Question: please write clear and with the number for the question attach the anwser please Check my work 1 Cola Company and Pop Company both produce

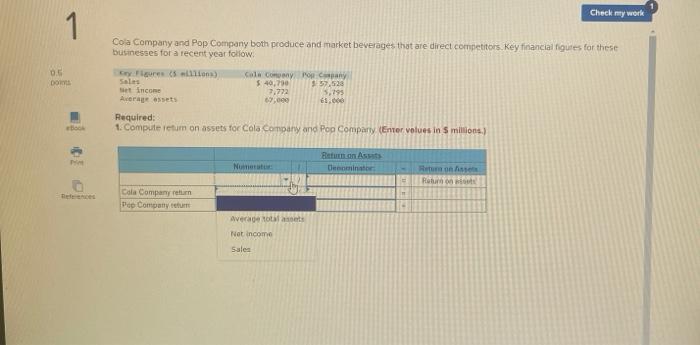

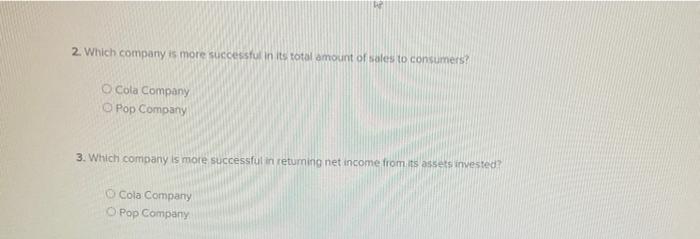

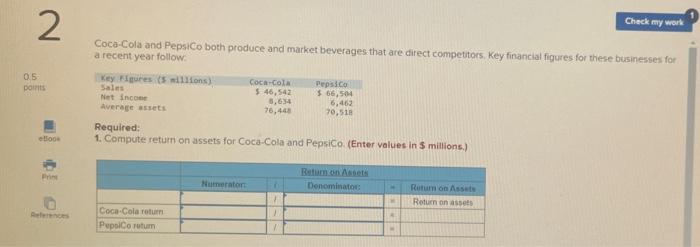

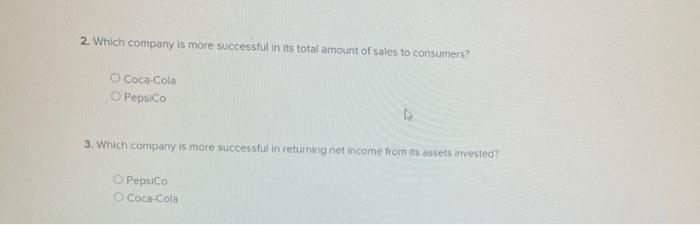

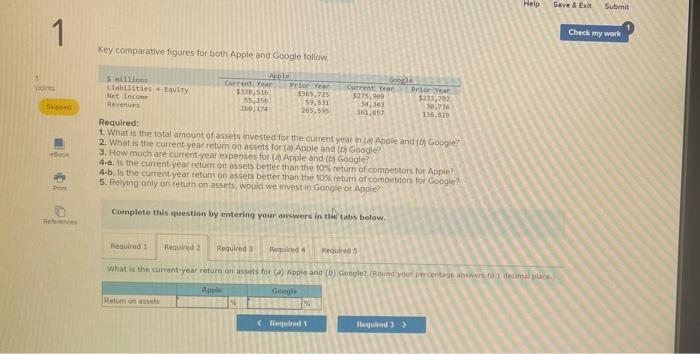

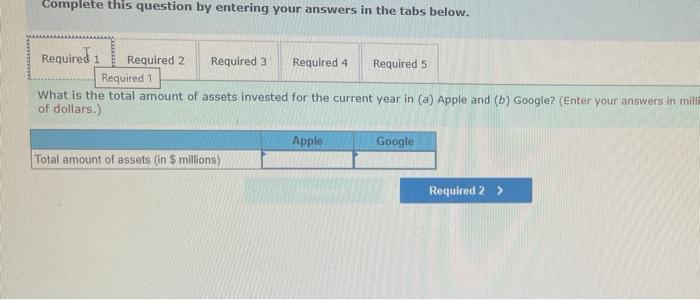

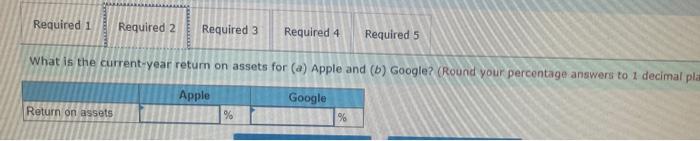

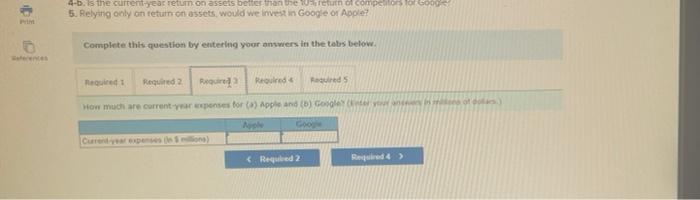

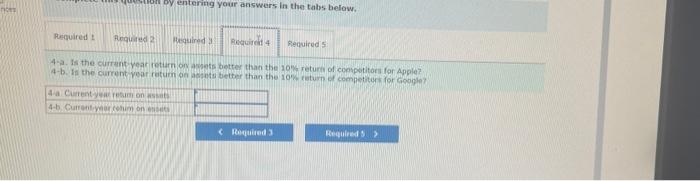

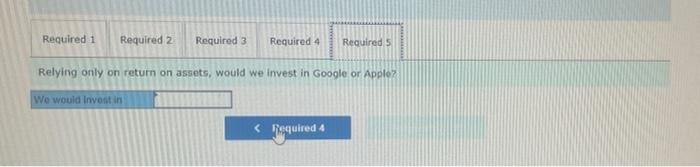

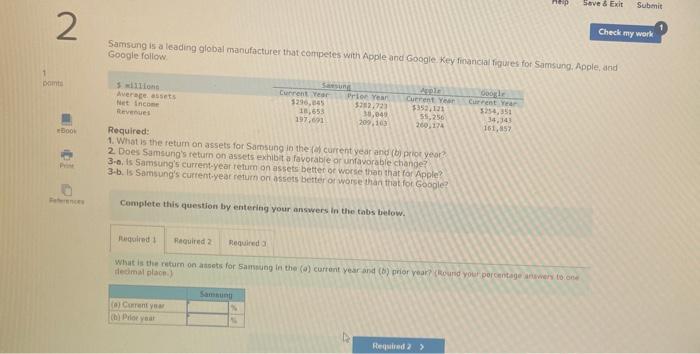

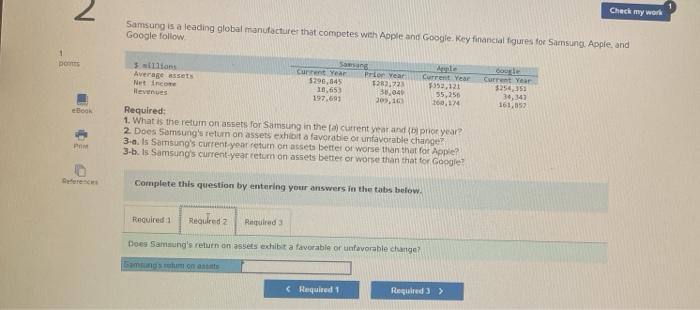

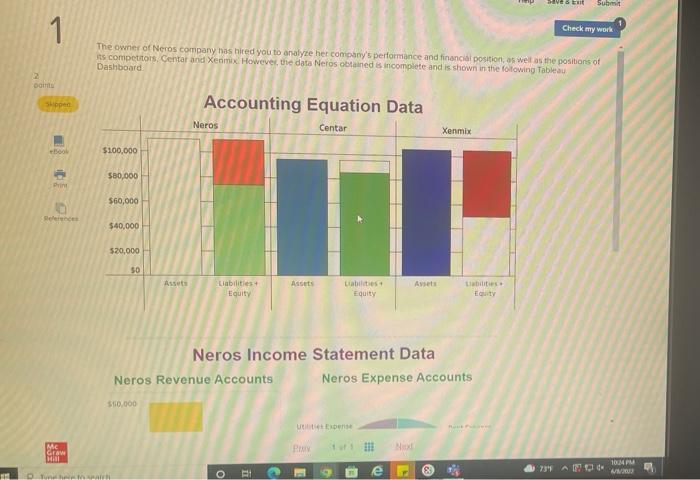

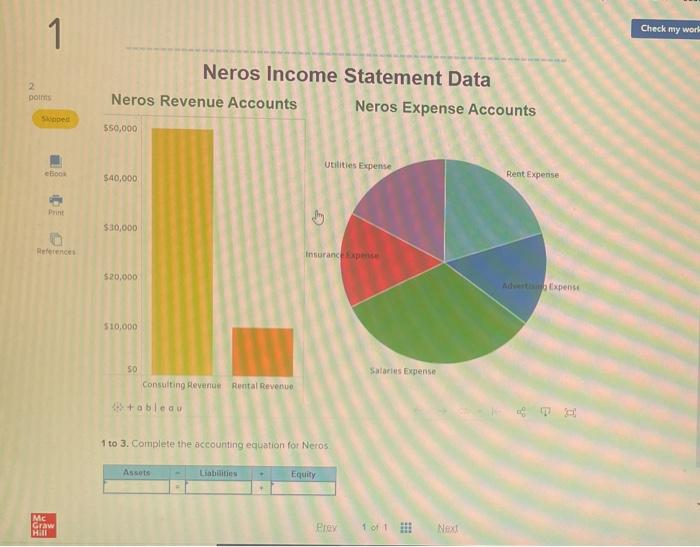

Check my work 1 Cola Company and Pop Company both produce and market beverages that are direct competitors. Key financial figures for these businesses for a recent year follow. Key Figures (5 millions) Sales Cola Company Pop Company $ 40,790 $57,528 Set income 7,772 5,795 Average essets 67,000 61,000 Required: 1. Compute return on assets for Cola Company and Pop Company (Enter velues in 5 millions.) Return on Assets Denominator Numeratur Return on Asses Return on est Cola Company return Pop Company return Average total assets Not income Sales 0.5 DORM ebook Pim References 19 m 14 2. Which company is more successful in its total amount of sales to consumers? O Cola Company O Pop Company 3. Which company is more successful in returning net income from its assets invested? O Cola Company O Pop Company 2 0.5 points elloos Prin References Check my work Coca-Cola and PepsiCo both produce and market beverages that are direct competitors. Key financial figures for these businesses for a recent year follow: Key Figures (5 millions) Sales Coca-Cola $ 46,542 PepsiCo $ 66,504 6,462 Net Income 8,634 Average assets 76,448 70,518 Required: 1. Compute return on assets for Coca-Cola and PepsiCo. (Enter values in 5 millions.) Beturn on Assets Denominator: Numerator: 6 Return on Assets M M AL Return on assets Coca-Cola return PepsiCo rutum 1 1 1 2. Which company is more successful in its total amount of sales to consumers? O Coca-Cola O PepsiCo 4 3. Which company is more successful in returning net income from its assets invested? O PepsiCo O Coca-Cola 1 1 points Skoped eBook P Help Save & Exit Submit Check my work Google Key comparative figures for both Apple and Google follow Apple 5 millions Current Year Current Year $330,516 Prior Year $365,725 Prior Year $275,909 $233,792 Liabilities+ Equity Net Income Revenues 55,256 $9,531 34,343 30,736 260,174 265,595 161,857 136,810 Required: 1. What is the total amount of assets invested for the current year in () Apple and (0) Google? 2. What is the current-year return on assets for (a) Apple and (b) Google? 3. How much are current-year expenses for (a) Apple and (b) Google? 4-6. Is the current-year return on assets better than the 10% return of competitors for Apple 4-b. Is the current-year return on assets better than the 10% return of competitors for Google? 5. Relying only on return on assets, would we invest in Google or Apple? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 31 Required 4 Required 5 What is the current-year return on assets for (a) Apple and (b) Google? (Round your percentage answers to 1 decimal place. Apple Google Return on assets Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 1 What is the total amount of assets invested for the current year in (a) Apple and (b) Google? (Enter your answers in milli of dollars.) Apple Google Total amount of assets (in $ millions) Required 2 > Required 1 Required 2 Required 3 Required 4 Required 5 What is the current-year return on assets for (a) Apple and (b) Google? (Round your percentage answers to 1 decimal pla Apple Google Return on assets % % of References 4-b. is the current-year return on assets better than the 10%, return of competitors for 5. Relying only on return on assets, would we invest in Google or Apple? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required? Required Required 5 How much are current-year expenses for (a) Apple and (b) Google (te your in eo of d Apple Google Current-year expenses (in 5 millions) not BH by entering your answers in the tabs below. Required 1 Required 21 Required 3 Required 4 Required 5 4-a. Is the current-year return on assets better than the 10% return of competitors for Apple? 4-b. Is the current-year return on assets better than the 10% return of competitors for Google? 4-a. Current-year retum on assets 4-b. Current-year cohum on ensets Required 1 Required 2 Required 3 Required 4 Required 5 Relying only on return on assets, would we invest in Google or Apple? We would invest in 2 1 points eBook POM Check my work Samsung is a leading global manufacturer that competes with Apple and Google. Key financial figures for Samsung, Apple, and Google follow Samsung 3 millions Apple Current Year Average assets Current Year $290,045 10,653 Prior Year 1282.728 36,040 Google Current Year $254,351 $352,121 Net Income Revenues 55,256 34,343 197,691 209,161 260,174 161,857 Required: 1. What is the return on assets for Samsung in the (a) current year and (b) prior year? 2. Does Samsung's return on assets exhibit a favorable or unfavorable change? 3-a. Is Samsung's current-year return on assets better or worse than that for Apple? 3-b. Is Samsung's current-year return on assets better or worse than that for Google? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Does Samsung's return on assets exhibit a favorable or unfavorable change? Samsung's retum on aas Required 11 Required 2 Required 3 3-a. Is Samsung's current-year return on assets better or worse than that for Apple? 3-b. Is Samsung's current-year return on assets better or worse than that for Google? 3-a. Is Samsung's current-year return on assets better or worse than that for Apple? 3-b. Is Samsung's current-year return on assets better or worse than that for Google?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts