Question: please work through whole problem, per chegg policy you may answer only one question but technically this is all only one question, let me know

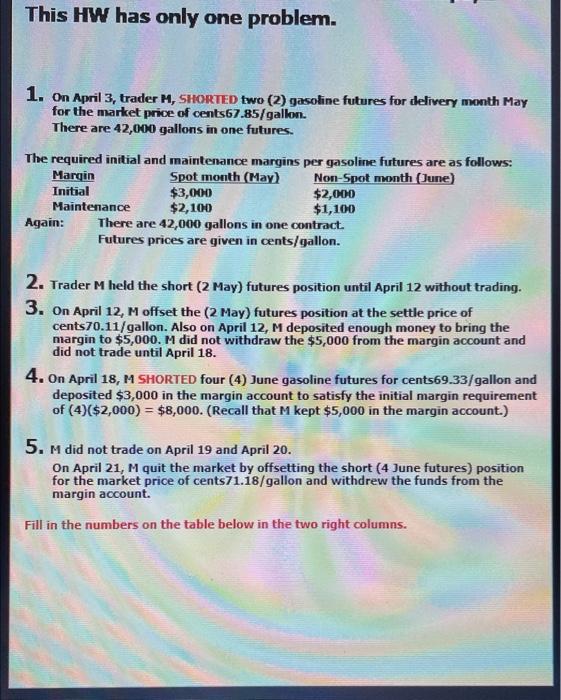

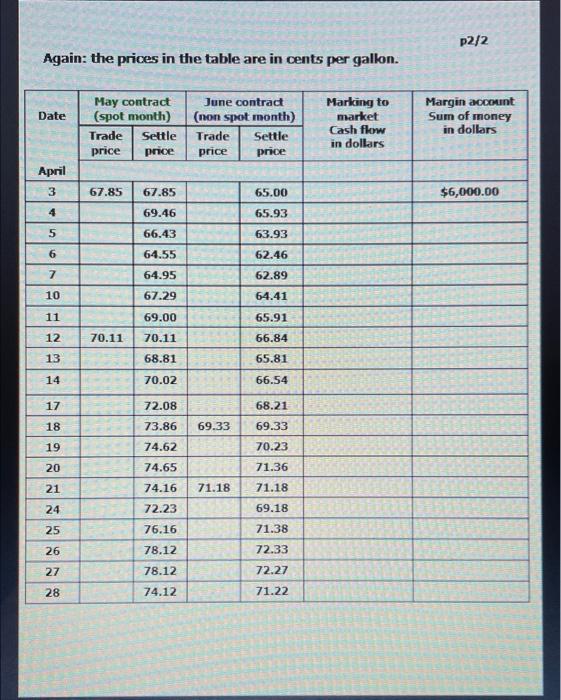

This HW has only one problem. 1. On April 3, trader M, 5 OORTED two (2) gasoline futures for delivery month May for the market price of cents67.85/gallon. There are 42,000 gallons in one fulures. The required initial and maintenance margins per gasoline futures are as follows: Again: There are 42,000 gallons in one contract. Futures prices are given in cents/gallon. 2. Trader M held the short (2 May) futures position until April 12 without trading. 3. On April 12, M offset the (2.May) futures position at the settle price of cents70.11/gallon. Also on April 12, M deposited enough money to bring the margin to $5,000. M did not withdraw the $5,000 from the margin account and did not trade until April 18. 4. On April 18, M SHORTED four (4) June gasoline futures for cents69.33/gallon and deposited $3,000 in the margin account to satisfy the initial margin requirement of (4)($2,000)=$8,000. (Recall that M kept $5,000 in the margin account) 5. M did not trade on April 19 and April 20. On April 21, M quit the market by offsetting the short (4 June futures) position for the market price of cents71.18/gallon and withdrew the funds from the margin account. Fill in the numbers on the table below in the two right columns. Aaain: the prices in the table are in cents ner callon. This HW has only one problem. 1. On April 3, trader M, 5 OORTED two (2) gasoline futures for delivery month May for the market price of cents67.85/gallon. There are 42,000 gallons in one fulures. The required initial and maintenance margins per gasoline futures are as follows: Again: There are 42,000 gallons in one contract. Futures prices are given in cents/gallon. 2. Trader M held the short (2 May) futures position until April 12 without trading. 3. On April 12, M offset the (2.May) futures position at the settle price of cents70.11/gallon. Also on April 12, M deposited enough money to bring the margin to $5,000. M did not withdraw the $5,000 from the margin account and did not trade until April 18. 4. On April 18, M SHORTED four (4) June gasoline futures for cents69.33/gallon and deposited $3,000 in the margin account to satisfy the initial margin requirement of (4)($2,000)=$8,000. (Recall that M kept $5,000 in the margin account) 5. M did not trade on April 19 and April 20. On April 21, M quit the market by offsetting the short (4 June futures) position for the market price of cents71.18/gallon and withdrew the funds from the margin account. Fill in the numbers on the table below in the two right columns. Aaain: the prices in the table are in cents ner callon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts