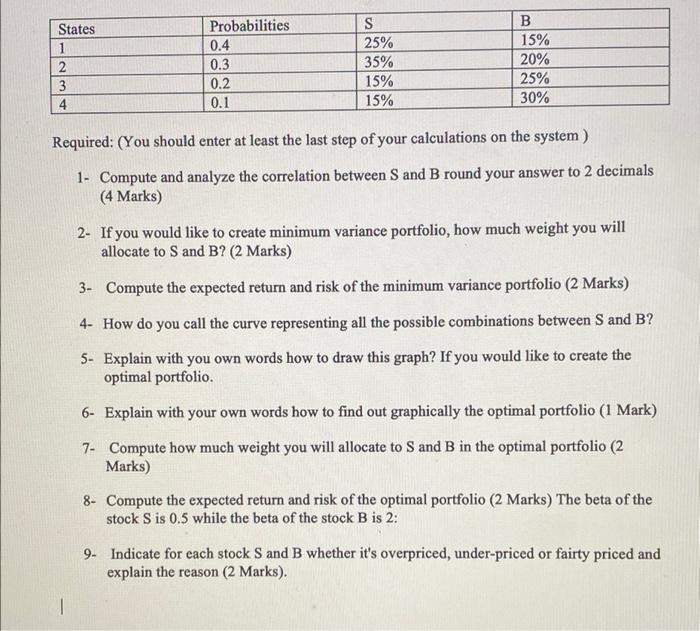

Question: please write all steps write it clearly and Each answer comes with a question number . States 1 2 3 4. Probabilities 0.4 0.3 0.2

States 1 2 3 4. Probabilities 0.4 0.3 0.2 0.1 S 25% 35% 15% 15% B 15% 20% 25% 30% Required: (You should enter at least the last step of your calculations on the system) 1- Compute and analyze the correlation between S and B round your answer to 2 decimals (4 Marks) 2- If you would like to create minimum variance portfolio, how much weight you will allocate to S and B? (2 Marks) 3- Compute the expected return and risk of the minimum variance portfolio (2 Marks) 4- How do you call the curve representing all the possible combinations between S and B? 5- Explain with you own words how to draw this graph? If you would like to create the optimal portfolio. 6- Explain with your own words how to find out graphically the optimal portfolio (1 Mark) 7- Compute how much weight you will allocate to S and B in the optimal portfolio (2 Marks) 8- Compute the expected return and risk of the optimal portfolio (2 Marks) The beta of the stock S is 0.5 while the beta of the stock B is 2: 9. Indicate for each stock Sand B whether it's overpriced, under-priced or fairty priced and explain the reason (2 Marks). 1 States 1 2 3 4. Probabilities 0.4 0.3 0.2 0.1 S 25% 35% 15% 15% B 15% 20% 25% 30% Required: (You should enter at least the last step of your calculations on the system) 1- Compute and analyze the correlation between S and B round your answer to 2 decimals (4 Marks) 2- If you would like to create minimum variance portfolio, how much weight you will allocate to S and B? (2 Marks) 3- Compute the expected return and risk of the minimum variance portfolio (2 Marks) 4- How do you call the curve representing all the possible combinations between S and B? 5- Explain with you own words how to draw this graph? If you would like to create the optimal portfolio. 6- Explain with your own words how to find out graphically the optimal portfolio (1 Mark) 7- Compute how much weight you will allocate to S and B in the optimal portfolio (2 Marks) 8- Compute the expected return and risk of the optimal portfolio (2 Marks) The beta of the stock S is 0.5 while the beta of the stock B is 2: 9. Indicate for each stock Sand B whether it's overpriced, under-priced or fairty priced and explain the reason (2 Marks). 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts