Question: please work out step by step !! thank you !!! QUESTION 6 An investor is trying to determine the optimal investment decision among two investment

please work out step by step !! thank you !!!

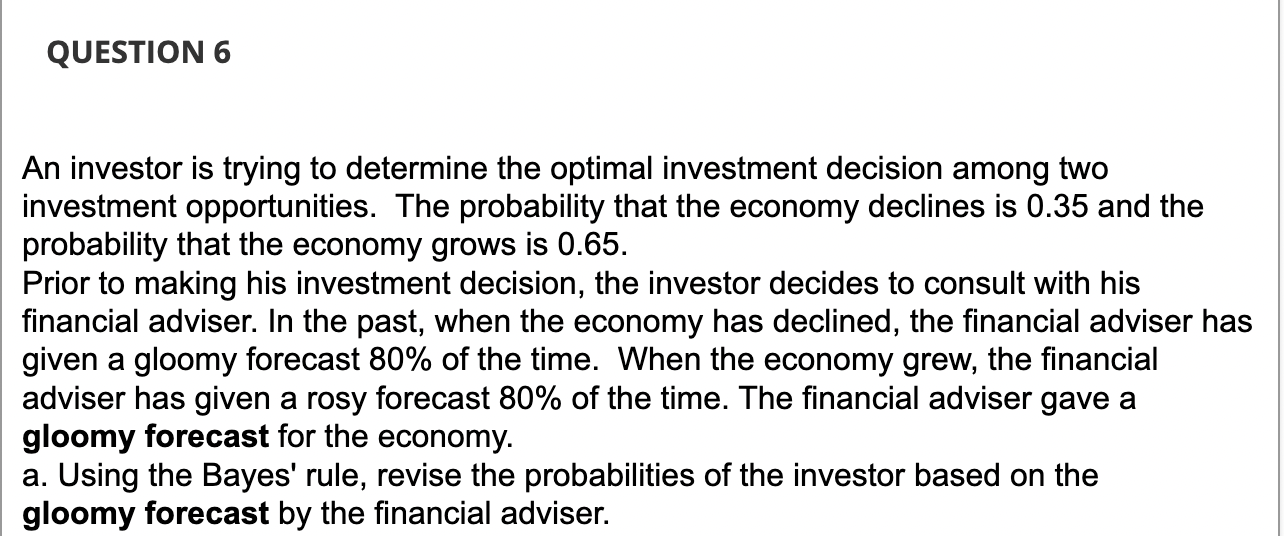

QUESTION 6 An investor is trying to determine the optimal investment decision among two investment opportunities. The probability that the economy declines is 0.35 and the probability that the economy grows is 0.65. Prior to making his investment decision, the investor decides to consult with his financial adviser. In the past, when the economy has declined, the financial adviser has given a gloomy forecast 80% of the time. When the economy grew, the financial adviser has given a rosy forecast 80% of the time. The financial adviser gave a gloomy forecast for the economy. a. Using the Bayes' rule, revise the probabilities of the investor based on the gloomy forecast by the financial adviser. QUESTION 6 An investor is trying to determine the optimal investment decision among two investment opportunities. The probability that the economy declines is 0.35 and the probability that the economy grows is 0.65. Prior to making his investment decision, the investor decides to consult with his financial adviser. In the past, when the economy has declined, the financial adviser has given a gloomy forecast 80% of the time. When the economy grew, the financial adviser has given a rosy forecast 80% of the time. The financial adviser gave a gloomy forecast for the economy. a. Using the Bayes' rule, revise the probabilities of the investor based on the gloomy forecast by the financial adviser

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts