Question: Please write down answer. 9. Find a statement which is not true. 1) The mean of a net return of certain financial asset can represent

Please write down answer.

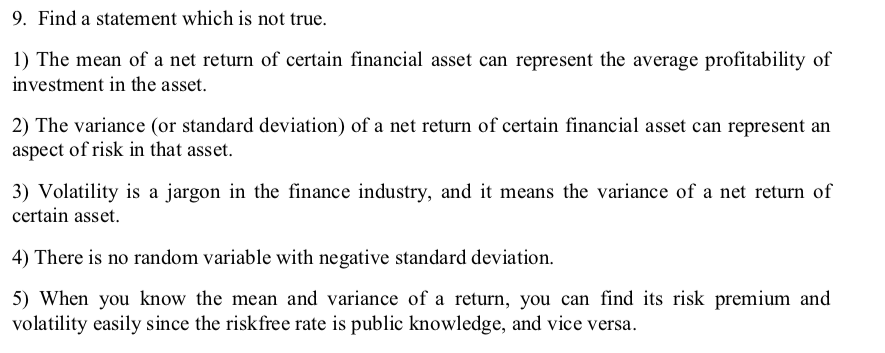

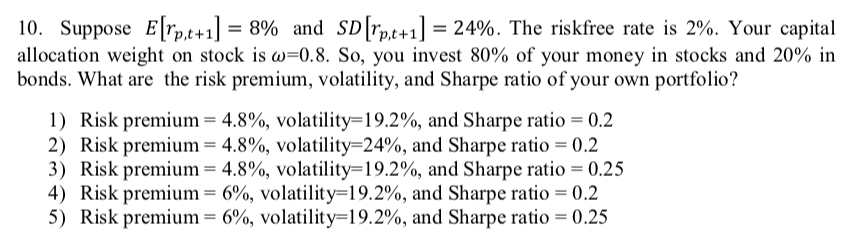

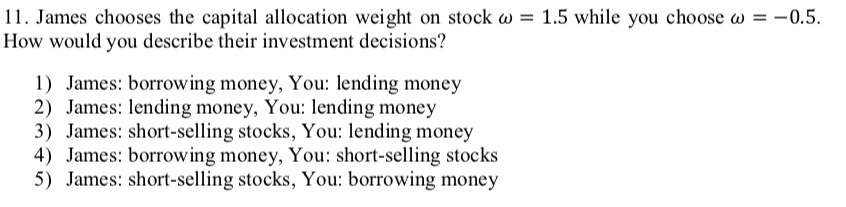

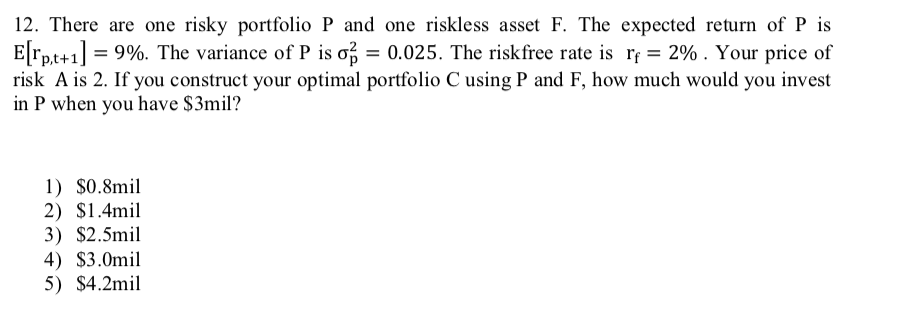

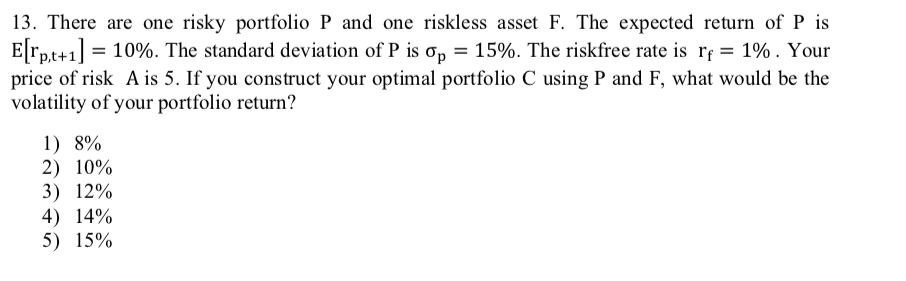

9. Find a statement which is not true. 1) The mean of a net return of certain financial asset can represent the average profitability of investment in the asset 2) The variance (or standard deviation) of a net return of certain financial asset can represent an aspect of risk in that asset. ) Volatility is a jargon in the finance industry, and it means the variance of a net return of certain asset 4) There is no random variable with negative standard deviation. 5) When you know the mean and variance of a return, you can find its risk premium and volatility easily since the riskfree rate is public knowledge, and vice versa. 10. Suppose Elr,t + 11-8% and SD[r,t + 11-24%. The riskfree rate is 2%. Your capital allocation weight on stock isu-0.8. So, you invest 80% of your money in stocks and 20% in bonds. What are the risk premium, volatility, and Sharpe ratio of your own portfolio? 1) Risk premium-4.8%, volatility-19.2%, and Sharpe ratio-0.2 2) Risk premium-48%, volatility-24%, and Sharpe ratio-0.2 3) Risk premium-48%, volatility: 19.2%, and Sharpe ratio-0.25 4) Risk premium 6%, volatility-19.2%, and Sharpe ratio-0.2 5) Risk premium = 6%, volatility= 19.2%, and Sharpe ratio = 0.25 11. James chooses the capital allocation weight on stock = 1.5 while you choose =-0.5. How would you describe their investment decisions? 1) James: borrowing money, You: lending money 2) James: lending money, You: lending money 3) James: short-selling stocks, You: lending money 4) James: borrowing money, You: short-selling stocks 5) James: short-selling stocks, You: borrowing money 12. There are one risky portfolio P and one riskless asset F. The expected return of P is 9%. The variance of P is = 0.025. The riskfree rate is r,-2% . Your price of p,t+1 risk A is 2. If you construct your optimal portfolio C using P and F, how much would you invest in P when you have $3mil? 1) S0.8mil 2) $1.4mil 3) $2.5mil 4) S3.0mil 5) S4.2mil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts