Question: please work only in the standard formats for calculations(second pic) i will apreacciate you help PART 1 A-COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC)

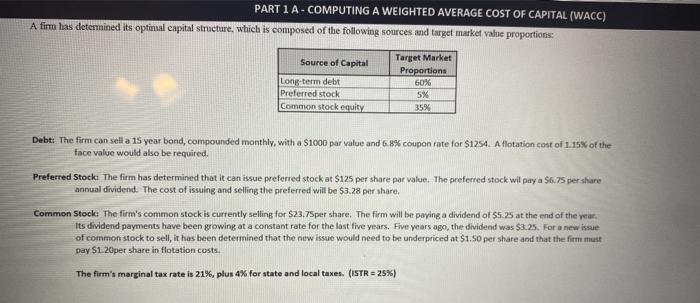

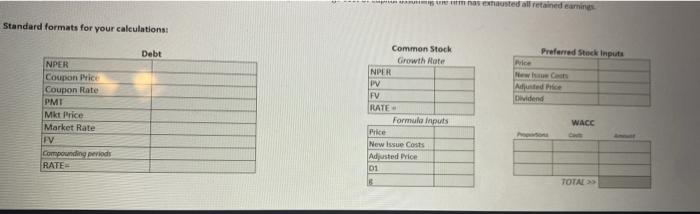

PART 1 A-COMPUTING A WEIGHTED AVERAGE COST OF CAPITAL (WACC) A firm has determined its optimal capital structure, which is composed of the following sources and target market value proportions: Source of Capital Long-term debt Preferred stock Common stock equity Target Market Proportions 60% 5% 35% Debt: The firm can sell a 15 year bond, compounded monthly, with a $1000 par value and 6.8% coupon rate for $1254. A flotation cost of 1.15% of the face value would also be required. Preferred Stock The firm has determined that it can issue preferred stock at $125 per shore per value. The preferred stock will pay a $6.75 per share annual dividend. The cost of issuing and selling the preferred will be $3.28 per share. Common Stock: The firm's common stock is currently selling for $23.7Sper share. The firm will be paying a dividend of 5.25 at the end of the year, Its dividend payments have been growing at a constant rate for the last five years. Five years ago, the dividend was $3.25. For a new issue of common stock to sell, it has been determined that the new issue would need to be underpriced at $1.50 per share and that the firm must pay S1 20per share in flotation costs The firm's marginal tax rate is 21%, plus 4% for state and local taxes. (ISTR = 25%) mashausted all retained earnings Standard formats for your calculations Debt Preferred Stock inputs rice Dividend NPER Coupon Price Coupon Rate PMI Mkt Price Market Rate FV Compounding Vids RATE Common Stock Growth Note NPER PV FV RATE Formule inputs Price New Issue Costs Adjusted Price 01 WACC TOTAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts