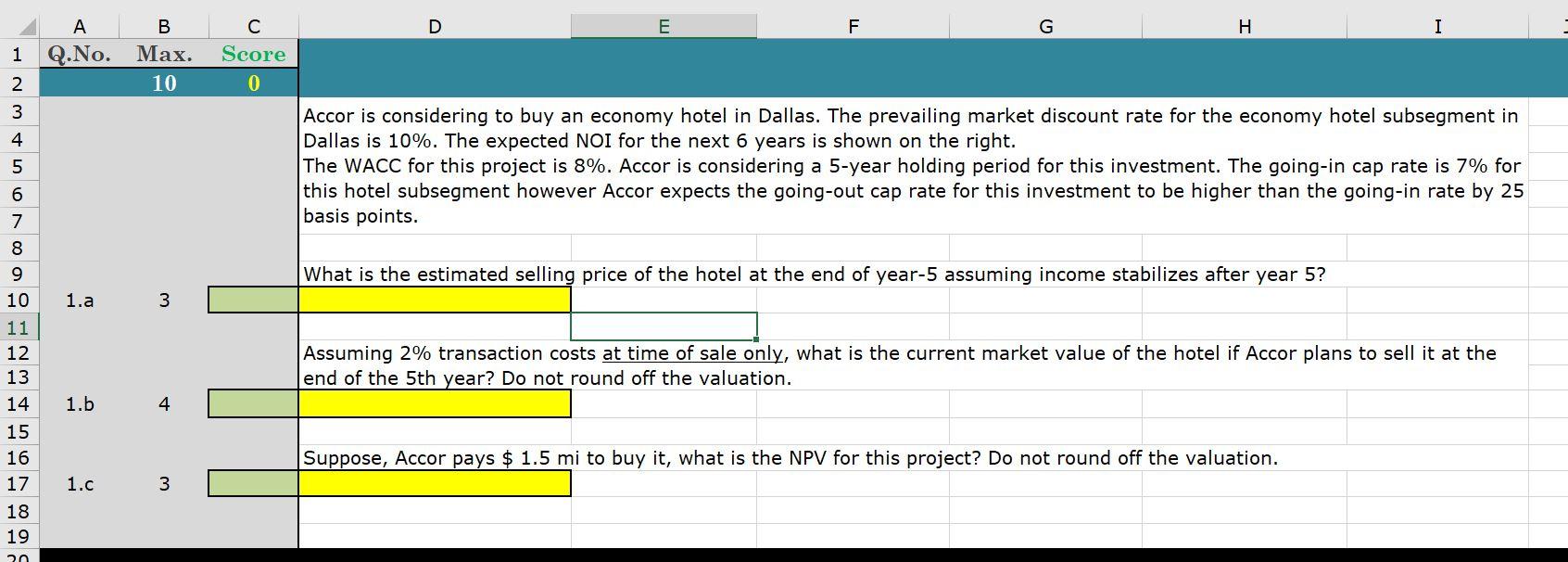

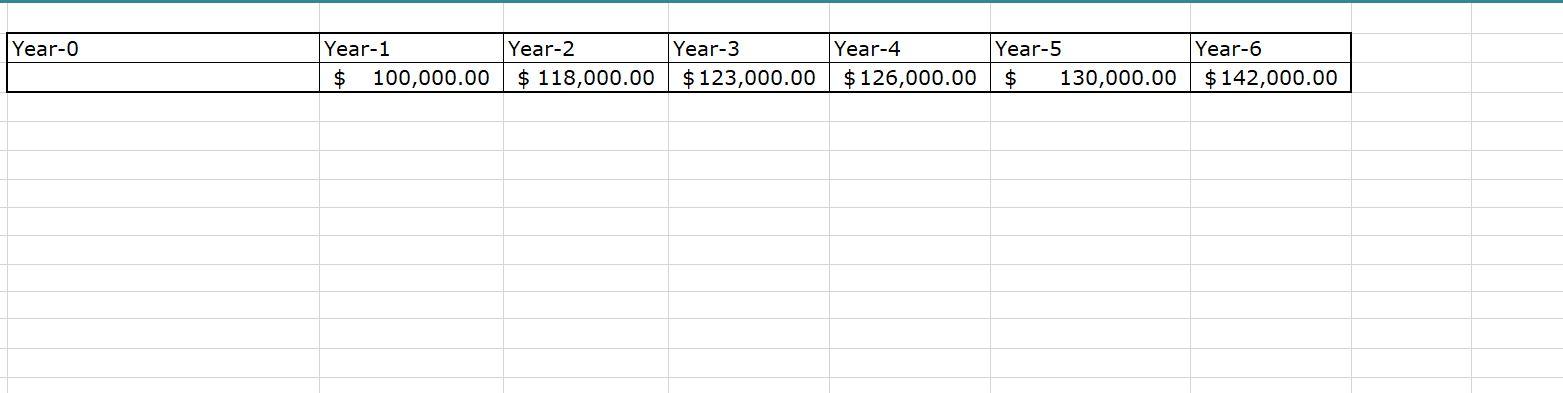

D E F G H I Score A B 1 Q.No. Max. 2 10 3 0 4 5 Accor is considering to buy an economy hotel in Dallas. The prevailing market discount rate for the economy hotel subsegment in Dallas is 10%. The expected NOI for the next 6 years is shown on the right. The WACC for this project is 8%. Accor is considering a 5-year holding period for this investment. The going-in cap rate is 7% for this hotel subsegment however Accor expects the going-out cap rate for this investment to be higher than the going-in rate by 25 basis points. What is the estimated selling price of the hotel at the end of year-5 assuming income stabilizes after year 5? 1.a 3 6 7 8 9 10 11 12 13 14 15 16 17 Assuming 2% transaction costs at time of sale only, what is the current market value of the hotel if Accor plans to sell it at the end of the 5th year? Do not round off the valuation. 1.b 4 Suppose, Accor pays $ 1.5 mi to buy it, what is the NPV for this project? Do not round off the valuation. 1.c 3 18 19 20 Year-o Year-1 $ 100,000.00 Year-2 $ 118,000.00 Year-3 $ 123,000.00 Year-4 $ 126,000.00 Year-5 $ 130,000.00 Year-6 $ 142,000.00 D E F G H I Score A B 1 Q.No. Max. 2 10 3 0 4 5 Accor is considering to buy an economy hotel in Dallas. The prevailing market discount rate for the economy hotel subsegment in Dallas is 10%. The expected NOI for the next 6 years is shown on the right. The WACC for this project is 8%. Accor is considering a 5-year holding period for this investment. The going-in cap rate is 7% for this hotel subsegment however Accor expects the going-out cap rate for this investment to be higher than the going-in rate by 25 basis points. What is the estimated selling price of the hotel at the end of year-5 assuming income stabilizes after year 5? 1.a 3 6 7 8 9 10 11 12 13 14 15 16 17 Assuming 2% transaction costs at time of sale only, what is the current market value of the hotel if Accor plans to sell it at the end of the 5th year? Do not round off the valuation. 1.b 4 Suppose, Accor pays $ 1.5 mi to buy it, what is the NPV for this project? Do not round off the valuation. 1.c 3 18 19 20 Year-o Year-1 $ 100,000.00 Year-2 $ 118,000.00 Year-3 $ 123,000.00 Year-4 $ 126,000.00 Year-5 $ 130,000.00 Year-6 $ 142,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts