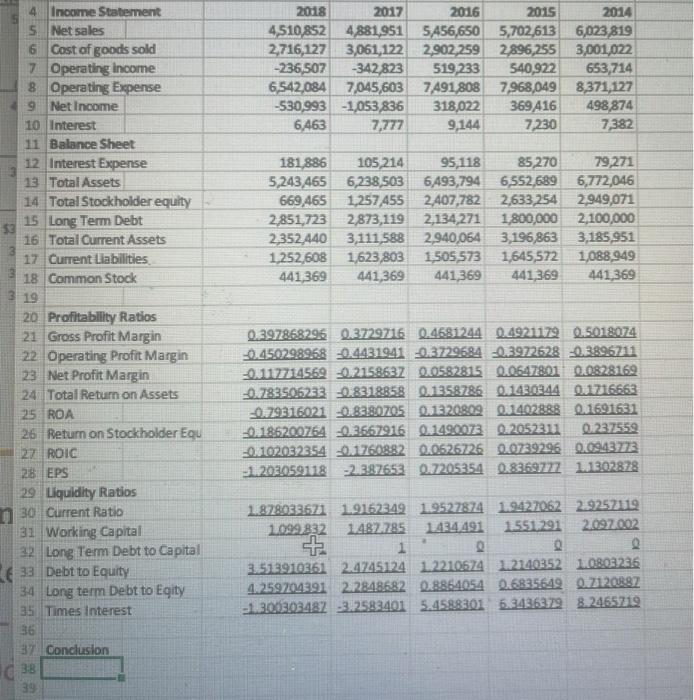

Question: please write 4 paragraph conclusions given the following calculated ratios about Mattel inc. 4 Income Statement Net sales 5 6 Cost of goods sold Operating

4 Income Statement Net sales 5 6 Cost of goods sold Operating income Operating Expense 8 9 Net Income 10 Interest 11 Balance Sheet 12 Interest Expense 13 Total Assets 14 Total Stockholder equity 15 Long Term Debt 16 Total Current Assets 17 Current Liabilities 18 Common Stock 19 20 Profitability Ratios 21 Gross Profit Margin 22 Operating Profit Margin 23 Net Profit Margin 24 Total Return on Assets 25 ROA 26 Return on Stockholder Equ 27 ROIC 28 EPS 29 Liquidity Ratios 30 Current Ratio 31 Working Capital 32 Long Term Debt to Capital 33 Debt to Equity 34 Long term Debt to Egity 35 Times Interest 36 37 Conclusion 38 39 $3 C 2018 2017 2016 2015 2014 4,510,852 4,881,951 5,456,650 5,702,613 6,023,819 2,716,127 3,061,122 2,902,259 2,896,255 3,001,022 -236,507 -342,823 519,233 540,922 653,714 6,542,084 7,045,603 7491,808 7,968,049 8,371,127 -530,993 -1,053,836 318,022 369416 498,874 6,463 7,777 9,144 7,230 7,382 105,214 95,118 85,270 79,271 181,886 5,243,465 6,238,503 6,493,794 6,552,689 6,772,046 669,465 1,257,455 2,407,782 2,633,254 2,949,071 2,851,723 2,873,119 2,134,271 1,800,000 2,100,000 2,352,440 3,111,588 2,940,064 3,196,863 3,185,951 1,252,608 1,623,803 1,505,573 1,645,572 1,088,949 441,369 441,369 441,369 441,369 441,369 0.397868296 0.3729716 0.4681244 0.4921179 0.5018074 -0.450298968 -0.4431941 -0.3729684 -0.3972628 -0.3896711 -0.117714569 -0.2158637 0.0582815 0.0647801 0.0828169 -0.783506233 0.8318858 0.1358786 0.1430344 0.1716663 -0.79316021 -0.8380705 0.1320809 0.1402888 0.1691631 0.237559 -0.186200764 -0.3667916 0.1490073 0.2052311 -0.102032354 0.1760882 0.0626726 0.0739296 0.0943773 -1.203059118 -2.387653 0.7205354 0.8369777 1.1302878 1.878033671 1.9162349 1.9527874 1.9427062 2.9257119 1.099.832 1487.785 1434.491 1.551.291 2.097.002 a 1 Q 3.513910361 2.4745124 1.2210674 1.2140352 1.0803236 4.259704391 2.2848682 0.8864054 0.6835649 0.7120887 -1.300303487 -3.2583401 5.4588301 6.3436379 8.2465719

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts