Question: please write out the entire number for the answers. do not abbreviate or shorten them. a (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation)

please write out the entire number for the answers. do not abbreviate or shorten them.

please write out the entire number for the answers. do not abbreviate or shorten them.

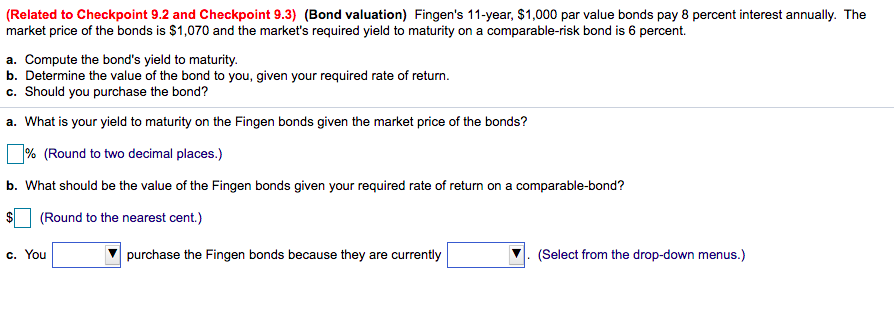

a (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation) Fingen's 11-year, $1,000 par value bonds pay 8 percent interest annually. The market price of the bonds is $1,070 and the market's required yield to maturity on a comparable-risk bond is 6 percent. a. Compute the bond's yield to maturity. b. Determine the value of the bond to you, given your required rate of return. c. Should you purchase the bond? a. What is your yield to maturity on the Fingen bonds given the market price of the bonds? 1% (Round to two decimal places.) b. What should be the value of the Fingen bonds given your required rate of return on a comparable-bond? (Round to the nearest cent.) c. You purchase the Fingen bonds because they are currently (Select from the drop-down menus.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts