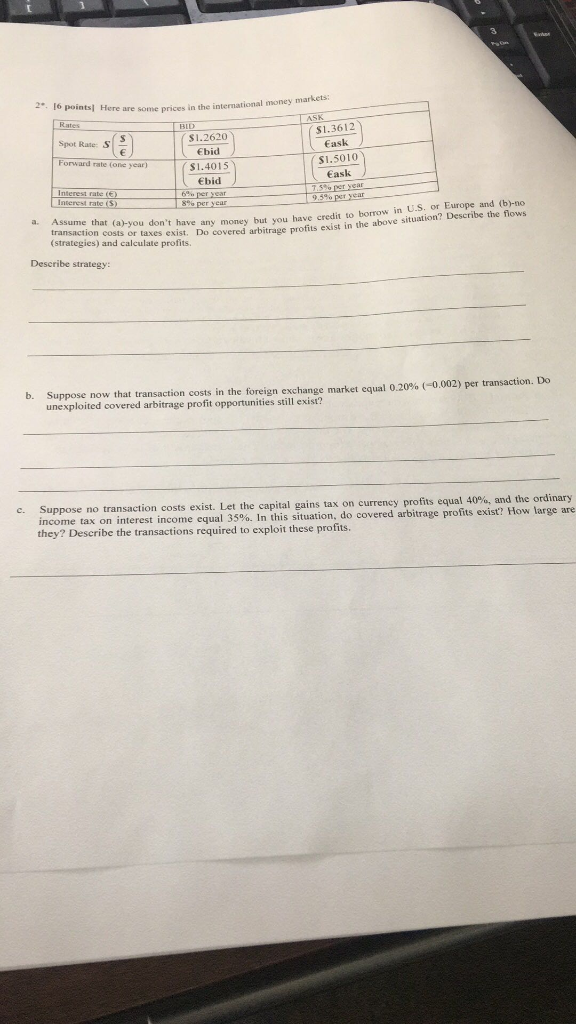

Question: Please write each steps clearly and specifically, thank you. I6 points) Here are some prices in the international money markets: ASK $1.3612 Eask $1.5010 Eask

Please write each steps clearly and specifically, thank you.

I6 points) Here are some prices in the international money markets: ASK $1.3612 Eask $1.5010 Eask $1.2620 Ebid S1. Spot Rate: S Forward rate (onar)S1.4015 Ebid Interest rate 7,5% 896 any money but you have credit to borrow in U.S. or Europe and (b)-no covered arbitrage profits exist in the above situation? Describe the flows a. Assume that (a)-you don't have any money but you transaction costs or taxes exist. Do (strategies) and calculate profits. Describe strategy suppose now that transaction costs in the foreign exchange market cqual 0.20%(-0002) per transaction, unexploited covered arbitrage profit opportunities still exist? b. S uppose no transaction costs exist. Let the capital gains tax on income tax on interest income equal 350 they? Describe the transactions required to exploit these profits. c. S currency profits equal 40%, and the ordinary arbitrage profits exist? How large are . In this situation, do covered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts