Question: Please write down the calculation process. Thank you! 1) Suppose a company issued a 20-year bond 4 years ago. The coupon rate is 8.5% (annual

Please write down the calculation process. Thank you!

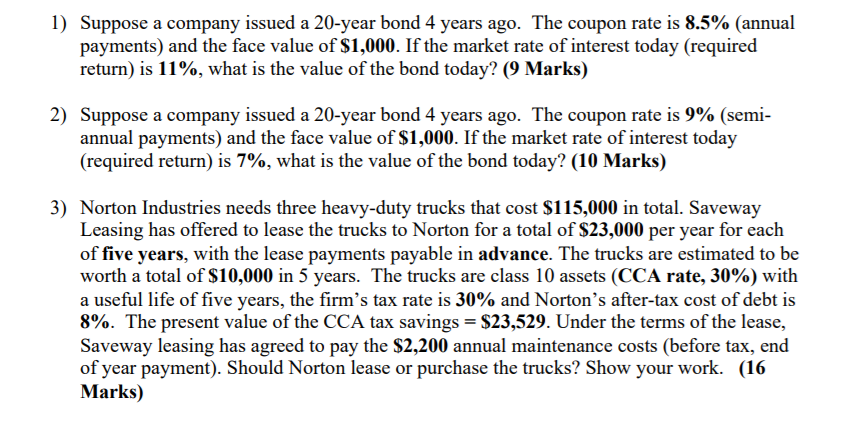

1) Suppose a company issued a 20-year bond 4 years ago. The coupon rate is 8.5% (annual payments) and the face value of $1,000. If the market rate of interest today (required return) is 11%, what is the value of the bond today? (9 Marks) 2) Suppose a company issued a 20-year bond 4 years ago. The coupon rate is 9% (semi- annual payments) and the face value of $1,000. If the market rate of interest today (required return) is 7%, what is the value of the bond today? (10 Marks) 3) Norton Industries needs three heavy-duty trucks that cost $115,000 in total. Saveway Leasing has offered to lease the trucks to Norton for a total of $23,000 per year for each of five years, with the lease payments payable in advance. The trucks are estimated to be worth a total of $10,000 in 5 years. The trucks are class 10 assets (CCA rate, 30%) with a useful life of five years, the firm's tax rate is 30% and Norton's after-tax cost of debt is 8%. The present value of the CCA tax savings = $23,529. Under the terms of the lease, Saveway leasing has agreed to pay the $2,200 annual maintenance costs (before tax, end of year payment). Should Norton lease or purchase the trucks? Show your work. (16 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts