Question: please write or type clearly, Thx!!!:) Question 3 - Interest rate and Bond valuation (10 marks) Suppose the real risk-free rate is 3.50%, the average

please write or type clearly, Thx!!!:)

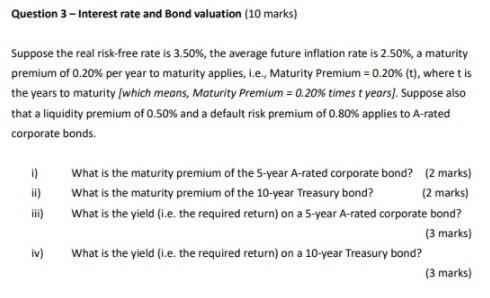

Question 3 - Interest rate and Bond valuation (10 marks) Suppose the real risk-free rate is 3.50%, the average future inflation rate is 2.50%, a maturity premium of 0.20% per year to maturity applies, L.e., Maturity Premium = 0.20% (t), wheret is the years to maturity (which means, Maturity Premium = 0.20% times t years). Suppose also that a liquidity premium of 0.50% and a default risk premium of 0.80% applies to A-rated corporate bonds. ) ii) What is the maturity premium of the 5-year A-rated corporate bond? (2 marks) What is the maturity premium of the 10-year Treasury bond? (2 marks) What is the yield (i.e. the required return) on a 5-year A-rated corporate bond? (3 marks) What is the yield (l.e. the required return) on a 10-year Treasury bond? (3 marks) iv)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts