Question: please write answers in the same format. thank you On January 1, 2021, the Taylor Company adopted the dollar-value LIFO method. The inventory value for

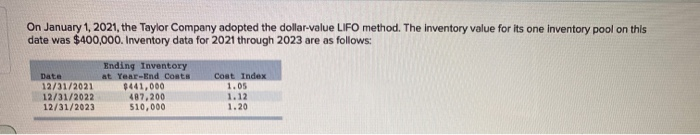

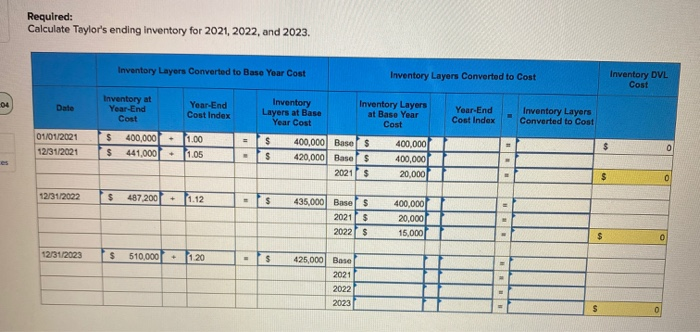

On January 1, 2021, the Taylor Company adopted the dollar-value LIFO method. The inventory value for its one inventory pool on this date was $400,000. Inventory data for 2021 through 2023 are as follows: Data 12/31/2021 12/31/2022 12/31/2023 Ending Inventory at Year-End Coats $441,000 487,200 510,000 Cost Index 1.05 1.12 1.20 Required: Calculate Taylor's ending Inventory for 2021, 2022, and 2023. Inventory Layers Converted to Base Year Cost Inventory Layers Converted to Cost Inventory DVL Cost Date Inventory at Year-End Cost Year-End Cost Index Year-End Cost Index Inventory Layers Converted to Cost 01/01/2021 12/31/2021 = $ $ 400,000 441,000 1.00 1.05 Inventory Inventory Layers Layers at Base at Base Year Year Cost Cost $ 400,000 Base $ 400,000 $ 420,000 Base $ 400,000 2021 $ 20,000 $ 0 : 0 12/31/2022 $ 487,200 + 1.12 $ 435,000 Bases 2021 $ 2022 $ 400,000 20,000 15,000 ### 12/31/2023 $ 510,000 1.20 - $ 425,000 Base 2021 2022 2023 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts