Question: Please write a step-by-step solution. Thank you!! DC FINAL Fan x 13. Consider the following two mutually exclusive investment projects, which have unequal service lives.

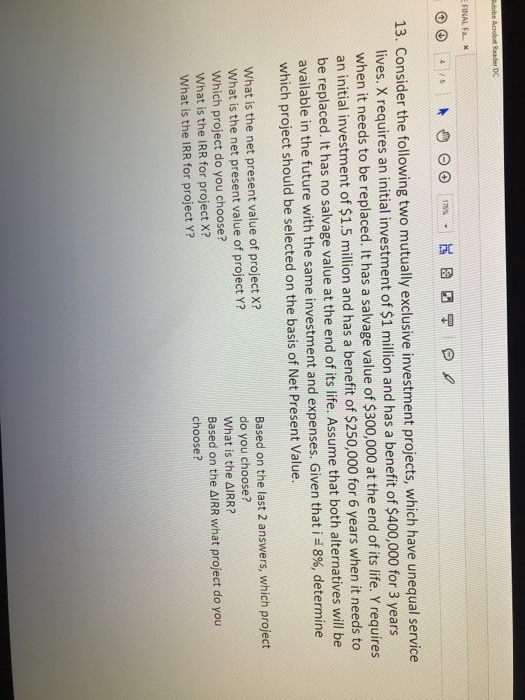

DC FINAL Fan x 13. Consider the following two mutually exclusive investment projects, which have unequal service lives. X requires an initial investment of $1 illion and has a benefit of $400,000 for 3 years when it needs to be replaced. It has a salvage value of $300,000 at the end of its life. Y requires an initial investment of $1.5 million and has a benefit of $250,000 for 6 years when it needs to be replaced. It has no salvage value at the end of its life. Assume that both alternatives will be available in the future with the same investment and expenses. Given that i a 8%, determine which project should be selected on the basis of Net Present Value. Based on the last 2 answers, which project do you choose? What is the AIRR? Based on the AIRR what project do you choose? What is the net present value of project X? What is the net present value of project Y? Which project do you choose? What is the IRR for project X? What is the IRR for project Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts