Question: Please write clearly. I am hoping you'd do both the problems. i will leave a thumbs up :) 2. Mr. John Smith owns Smith Construction

Please write clearly. I am hoping you'd do both the problems. i will leave a thumbs up :)

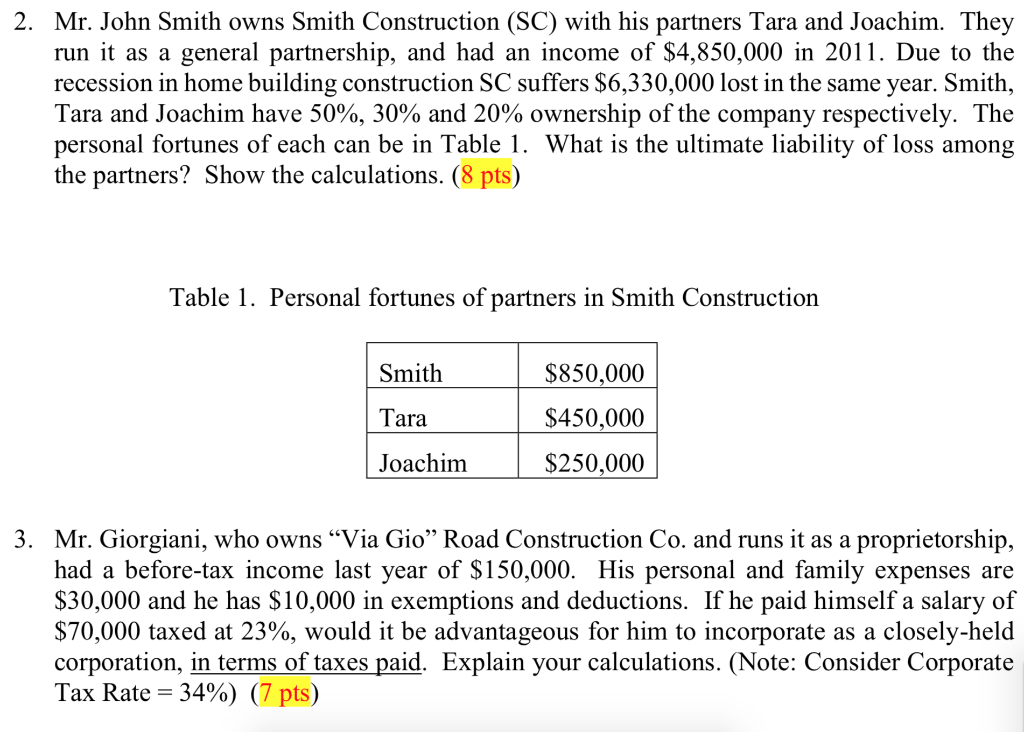

2. Mr. John Smith owns Smith Construction (SC) with his partners Tara and Joachim. They run it as a general partnership, and had an income of $4,850,000 in 2011. Due to the recession in home building construction SC suffers $6,330,000 lost in the same year. Smith Tara and Joachim have 50%, 30% and 20% ownership of the company respectively. The personal fortunes of each can be in Table 1. What is the ultimate liability of loss among the partners? Show the calculations. (8 pts) Table 1. Personal fortunes of partners in Smith Construction Smith Tara Joachim $850,000 $450,000 $250,000 . Mr. Giorgiani, who owns "Via Gio" Road Construction Co. and runs it as a proprietorship, had a before-tax income last year of $150,000. His personal and family expenses are S30,000 and he has $10,000 in exemptions and deductions. If he paid himself a salary of $70,000 taxed at 23%, would it be advantageous for him to incorporate as a closely-held corporation, in terms of taxes paid. Explain your calculations. (Note: Consider Corporate Tax Rate = 34%) (7 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts