Question: please write a paragraph explaining! Please discuss Learning Objective A1 in chapter 10 of our book Financial Accounting Fundamentals. Please include the advantages and disadvantages

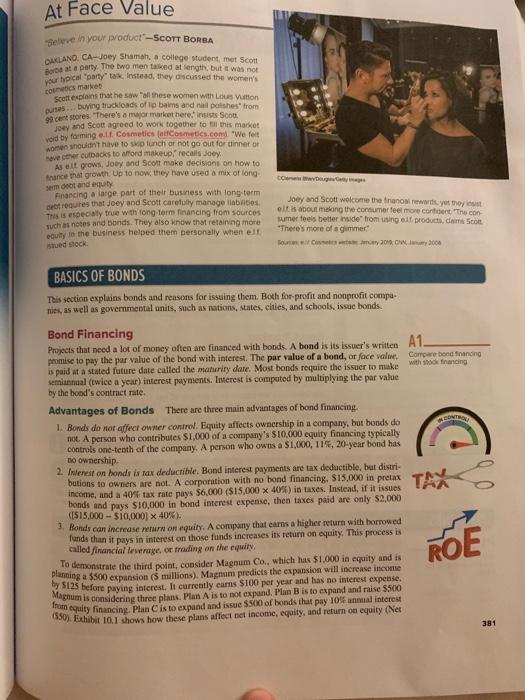

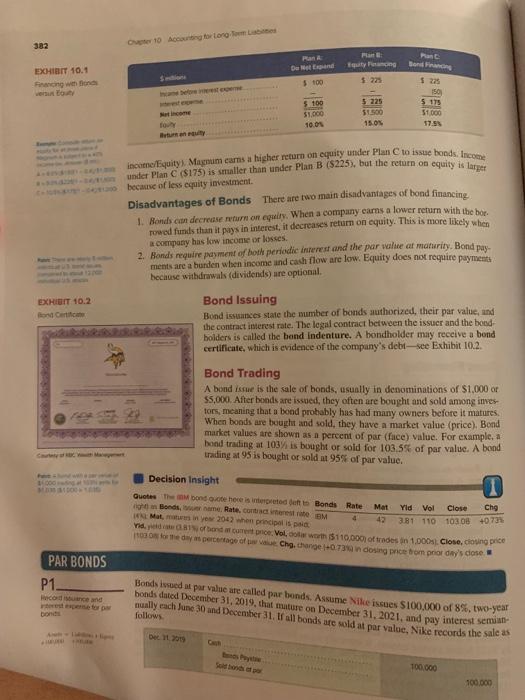

Please discuss Learning Objective A1 in chapter 10 of our book Financial Accounting Fundamentals. Please include the advantages and disadvantages of this type of financing. At Face Value delave in your product-SCOTT BORBA DAKLANO, CA-Joey Shama a conege student met Scom your typical party tax Instead, they discussed the women's come market Scott explains that he saw all these women with Louis Vuitton purses.. buying truckloads of io baims and nail polishes from 9 cent stores. There's a major market here insists Scott Joey and Scott agreed to work together to this market void by forming Lt. Cosmetics Cosmetics.com "We feit women shouldn't have to splunch or not go out for dinner or have the cutbacks to afford makeup. recalls Joey As it grows, Joey and Scot make decisions on how to trance that growth Up to now, they have used a mix of long met and equity Financing a large part of their business with long term de requires that Joey and Scott carefully manage labios This is especially true with long term financing from sources such as notes and bonds. They also know that retaining more equity in the business helped them personally when alt Sed stock www.Ge Joey and Scott welcome the financial rewarsyete it is about malong the commerfeel more confident. The con sumer feel better inside from using all products, como con There's more of a gimmer" Tout 20 W, 2009 BASICS OF BONDS This section explains bonds and reasons for issuing them. Both for-profit and nonprofit compu. nies, as well as governmental units, such as nations, states, cities, and schools, issue bonds. Bond Financing Projects that need a lot of money often are financed with bonds. A bond is its issuer's written A1_ promise to pay the par value of the bond with interest. The par value of a bond, or face value. Compare bona financing is paid at a stated future date called the maturity date. Most bonds require the issuer to make with the financing seminual (twice a year) interest payments. Interest is computed by multiplying the par value by the bood's contract rate. Advantages of Bonds There are three main advantages of bond financing 1. Bonds do not affect owner control. Equity affects ownership in a company, but bonds do nol. A person who contributes $1,000 of a company's $10.000 equity financing typically controls one-tenth of the company. A person who owns a $1,000, 115, 20-year bond has Do ownership 2. Interest on honde is tax deductible. Band interest payments are tax deductible, but distri butions to owners are not. A corporation with no bond financing. $15,000 in prelax income, and a 40% tax rate pays $6,000 ($15,000 x 40%) in taxes. Instead, if it issues TAX bonds and pays $10,000 in bond interest expense, then taxes paid are only $2,000 (515,000 - $10,000) x 40%). Ronds can increase return on equity. A company that carns a higher return with borrowed funds than it pays in interest on those funds increases its return on equity. This process is called financial leverage, or trading on the equity, To demonstrate the third point, consider Magnum Co., which has $1,000 in equity and is $125 before paying interest. Il currently carns $100 per year and has no interest expense. Magnum is considering three plans. Plan A is to not expand. Plan B is to expand and raise $500 (850). Exhibit 10.) shows how these plans affect net income, equity, and return on equity (Net ROE 381 382 Otto Account Long De end EXHIBIT 10.1 Financing wenn $ 100 150 S 175 5 100 $1.000 5 225 $1.500 15.0 000 17.5 income Equity Magnum cars a higher return on equity ander Plan to issue bonds. Inco undet Plan C($175) is smaller than under Plan B (225)but the return on equity is lapa because of less equity investment. Disadvantages of Bonds There are two main disadvantages of bond financing 1. Bonds can decrease return on equiry. When a company carns a lower return with the bor rowed funds than it pays in interest, it decreases return on equity. This is more likely when a company has low income or losses. 2. Bonds require payment of both periodic interest and the par wale at maturity. Bond pay- ments are a burden when income and cash flow are low. Equity does not require payment because withdrawals (dividends) are optional Bond Issuing Bond issuances state the number of bands authorized, their par value, and the contract interest rate. The legal contract between the issue and the bond bolders is called the band indenture. A bondholder may receive a bond certificate, which is evidence of the company's debt - see Exhibit 10.2. EXHIBIT 10.2 Bond Trading A bond issue is the sale of bonds, usually in denominations of $1,000 or $5,000. After bonds are issued, they often are bought and sold among inves tors, meaning that a bond probably has had many owners before it matures. When boods are bought and sold, they have a market value (price), Bond market values are shown as a percent of par (fice) value. For example, a bond trading at 103% is bought or sold for 103.5% of par value. A bond trading at 95 is bought or sold at 95% of par value. Decision Insight Quotes The Mbondo.cohereinterpreted des Bonds Rate Mat Yid Vol Close che Bonsmate contesto 4 42 Matin year 2042 when principal is paid 381 110 10308 40.73% de bond touret po Volo warm $110.000 of trade in 1,000s. Close, doug price TOON e percentage of Che, change 1073 ndosing me tom prior day's close PAR BONDS P1 codice and Bonds ved at par value are called par bonds. Assume Nike issues S100,000 of 8%, two-year bonds duted December 31, 2019. that mature on December 31, 2021, and pay interest seminar muilly rach June 30 and December 31. tall bonds ate sold at par valoc, Nike records the salcas follows bond Solongo 100.000 100.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts