Question: Please write a Python program. Problem 2. (75 pts) A European call option is a financial contract the gives its holder the right to buy

Please write a Python program.

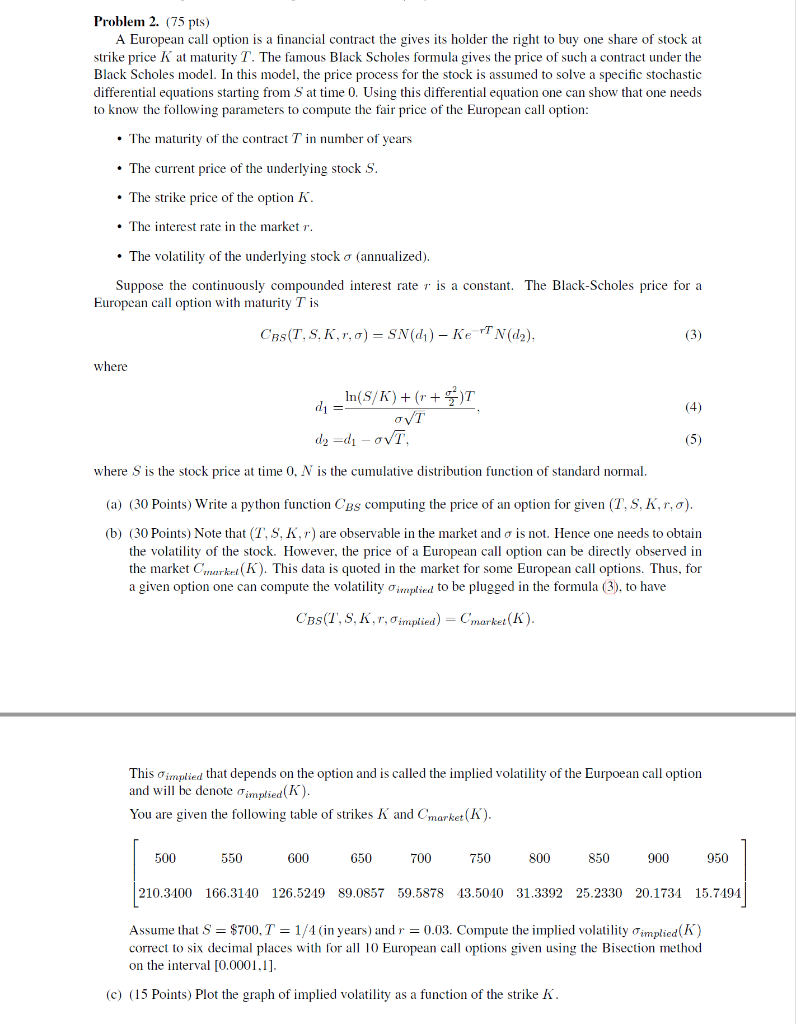

Problem 2. (75 pts) A European call option is a financial contract the gives its holder the right to buy one share of stock at strike price K at maturity T. The famous Black Scholes formula gives the price of such a contract under the Black Scholes model. In this model, the price process for the stock is assumed to solve a specific stochastic differential equations starting from S at time 0. Using this differential equation one can show that one needs to know the following parameters to compute the fair price of the European call option: . The maturity of the contract T in number of years The current price of the underlying stock S. The strike price of the option K. The interest rate in the market r. The volatility of the underlying stock o (annualized). Suppose the continuously compounded interest rate r is a constant. The Black-Scholes price for a European call option with maturity T is CBS(T,S, K,1,0) = SN(d) - Ke PT N(dz) (3) where (4) _In(S/K)+(r+)T di = OVT dy=d -ovt. (5) where S is the stock price at time 0. N is the cumulative distribution function of standard normal. (a) (30 Points) Write a python function CBS computing the price of an option for given (T.SK.r.o). (b) (30 Points) Note that (T.S, K,r) are observable in the market and o is not. Hence one needs to obtain the volatility of the stock. However, the price of a European call option can be directly observed in the market market(K). This data is quoted in the market for some European call options. Thus, for a given option one can compute the volatility implied to be plugged in the formula (3), to have CBS(T,S, K, r, implied) = market(K). This implied that depends on the option and is called the implied volatility of the Eurpoean call option and will be denote implied(K). You are given the following table of strikes K and market(K). 500 550 600 650 700 750 800 850 900 950 210.3100 166.3140 126.5219 89.0857 59.5878 13.5010 31.3392 25.2330 20.1731 15.7191 Assume that S = $700, T = 1/4 (in years) and r = 0.03. Compute the implied volatility O implied(K) correct to six decimal places with for all 10 European call options given using the Bisection method on the interval [0.0001,1]. (c) (15 Points) Plot the graph of implied volatility as a function of the strike K. Problem 2. (75 pts) A European call option is a financial contract the gives its holder the right to buy one share of stock at strike price K at maturity T. The famous Black Scholes formula gives the price of such a contract under the Black Scholes model. In this model, the price process for the stock is assumed to solve a specific stochastic differential equations starting from S at time 0. Using this differential equation one can show that one needs to know the following parameters to compute the fair price of the European call option: . The maturity of the contract T in number of years The current price of the underlying stock S. The strike price of the option K. The interest rate in the market r. The volatility of the underlying stock o (annualized). Suppose the continuously compounded interest rate r is a constant. The Black-Scholes price for a European call option with maturity T is CBS(T,S, K,1,0) = SN(d) - Ke PT N(dz) (3) where (4) _In(S/K)+(r+)T di = OVT dy=d -ovt. (5) where S is the stock price at time 0. N is the cumulative distribution function of standard normal. (a) (30 Points) Write a python function CBS computing the price of an option for given (T.SK.r.o). (b) (30 Points) Note that (T.S, K,r) are observable in the market and o is not. Hence one needs to obtain the volatility of the stock. However, the price of a European call option can be directly observed in the market market(K). This data is quoted in the market for some European call options. Thus, for a given option one can compute the volatility implied to be plugged in the formula (3), to have CBS(T,S, K, r, implied) = market(K). This implied that depends on the option and is called the implied volatility of the Eurpoean call option and will be denote implied(K). You are given the following table of strikes K and market(K). 500 550 600 650 700 750 800 850 900 950 210.3100 166.3140 126.5219 89.0857 59.5878 13.5010 31.3392 25.2330 20.1731 15.7191 Assume that S = $700, T = 1/4 (in years) and r = 0.03. Compute the implied volatility O implied(K) correct to six decimal places with for all 10 European call options given using the Bisection method on the interval [0.0001,1]. (c) (15 Points) Plot the graph of implied volatility as a function of the strike K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts