Question: PLEASE WRITE OUT AND SOLVE, no excel ABC Inc's preferred stock is currently worth $22.50. The perpetual dividend is $1.75. Calculate the cost of preferred

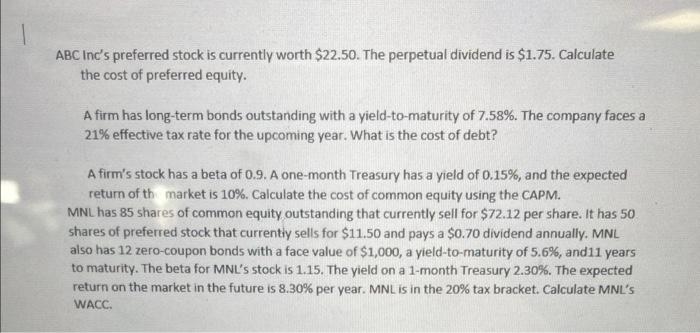

ABC Inc's preferred stock is currently worth $22.50. The perpetual dividend is $1.75. Calculate the cost of preferred equity. A firm has long-term bonds outstanding with a yield-to-maturity of 7.58%. The company faces a 21% effective tax rate for the upcoming year. What is the cost of debt? A firm's stock has a beta of 0.9. A one-month Treasury has a yield of 0.15%, and the expected return of th market is 10%. Calculate the cost of common equity using the CAPM. MNL has 85 shares of common equity outstanding that currently sell for $72.12 per share. It has 50 shares of preferred stock that currentiy sells for $11.50 and pays a $0.70 dividend annually. MNL also has 12 zero-coupon bonds with a face value of $1,000, a yield-to-maturity of 5.6%, and11 years to maturity. The beta for MNL's stock is 1.15. The yield on a 1-month Treasury 2.30\%. The expected return on the market in the future is 8.30% per year. MNL is in the 20% tax bracket. Calculate MNL's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts