Question: please work out by hand step by step thanks Unless otherwise stated, assume annual compounding. Also, assume cash flows are at the end of the

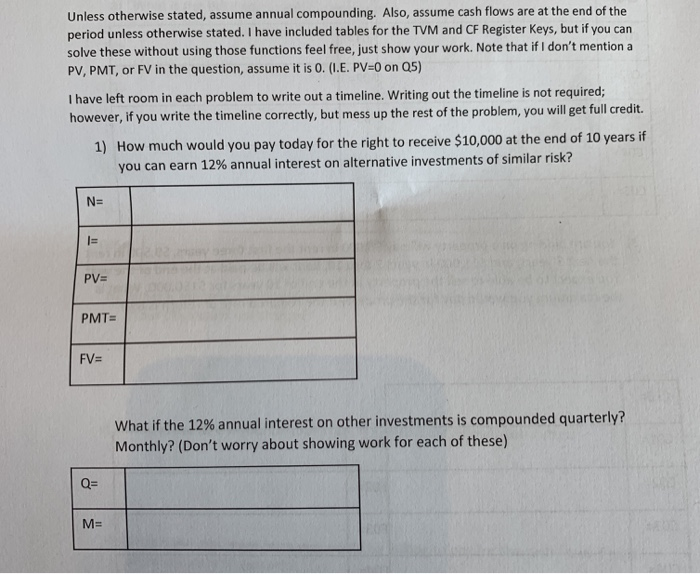

Unless otherwise stated, assume annual compounding. Also, assume cash flows are at the end of the period unless otherwise stated. I have included tables for the TVM and CF Register Keys, but if you can solve these without using those functions feel free, just show your work. Note that if I don't mention a PV, PMT, or FV in the question, assume it is 0. (I.E. PV=O on 05) I have left room in each problem to write out a timeline. Writing out the timeline is not required; however, if you write the timeline correctly, but mess up the rest of the problem, you will get full credit. 1) How much would you pay today for the right to receive $10,000 at the end of 10 years if you can earn 12% annual interest on alternative investments of similar risk? N= PV= PMT= FV= What if the 12% annual interest on other investments is compounded quarterly? Monthly? (Don't worry about showing work for each of these) M=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts