Question: Please write a competitor analysis for Twitter on the following companies: Snapchat, LinkedIn, Facebook, WhatsApp, and Instagram; using the images attached. Please write a 150-word

Please write a competitor analysis for Twitter on the following companies: Snapchat, LinkedIn, Facebook, WhatsApp, and Instagram; using the images attached. Please write a 150-word analysis for each of the companies.

Please write a competitor analysis for Twitter on the following companies: Snapchat, LinkedIn, Facebook, WhatsApp, and Instagram; using the images attached. Please write a 150-word analysis for each of the companies.

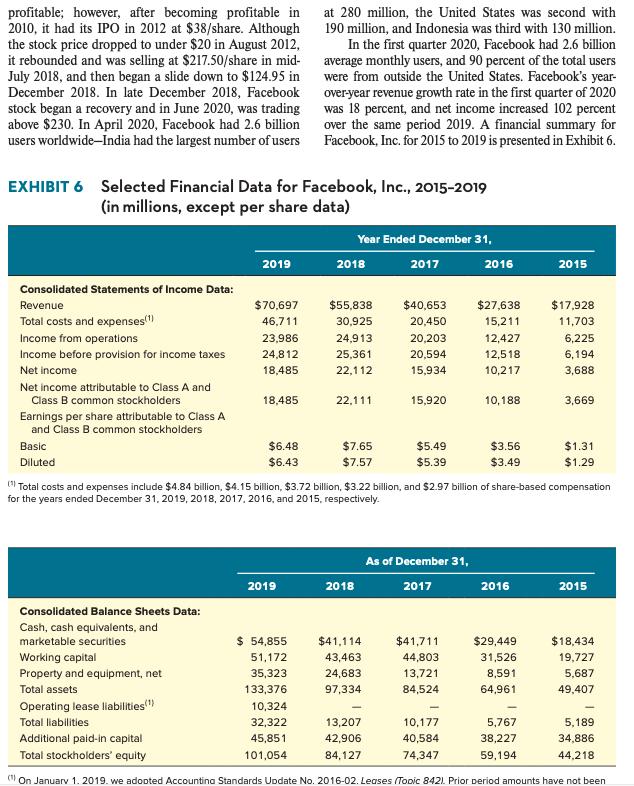

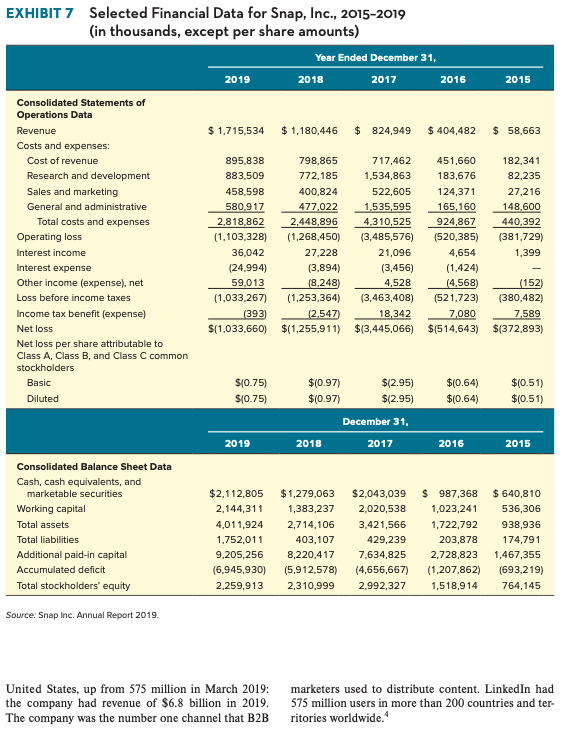

TWITTER'S MAJOR COMPETITORS Facebook Facebook was the world's largest online social net- working and social media company. It was founded in February 2004 by Mark Zuckerberg, Eduardo Saverin, Dustin Moskivitz, Chris Hughes, and Andrew McCollum. As was common among online social net- working companies, Facebook was not immediately profitable; however, after becoming profitable in 2010, it had its IPO in 2012 at $38/share. Although the stock price dropped to under $20 in August 2012, it rebounded and was selling at $217.50/share in mid- July 2018, and then began a slide down to $124.95 in December 2018. In late December 2018, Facebook stock began a recovery and in June 2020, was trading above $230. In April 2020, Facebook had 2.6 billion users worldwide-India had the largest number of users at 280 million, the United States was second with 190 million, and Indonesia was third with 130 million. In the first quarter 2020, Facebook had 2.6 billion average monthly users, and 90 percent of the total users were from outside the United States. Facebook's year- over-year revenue growth rate in the first quarter of 2020 was 18 percent, and net income increased 102 percent over the same period 2019. A financial summary for Facebook, Inc. for 2015 to 2019 is presented in Exhibit 6. EXHIBIT 6 Selected Financial Data for Facebook, Inc., 2015-2019 (in millions, except per share data) Year Ended December 31, 2019 2018 2017 2016 2015 Consolidated Statements of Income Data: Revenue $ 70,697 $55,838 $40,653 $27,638 $17,928 Total costs and expenses 46,711 30,925 20,450 15,211 11,703 Income from operations 23,986 24,913 20,203 12,427 6,225 Income before provision for income taxes 24,812 25,361 20,594 12,518 6,194 Net income 18,485 22,112 15,934 10,217 3,688 Net income attributable to Class A and Class B common stockholders 18,485 22,111 15,920 10,188 3,669 Earnings per share attributable to Class A and Class B common stockholders Basic $6.48 $7.65 $5.49 $3.56 $1.31 Diluted $6.43 $7.57 $5.39 $3.49 $1.29 "Total costs and expenses include $4.84 billion, $4.15 billion, $3.72 billion, $3.22 billion, and $2.97 billion of share-based compensation for the years ended December 31, 2019, 2018, 2017, 2016, and 2015, respectively. As of December 31, 2017 2019 2018 2016 2015 Consolidated Balance Sheets Data: Cash, cash equivalents, and marketable securities Working capital Property and equipment, net Total assets Operating lease liabilities) Total liabilities Additional paid-in capital Total stockholders' equity $41,114 43,463 24,683 97,334 $41,711 44,803 13,721 84,524 $29,449 31,526 8,591 64,961 $18.434 19,727 5,687 49,407 $ 54,855 51,172 35,323 133,376 10,324 32,322 45,851 101,054 13,207 42,906 84,127 10.177 40,584 74,347 5,767 38,227 59,194 5.189 34,886 44,218 (01 On January 1, 2019. we adopted Accounting Standards Update No. 2016-02. Leases (Topic 8421. Prior period amounts have not been WhatsApp Snapchat had over 398 million active users worldwide, and 101 million users in the United States WhatsApp was a freeware and cross-platform mes saging and IP service owned by Facebook. The com- in January 2020. On average, 218 million people pany was founded in 2009 by ex-Yahoo employees Jan used Snapchat daily, creating over 3 billion snaps Koum and Brian Acton. WhatsApp used the Internet every day, however, its users were declining. A finan- to send messages, audio, video, and images, and was cial summary for Snap Inc. for 2015 through 2019 is similar to a text messaging service. However, because presented in Exhibit 7. WhatsApp sent messages over the Internet, the cost for users was much less than texting. The company Instagram grew quickly and within a few months of startup, Instagram was a video and photo-sharing social net- WhatsApp added a service charge to slow down its work service created by Kevin Systrom and Mike growth rate. In 2014, WhatsApp was acquired by Krieger in 2010. Facebook acquired the company in Facebook for $21.94 billion. 2012: the agreed price was $1 billion (a mixture of In early 2018, after a long feud with Facebook case and Facebook stock), however the final price founder and CEO Mark Zuckerberg about how to get was $715 million because Facebook's share process additional revenue from WhatsApp, Koum and Acton tumbled before the deal was finalized. If Instagram resigned from Facebook. Zuckerberg was focused were a standalone company, it would be worth more on using targeted ads to WhatsApp's large user base; than $100 billion, which would be a 100-fold return Koum and Acton were believers in privacy and had no for Facebook interest in the potential commercial applications. When In March 2019, Instagram reached 1.1 billion WhatsApp was sold to Facebook, the founders pledged monthly active users, but by April 2020, that number privacy of WhatsApp. Four years later, Facebook was down slightly to 1 billion. There were 89 percent pushed WhatsApp to change its terms of service and of which are outside the United States in October give Facebook access to WhatsApp users' phone 2019. The company generated $20 billion in advertis- numbers. Facebook also wanted a unified profile that ing revenue in 2019, which was over 25 percent of could be used for ad targeting and data mining, and a Facebook sales, and Instagram attracted new users recommendation system that would suggest Facebook at a faster rate than Facebook's main site in 2018. friends based on WhatsApp contacts. WhatsApp was In the second quarter 2019, at five percent per quar- the most popular messaging app in the world in 2020, ter growth, Instagram was ahead of Facebook, which with 0.2 billion more users than Facebook Messenger. was growing at 3.14 percent, and Snapchat, growing WhatsApp had 1.5 billion users in 180 countries in the at 2.13 percent. The company was forecast to gener- first quarter 2020,68 million in the United States, with ate $9.5 billion in advertising revenues in 2019 and to 1 billion daily active WhatsApp users and 65 billion grow 47 percent to $13.9 billion in fiscal 2020. messages, sent each day. Snapchat LinkedIn Snap Inc. was a camera company that believed that LinkedIn was a social media service that operated reinventing the camera was a great opportunity to through websites and mobile apps, and focused pri- improve the way that people communicated and lived. marily on professional networking, which enabled Snap, Inc.'s products empowered people to express members to create, manage, and share their profes- themselves, live in the moment, learn about the sional identities online, create professional networks, world, and have fun together. The company's flagship share insights and knowledge, and find jobs and product, Snapchat, was a camera application that business opportunities. The company was founded helped people communicate visually with friends and in December 2002 by Allen Blue, Reid G. Hoffman, family through short videos and images called snaps. Jean-Luc Vaillant, Konstantin Guericke, and Eric Ly. Snaps were deleted by default, so there was less pres- LinkedIn was named by Forbes as one of America's sure to look good when creating and sending images Best Employers in 2016. LinkedIn was acquired by on Snapchat. By reducing the friction typically asso- Microsoft for $26.2 billion in June 2016. ciated with creating and sharing content, Snapchat In March 2020, LinkedIn had over 660 million became one of the most-used cameras in the world. members, 70 percent of which were outside the 2015 $ 58,663 182.341 82.235 27.216 148,600 440.392 (381,729) 1.399 EXHIBIT 7 Selected Financial Data for Snap, Inc., 2015-2019 (in thousands, except per share amounts) Year Ended December 31, 2019 2018 2017 2016 Consolidated Statements of Operations Data Revenue $ 1.715,534 $ 1,180,446 $ 824,949 $ 404,482 Costs and expenses: Cost of revenue 895,838 798.865 717,462 451,660 Research and development 883,509 772,185 1,534,863 183,676 Sales and marketing 458,598 400.824 522,605 124,371 General and administrative 580.917 477,022 1,535,595 165,160 Total costs and expenses 2,818,862 2,448,896 4,310,525 924,867 Operating loss (1.103,328) (1,268,450) (3,485,576) (520,385) Interest income 36,042 27,228 21,096 4,654 Interest expense (24,994) (3,894) (3,456) (1.424) Other income (expense). net 59,013 (8,248) 4,528 (4,568) Loss before income taxes (1.033.267) (1,253,364) (3,463,408) (521,723) Income tax benefit (expense) (393) (2.547) 18,342 7.080 Net loss $(1.033,660) $(1,255,911) $(3.445,066) $(514,643) Net loss per share attributable to Class A, Class B, and Class C common stockholders Basic $10.75) $(0.97) $12.95) $(0.64) $(0.75) $(0.97) $12.95) $(0.64) December 31 2019 2018 2017 2016 Consolidated Balance Sheet Data Cash, cash equivalents, and marketable securities $2,112,805 $1,279,063 $2,043,039 $ 987,368 Working capital 2.144,311 1,383,237 2,020,538 1,023,241 Total assets 4,011,924 2,714,106 3,421,566 1.722.792 Total liabilities 1.752,011 403, 107 429,239 203,878 Additional paid-in capital 9,205,256 8,220.417 7,634,825 2,728,823 Accumulated deficit (6,945,930) (5,912.578) (4,656,667) (1,207,862) Total stockholders' equity 2,259,913 2,310,999 2.992,327 1,518,914 (152) (380,482) 7,589 $(372,893) Diluted $(0.51) $(0.51) 2015 $ 640,810 536,306 938,936 174,791 1,467,355 (693,219) 764,145 Source: Snap Inc. Annual Report 2019. United States, up from 575 million in March 2019: the company had revenue of $6.8 billion in 2019. The company was the number one channel that B2B marketers used to distribute content. LinkedIn had 575 million users in more than 200 countries and ter- ritories worldwide." TWITTER'S MAJOR COMPETITORS Facebook Facebook was the world's largest online social net- working and social media company. It was founded in February 2004 by Mark Zuckerberg, Eduardo Saverin, Dustin Moskivitz, Chris Hughes, and Andrew McCollum. As was common among online social net- working companies, Facebook was not immediately profitable; however, after becoming profitable in 2010, it had its IPO in 2012 at $38/share. Although the stock price dropped to under $20 in August 2012, it rebounded and was selling at $217.50/share in mid- July 2018, and then began a slide down to $124.95 in December 2018. In late December 2018, Facebook stock began a recovery and in June 2020, was trading above $230. In April 2020, Facebook had 2.6 billion users worldwide-India had the largest number of users at 280 million, the United States was second with 190 million, and Indonesia was third with 130 million. In the first quarter 2020, Facebook had 2.6 billion average monthly users, and 90 percent of the total users were from outside the United States. Facebook's year- over-year revenue growth rate in the first quarter of 2020 was 18 percent, and net income increased 102 percent over the same period 2019. A financial summary for Facebook, Inc. for 2015 to 2019 is presented in Exhibit 6. EXHIBIT 6 Selected Financial Data for Facebook, Inc., 2015-2019 (in millions, except per share data) Year Ended December 31, 2019 2018 2017 2016 2015 Consolidated Statements of Income Data: Revenue $ 70,697 $55,838 $40,653 $27,638 $17,928 Total costs and expenses 46,711 30,925 20,450 15,211 11,703 Income from operations 23,986 24,913 20,203 12,427 6,225 Income before provision for income taxes 24,812 25,361 20,594 12,518 6,194 Net income 18,485 22,112 15,934 10,217 3,688 Net income attributable to Class A and Class B common stockholders 18,485 22,111 15,920 10,188 3,669 Earnings per share attributable to Class A and Class B common stockholders Basic $6.48 $7.65 $5.49 $3.56 $1.31 Diluted $6.43 $7.57 $5.39 $3.49 $1.29 "Total costs and expenses include $4.84 billion, $4.15 billion, $3.72 billion, $3.22 billion, and $2.97 billion of share-based compensation for the years ended December 31, 2019, 2018, 2017, 2016, and 2015, respectively. As of December 31, 2017 2019 2018 2016 2015 Consolidated Balance Sheets Data: Cash, cash equivalents, and marketable securities Working capital Property and equipment, net Total assets Operating lease liabilities) Total liabilities Additional paid-in capital Total stockholders' equity $41,114 43,463 24,683 97,334 $41,711 44,803 13,721 84,524 $29,449 31,526 8,591 64,961 $18.434 19,727 5,687 49,407 $ 54,855 51,172 35,323 133,376 10,324 32,322 45,851 101,054 13,207 42,906 84,127 10.177 40,584 74,347 5,767 38,227 59,194 5.189 34,886 44,218 (01 On January 1, 2019. we adopted Accounting Standards Update No. 2016-02. Leases (Topic 8421. Prior period amounts have not been WhatsApp Snapchat had over 398 million active users worldwide, and 101 million users in the United States WhatsApp was a freeware and cross-platform mes saging and IP service owned by Facebook. The com- in January 2020. On average, 218 million people pany was founded in 2009 by ex-Yahoo employees Jan used Snapchat daily, creating over 3 billion snaps Koum and Brian Acton. WhatsApp used the Internet every day, however, its users were declining. A finan- to send messages, audio, video, and images, and was cial summary for Snap Inc. for 2015 through 2019 is similar to a text messaging service. However, because presented in Exhibit 7. WhatsApp sent messages over the Internet, the cost for users was much less than texting. The company Instagram grew quickly and within a few months of startup, Instagram was a video and photo-sharing social net- WhatsApp added a service charge to slow down its work service created by Kevin Systrom and Mike growth rate. In 2014, WhatsApp was acquired by Krieger in 2010. Facebook acquired the company in Facebook for $21.94 billion. 2012: the agreed price was $1 billion (a mixture of In early 2018, after a long feud with Facebook case and Facebook stock), however the final price founder and CEO Mark Zuckerberg about how to get was $715 million because Facebook's share process additional revenue from WhatsApp, Koum and Acton tumbled before the deal was finalized. If Instagram resigned from Facebook. Zuckerberg was focused were a standalone company, it would be worth more on using targeted ads to WhatsApp's large user base; than $100 billion, which would be a 100-fold return Koum and Acton were believers in privacy and had no for Facebook interest in the potential commercial applications. When In March 2019, Instagram reached 1.1 billion WhatsApp was sold to Facebook, the founders pledged monthly active users, but by April 2020, that number privacy of WhatsApp. Four years later, Facebook was down slightly to 1 billion. There were 89 percent pushed WhatsApp to change its terms of service and of which are outside the United States in October give Facebook access to WhatsApp users' phone 2019. The company generated $20 billion in advertis- numbers. Facebook also wanted a unified profile that ing revenue in 2019, which was over 25 percent of could be used for ad targeting and data mining, and a Facebook sales, and Instagram attracted new users recommendation system that would suggest Facebook at a faster rate than Facebook's main site in 2018. friends based on WhatsApp contacts. WhatsApp was In the second quarter 2019, at five percent per quar- the most popular messaging app in the world in 2020, ter growth, Instagram was ahead of Facebook, which with 0.2 billion more users than Facebook Messenger. was growing at 3.14 percent, and Snapchat, growing WhatsApp had 1.5 billion users in 180 countries in the at 2.13 percent. The company was forecast to gener- first quarter 2020,68 million in the United States, with ate $9.5 billion in advertising revenues in 2019 and to 1 billion daily active WhatsApp users and 65 billion grow 47 percent to $13.9 billion in fiscal 2020. messages, sent each day. Snapchat LinkedIn Snap Inc. was a camera company that believed that LinkedIn was a social media service that operated reinventing the camera was a great opportunity to through websites and mobile apps, and focused pri- improve the way that people communicated and lived. marily on professional networking, which enabled Snap, Inc.'s products empowered people to express members to create, manage, and share their profes- themselves, live in the moment, learn about the sional identities online, create professional networks, world, and have fun together. The company's flagship share insights and knowledge, and find jobs and product, Snapchat, was a camera application that business opportunities. The company was founded helped people communicate visually with friends and in December 2002 by Allen Blue, Reid G. Hoffman, family through short videos and images called snaps. Jean-Luc Vaillant, Konstantin Guericke, and Eric Ly. Snaps were deleted by default, so there was less pres- LinkedIn was named by Forbes as one of America's sure to look good when creating and sending images Best Employers in 2016. LinkedIn was acquired by on Snapchat. By reducing the friction typically asso- Microsoft for $26.2 billion in June 2016. ciated with creating and sharing content, Snapchat In March 2020, LinkedIn had over 660 million became one of the most-used cameras in the world. members, 70 percent of which were outside the 2015 $ 58,663 182.341 82.235 27.216 148,600 440.392 (381,729) 1.399 EXHIBIT 7 Selected Financial Data for Snap, Inc., 2015-2019 (in thousands, except per share amounts) Year Ended December 31, 2019 2018 2017 2016 Consolidated Statements of Operations Data Revenue $ 1.715,534 $ 1,180,446 $ 824,949 $ 404,482 Costs and expenses: Cost of revenue 895,838 798.865 717,462 451,660 Research and development 883,509 772,185 1,534,863 183,676 Sales and marketing 458,598 400.824 522,605 124,371 General and administrative 580.917 477,022 1,535,595 165,160 Total costs and expenses 2,818,862 2,448,896 4,310,525 924,867 Operating loss (1.103,328) (1,268,450) (3,485,576) (520,385) Interest income 36,042 27,228 21,096 4,654 Interest expense (24,994) (3,894) (3,456) (1.424) Other income (expense). net 59,013 (8,248) 4,528 (4,568) Loss before income taxes (1.033.267) (1,253,364) (3,463,408) (521,723) Income tax benefit (expense) (393) (2.547) 18,342 7.080 Net loss $(1.033,660) $(1,255,911) $(3.445,066) $(514,643) Net loss per share attributable to Class A, Class B, and Class C common stockholders Basic $10.75) $(0.97) $12.95) $(0.64) $(0.75) $(0.97) $12.95) $(0.64) December 31 2019 2018 2017 2016 Consolidated Balance Sheet Data Cash, cash equivalents, and marketable securities $2,112,805 $1,279,063 $2,043,039 $ 987,368 Working capital 2.144,311 1,383,237 2,020,538 1,023,241 Total assets 4,011,924 2,714,106 3,421,566 1.722.792 Total liabilities 1.752,011 403, 107 429,239 203,878 Additional paid-in capital 9,205,256 8,220.417 7,634,825 2,728,823 Accumulated deficit (6,945,930) (5,912.578) (4,656,667) (1,207,862) Total stockholders' equity 2,259,913 2,310,999 2.992,327 1,518,914 (152) (380,482) 7,589 $(372,893) Diluted $(0.51) $(0.51) 2015 $ 640,810 536,306 938,936 174,791 1,467,355 (693,219) 764,145 Source: Snap Inc. Annual Report 2019. United States, up from 575 million in March 2019: the company had revenue of $6.8 billion in 2019. The company was the number one channel that B2B marketers used to distribute content. LinkedIn had 575 million users in more than 200 countries and ter- ritories worldwide

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts