Question: Please write or type clearly as I struggle with reading online. Thank you so much in advance for your help! QUESTION #1 QUESTION #2 QUESTION

Please write or type clearly as I struggle with reading online. Thank you so much in advance for your help!

QUESTION #1

QUESTION #2

QUESTION #3

QUESTION #4

QUESTION #5

QUESTION #6

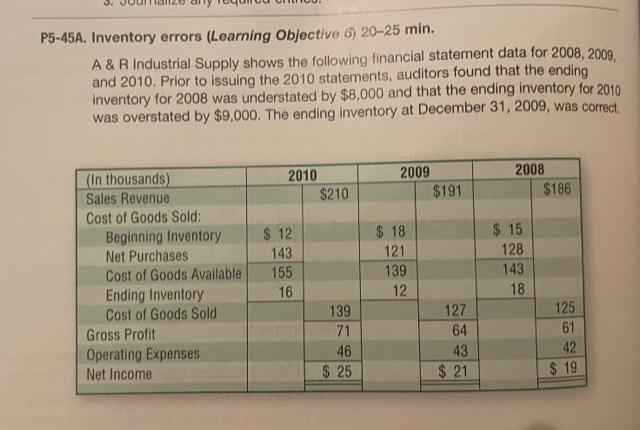

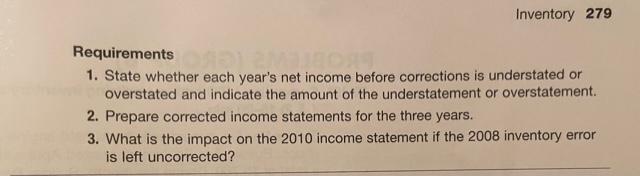

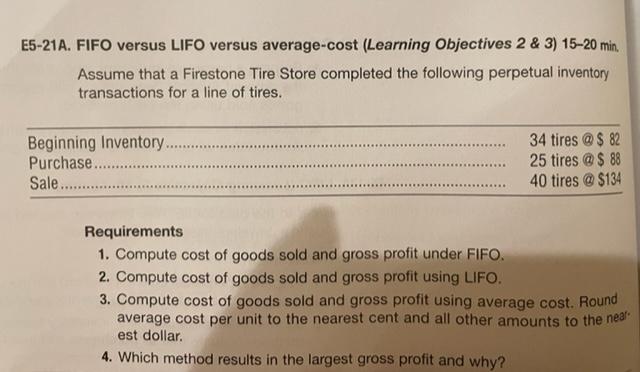

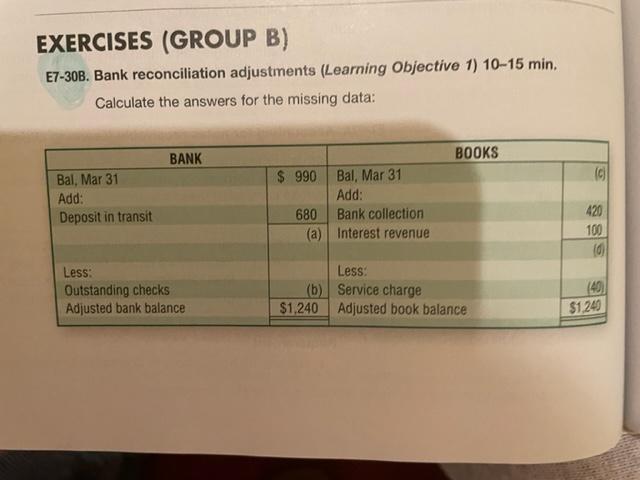

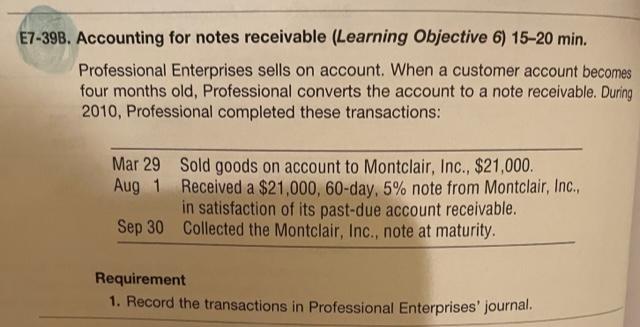

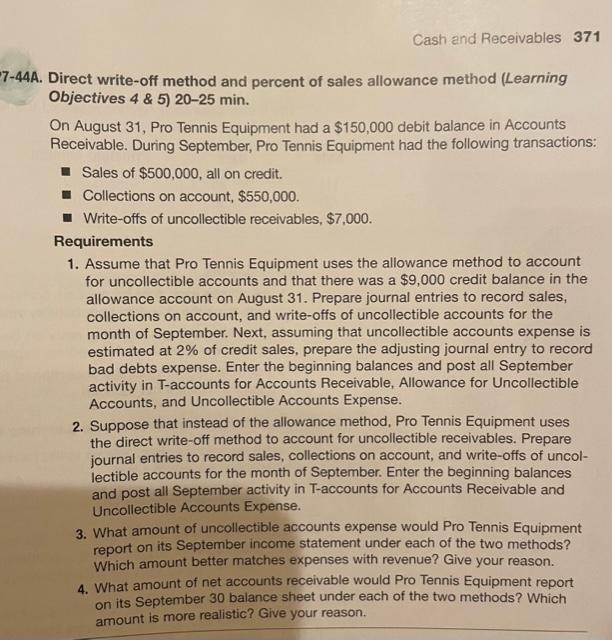

P5-45A. Inventory errors (Learning Objective 6) 20-25 min. A & R Industrial Supply shows the following financial statement data for 2008, 2009, and 2010. Prior to issuing the 2010 statements, auditors found that the ending inventory for 2008 was understated by $8,000 and that the ending inventory for 2010 was overstated by $9,000. The ending inventory at December 31, 2009, was correct 2008 2010 $210 2009 $191 $186 (In thousands) Sales Revenue Cost of Goods Sold: Beginning Inventory Net Purchases Cost of Goods Available Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Net Income $ 12 143 155 16 $ 18 121 139 12 $ 15 128 143 18 139 71 46 $ 25 127 64 43 $ 21 125 61 42 $ 19 Inventory 279 Requirements 1. State whether each year's net income before corrections is understated or overstated and indicate the amount of the understatement or overstatement. 2. Prepare corrected income statements for the three years. 3. What is the impact on the 2010 income statement if the 2008 inventory error is left uncorrected? E5-21A. FIFO versus LIFO versus average-cost (Learning Objectives 2 & 3) 15-20 min. Assume that a Firestone Tire Store completed the following perpetual inventory transactions for a line of tires. Beginning Inventory..... Purchase. Sale.......... 34 tires @ $ 82 25 tires @$ 88 40 tires @ $134 Requirements 1. Compute cost of goods sold and gross profit under FIFO. 2. Compute cost of goods sold and gross profit using LIFO. 3. Compute cost of goods sold and gross profit using average cost. Round average cost per unit to the nearest cent and all other amounts to the near est dollar 4. Which method results in the largest gross profit and why? 5-46A. Estimating ending inventory (Learning Objective 7) 15-20 min. Amtran Enterprises lost its entire inventory in a hurricane that occurred on May 31, 2010. Over the past five years, gross profit has averaged 32% of net sales. The company's records reveal the following data for the month of May: Beginning Inventory. Net Purchases. Sales. Sales Returns and Allowances Sales Discounts $ 38,600 341,900 530,400 12,300 6,500 Requirements 1. Estimate the May 31 inventory, using the gross profit method. 2. Prepare the May income statement through gross profit for Amtran Enterprises. EXERCISES (GROUP B) E7-30B. Bank reconciliation adjustments (Learning Objective 1) 10-15 min. Calculate the answers for the missing data: BANK BOOKS 0 Bal, Mar 31 Add: Deposit in transit $ 990 Bal, Mar 31 Add: 680 Bank collection (a) Interest revenue 420 100 lo Less: Outstanding checks Adjusted bank balance Less: (b) Service charge $1.240 Adjusted book balance (40) $1,240 E7-39B. Accounting for notes receivable (Learning Objective 6) 15-20 min. Professional Enterprises sells on account. When a customer account becomes four months old, Professional converts the account to a note receivable. During 2010, Professional completed these transactions: Mar 29 Sold goods on account to Montclair, Inc., $21,000. Aug 1 Received a $21,000, 60-day, 5% note from Montclair, Inc., in satisfaction of its past-due account receivable. Sep 30 Collected the Montclair, Inc., note at maturity. Requirement 1. Record the transactions in Professional Enterprises' journal. Cash and Receivables 371 7-44A. Direct write-off method and percent of sales allowance method (Learning Objectives 4 & 5) 20-25 min. On August 31, Pro Tennis Equipment had a $150,000 debit balance in Accounts Receivable. During September, Pro Tennis Equipment had the following transactions: Sales of $500,000, all on credit. Collections on account, $550,000. Write-offs of uncollectible receivables, $7,000. Requirements 1. Assume that Pro Tennis Equipment uses the allowance method to account for uncollectible accounts and that there was a $9,000 credit balance in the allowance account on August 31. Prepare journal entries to record sales, collections on account, and write-offs of uncollectible accounts for the month of September. Next, assuming that uncollectible accounts expense is estimated at 2% of credit sales, prepare the adjusting journal entry to record bad debts expense. Enter the beginning balances and post all September activity in T-accounts for Accounts Receivable, Allowance for Uncollectible Accounts, and Uncollectible Accounts Expense. 2. Suppose that instead of the allowance method, Pro Tennis Equipment uses the direct write-off method to account for uncollectible receivables. Prepare journal entries to record sales, collections on account, and write-offs of uncol- lectible accounts for the month of September. Enter the beginning balances and post all September activity in T-accounts for Accounts Receivable and Uncollectible Accounts Expense. 3. What amount of uncollectible accounts expense would Pro Tennis Equipment report on its September income statement under each of the two methods? Which amount better matches expenses with revenue? Give your reason. 4. What amount of net accounts receivable would Pro Tennis Equipment report on its September 30 balance sheet under each of the two methods? Which amount is more realistic? Give your reason

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts