Question: Please write detailed steps for using excel Mr.Arnold is considering constructing a bungalow project that requires an investment of $15,500,000, which comprises $12,000,000 for the

Please write detailed steps for using excel

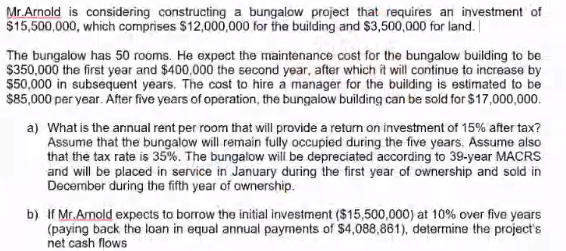

Mr.Arnold is considering constructing a bungalow project that requires an investment of $15,500,000, which comprises $12,000,000 for the building and $3,500,000 for land. The bungalow has 50 rooms. He expect the maintenance cost for the bungalow building to be $350,000 the first year and $400,000 the second year, after which it will continue to increase by $50,000 in subsequent years. The cost to hire a manager for the building is estimated to be $85,000 per year. After five years of operation, the bungalow building can be sold for $17,000,000 a) What is the annual rent per room that will provide a return on investment of 15% after tax? Assume that the bungalow will remain fully occupied during the five years. Assume also that the tax rate is 35%. The bungalow will be depreciated according to 39-year MACRS and will be placed in service in January during the first year of ownership and sold in December during the fifth year of ownership. b) If Mr.Amold expects to borrow the initial investment ($15,500,000) at 10% over five years (paying back the loan in equal annual payments of $4,088,861), determine the project's net cash flows Mr.Arnold is considering constructing a bungalow project that requires an investment of $15,500,000, which comprises $12,000,000 for the building and $3,500,000 for land. The bungalow has 50 rooms. He expect the maintenance cost for the bungalow building to be $350,000 the first year and $400,000 the second year, after which it will continue to increase by $50,000 in subsequent years. The cost to hire a manager for the building is estimated to be $85,000 per year. After five years of operation, the bungalow building can be sold for $17,000,000 a) What is the annual rent per room that will provide a return on investment of 15% after tax? Assume that the bungalow will remain fully occupied during the five years. Assume also that the tax rate is 35%. The bungalow will be depreciated according to 39-year MACRS and will be placed in service in January during the first year of ownership and sold in December during the fifth year of ownership. b) If Mr.Amold expects to borrow the initial investment ($15,500,000) at 10% over five years (paying back the loan in equal annual payments of $4,088,861), determine the project's net cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts