Question: Please write down steps! Thank you!! Your company is whether to invest in a new factory. The new factory will produce total cash flow of

Please write down steps! Thank you!!

Please write down steps! Thank you!!

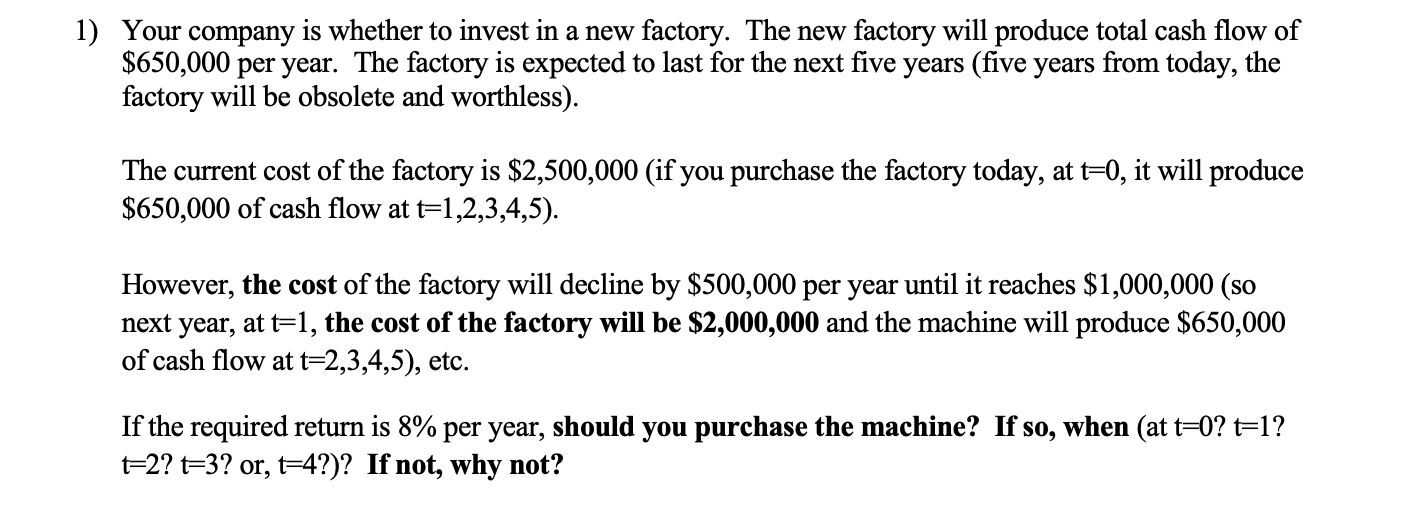

Your company is whether to invest in a new factory. The new factory will produce total cash flow of $650,000 per year. The factory is expected to last for the next five years (five years from today, the factory will be obsolete and worthless). The current cost of the factory is $2,500,000 (if you purchase the factory today, at t=0, it will produce $650,000 of cash flow at t=1,2,3,4,5). However, the cost of the factory will decline by $500,000 per year until it reaches $1,000,000 (so next year, at t=1, the cost of the factory will be $2,000,000 and the machine will produce $650,000 of cash flow at t=2,3,4,5), etc. If the required return is 8% per year, should you purchase the machine? If so, when (at t=0 ? t=1 ? t=2?t=3 ? or, t=4 ?)? If not, why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts