Question: Please write clearly and be concise. If I can't read what you wrote, it will be considered incorrect Short Answers: 1. In forming a portfolio

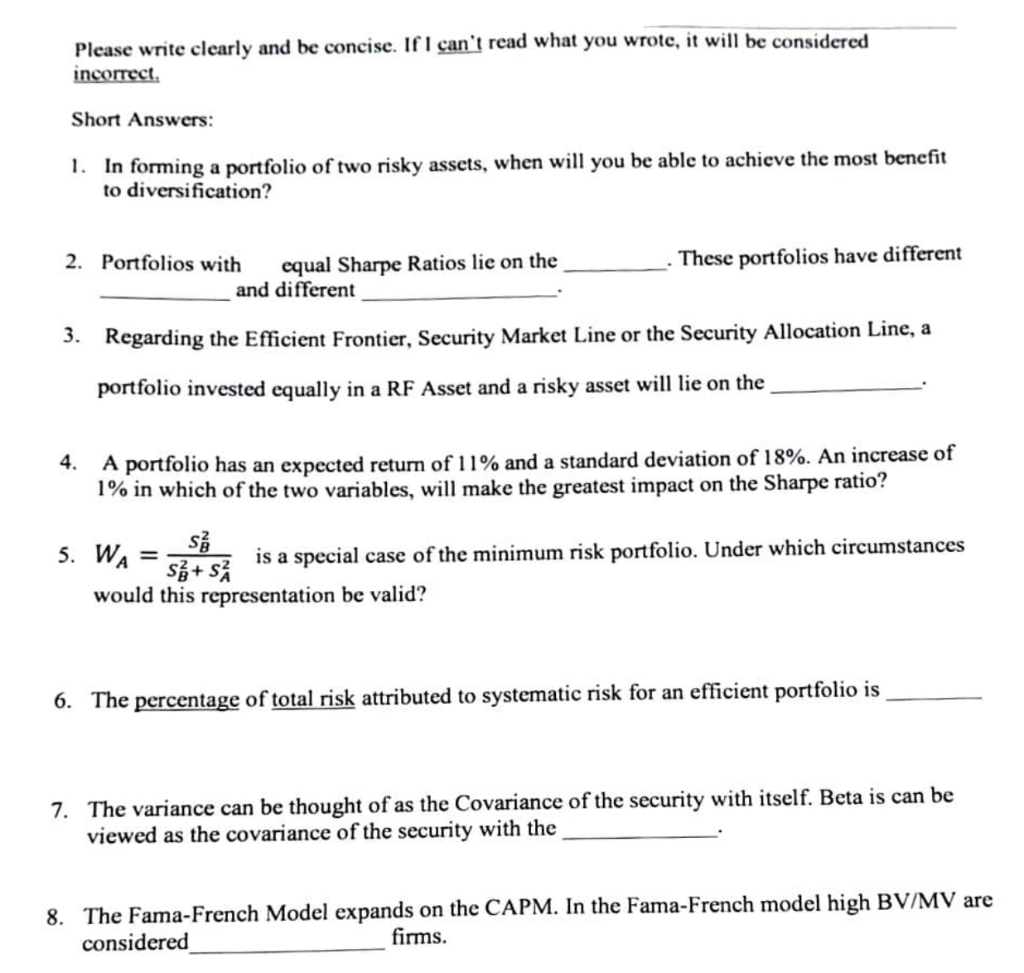

Please write clearly and be concise. If I can't read what you wrote, it will be considered incorrect Short Answers: 1. In forming a portfolio of two risky assets, when will you be able to achieve the most benefit to diversification? 2. Portfolios with equal Sharpe Ratios lie on the and different These portfolios have different 3. Regarding the Efficient Frontier, Security Market Line or the Security Allocation Line, a portfolio invested equally in a RF Asset and a risky asset will lie on the 4. portfolio has an expected return of 11% and a standard deviation of 18%. An increase of 1% in which of the two variables, will make the greatest impact on the Sharpe ratio? 5. WA s s$+ S is a special case of the minimum risk portfolio. Under which circumstances would this representation be valid? 6. The percentage of total risk attributed to systematic risk for an efficient portfolio is 7. The variance can be thought of as the Covariance of the security with itself. Beta is can be viewed as the covariance of the security with the 8. The Fama-French Model expands on the CAPM. In the Fama-French model high BV/MV are considered firms. Please write clearly and be concise. If I can't read what you wrote, it will be considered incorrect Short Answers: 1. In forming a portfolio of two risky assets, when will you be able to achieve the most benefit to diversification? 2. Portfolios with equal Sharpe Ratios lie on the and different These portfolios have different 3. Regarding the Efficient Frontier, Security Market Line or the Security Allocation Line, a portfolio invested equally in a RF Asset and a risky asset will lie on the 4. portfolio has an expected return of 11% and a standard deviation of 18%. An increase of 1% in which of the two variables, will make the greatest impact on the Sharpe ratio? 5. WA s s$+ S is a special case of the minimum risk portfolio. Under which circumstances would this representation be valid? 6. The percentage of total risk attributed to systematic risk for an efficient portfolio is 7. The variance can be thought of as the Covariance of the security with itself. Beta is can be viewed as the covariance of the security with the 8. The Fama-French Model expands on the CAPM. In the Fama-French model high BV/MV are considered firms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts