Question: Please write out the steps and work step by step. no excel Your division is considering two projects, each of which requires an upfront expenditure

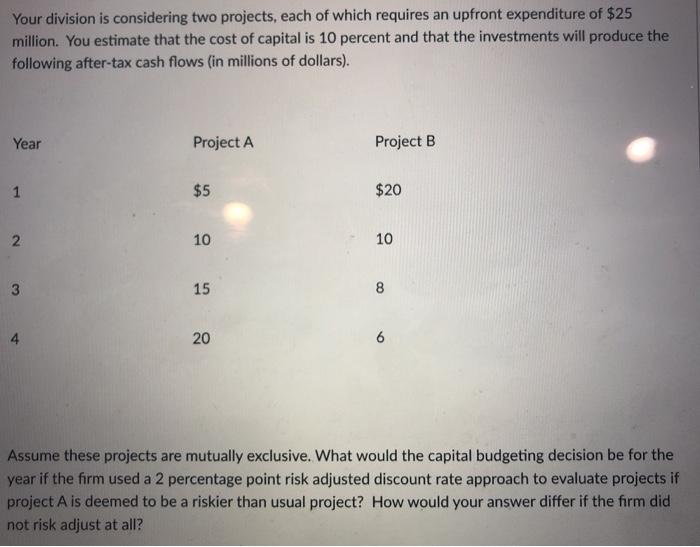

Your division is considering two projects, each of which requires an upfront expenditure of $25 million. You estimate that the cost of capital is 10 percent and that the investments will produce the following after-tax cash flows (in millions of dollars). Year Project A Project B 1 $5 $20 2 10 10 3 15 8 4 20 6 Assume these projects are mutually exclusive. What would the capital budgeting decision be for the year if the firm used a 2 percentage point risk adjusted discount rate approach to evaluate projects if project A is deemed to be a riskier than usual project? How would your answer differ if the firm did not risk adjust at all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts