Question: please write detailed process MGT225 SECTION A Question A1 (Compulsory question) Oxford Ltd prepares financial statements to 31 December each year. The company's trial balance

please write detailed process

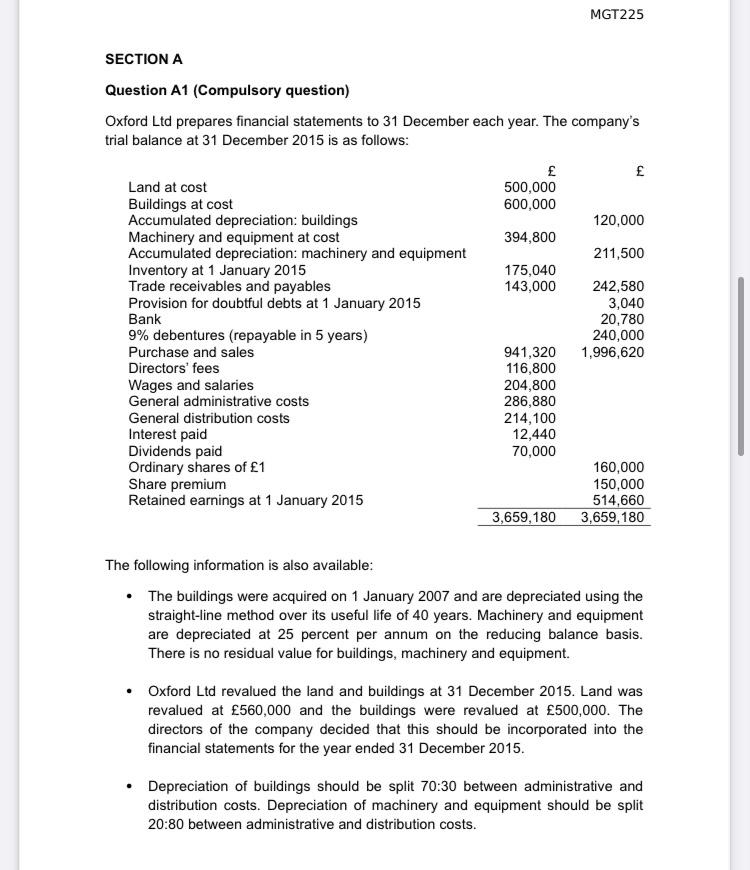

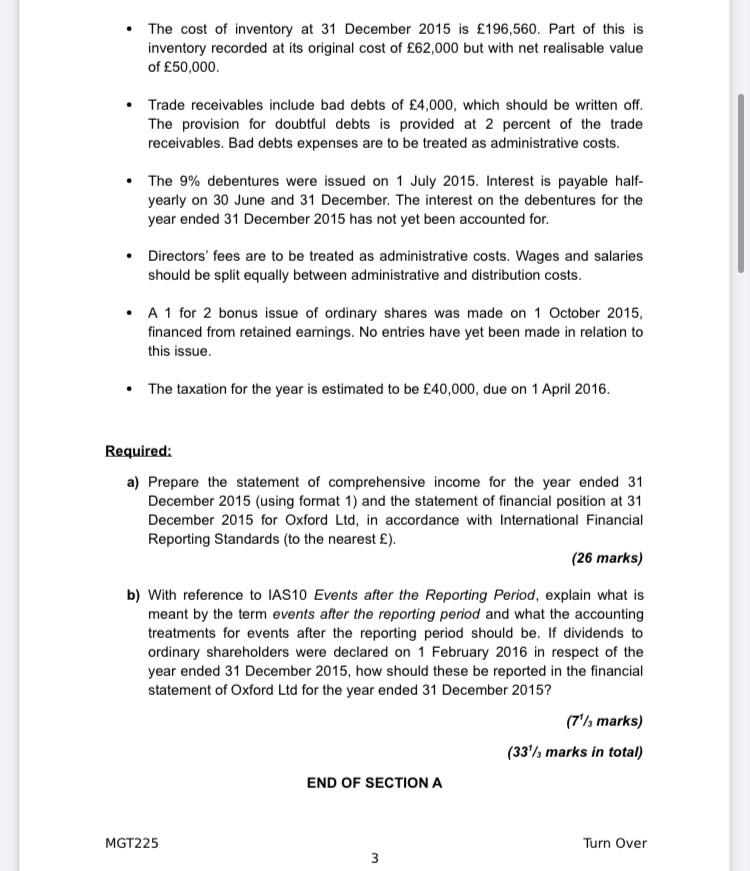

MGT225 SECTION A Question A1 (Compulsory question) Oxford Ltd prepares financial statements to 31 December each year. The company's trial balance at 31 December 2015 is as follows: Land at cost 500,000 Buildings at cost 600,000 Accumulated depreciation: buildings 120,000 Machinery and equipment at cost 394,800 211,500 Accumulated depreciation: machinery and equipment Inventory at 1 January 2015 175,040 Trade receivables and payables 143,000 242,580 Provision for doubtful debts at 1 January 2015 3,040 Bank 20,780 9% debentures (repayable in 5 years) 240,000 Purchase and sales 941,320 1,996,620 Directors' fees 116,800 Wages and salaries 204,800 General administrative costs 286,880 General distribution costs 214,100 Interest paid 12,440 Dividends paid 70,000 Ordinary shares of 1 160,000 Share premium 150,000 Retained earnings at 1 January 2015 514,660 3,659,180 3,659,180 The following information is also available: The buildings were acquired on 1 January 2007 and are depreciated using the straight-line method over its useful life of 40 years. Machinery and equipment are depreciated at 25 percent per annum on the reducing balance basis. There is no residual value for buildings, machinery and equipment. Oxford Ltd revalued the land and buildings at 31 December 2015. Land was revalued at 560,000 and the buildings were revalued at 500,000. The directors of the company decided that this should be incorporated into the financial statements for the year ended 31 December 2015. Depreciation of buildings should be split 70:30 between administrative and distribution costs. Depreciation of machinery and equipment should be split 20:80 between administrative and distribution costs. The cost of inventory at 31 December 2015 is 196,560. Part of this is inventory recorded at its original cost of 62,000 but with net realisable value of 50,000. Trade receivables include bad debts of 4,000, which should be written off. The provision for doubtful debts is provided at 2 percent of the trade receivables. Bad debts expenses are to be treated as administrative costs. The 9% debentures were issued on 1 July 2015. Interest is payable half- yearly on 30 June and 31 December. The interest on the debentures for the year ended 31 December 2015 has not yet been accounted for. Directors' fees are to be treated as administrative costs. Wages and salaries should be split equally between administrative and distribution costs. A 1 for 2 bonus issue of ordinary shares was made on 1 October 2015, financed from retained earnings. No entries have yet been made in relation to this issue. The taxation for the year is estimated to be 40,000, due on 1 April 2016. Required: a) Prepare the statement of comprehensive income for the year ended 31 December 2015 (using format 1) and the statement of financial position at 31 December 2015 for Oxford Ltd, in accordance with International Financial Reporting Standards (to the nearest ). (26 marks) b) With reference to IAS10 Events after the Reporting Period, explain what is meant by the term events after the reporting period and what the accounting treatments for events after the reporting period should be. If dividends to ordinary shareholders were declared on 1 February 2016 in respect of the year ended 31 December 2015, how should these be reported in the financial statement of Oxford Ltd for the year ended 31 December 2015? (7/ marks) (33% marks in total) END OF SECTION A MGT225 Turn Over

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts