Question: please write out steps 7. Three-month call options on Goldman, struck at $195, are currently trading at $6.15. Goldman stock is currently trading at $192.96

please write out steps

please write out steps

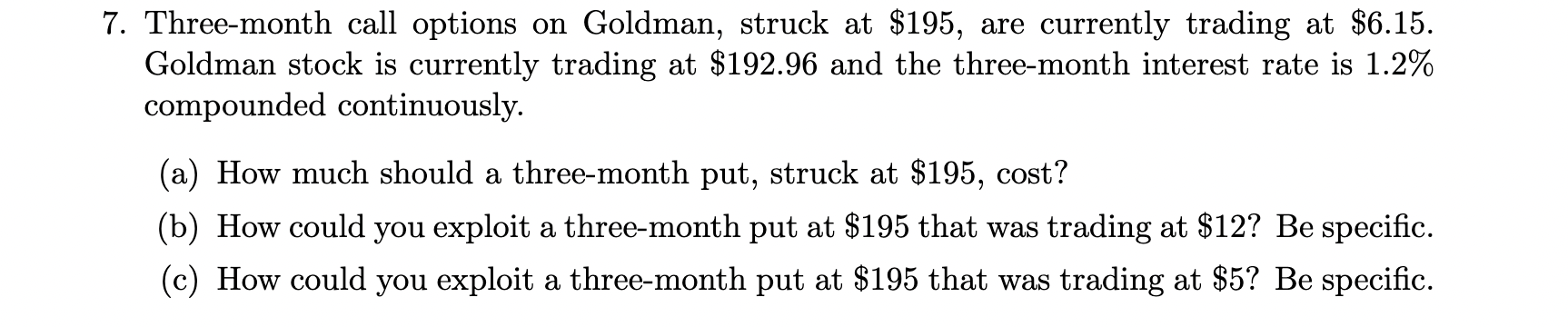

7. Three-month call options on Goldman, struck at $195, are currently trading at $6.15. Goldman stock is currently trading at $192.96 and the three-month interest rate is 1.2% compounded continuously. (a) How much should a three-month put, struck at $195, cost? (b) How could you exploit a three-month put at $195 that was trading at $12 ? Be specific. (c) How could you exploit a three-month put at $195 that was trading at $5 ? Be specific. 7. Three-month call options on Goldman, struck at $195, are currently trading at $6.15. Goldman stock is currently trading at $192.96 and the three-month interest rate is 1.2% compounded continuously. (a) How much should a three-month put, struck at $195, cost? (b) How could you exploit a three-month put at $195 that was trading at $12 ? Be specific. (c) How could you exploit a three-month put at $195 that was trading at $5 ? Be specific

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts